- Using a Virtual Address For LLC Registration

- Also See: Virtual Business Addresses Plans & Pricing

- Using a Virtual Address as a Registered Agent Address

Q: Can I use virtual address for LLC?

A: Yes – You can use a virtual address for LLC registration. A virtual address is a real physical address you can use to register your business. However, you cannot use a PO Box for LLC registration. This article explains why you should use a virtual address for your LLC, where to buy a virtual address, and how to set up your LLC using a virtual business address.

Technically speaking, you can use your home address for your LLC.

But this comes with a load of privacy and safety issues.

Registering your business with your home address makes your home address public. A lot of people don’t feel comfortable exposing their home address, and for good reason.

A home address also lacks the professionalism and credibility a business needs to thrive.

That’s why so many entrepreneurs use a virtual business address for LLC registration.

With a virtual business address, you don’t need to lease expensive office space to protect your home, or to get that all-important professional exterior.

With a virtual office, you get a recognized business address, a place to receive mail, and flexible access to professional onsite space, without having to pay for full-time office rental.

In this article, we explain where to buy a virtual address for your business, the pros and cons of using a virtual address, and the steps required to register your LLC with a virtual address.

Note: We are not lawyers and cannot give advice. We advise that you speak to an appropriate tax advisor or lawyer to help you best understand your options to protect your personal assets such as any savings, your home, etc., when setting up your business.

What is a Virtual Address for LLC Services

A virtual address for an LLC provides businesses with a physical address they can use for legal registration and mailing purposes.

You can get a virtual business address for your LLC quickly and easily with Alliance Virtual Offices.

A virtual address from Alliance starts from $49 per month (+ setup fee) and includes:

- A recognized address for business registration, licensing, marketing, banking, and other documentation purposes.

- Mail receipt and secure storage for unlimited letters with customizable mail forwarding options.

- Easy access to on-site meeting space by the hour or by the day, starting from $10 per hour. Or upgrade to a Platinum Plus plan for up to 16 hours of meeting room access per month.

Search for a virtual address here by typing in a city, postal code, or US state.

Select a virtual address location and choose a plan from the options available. Alliance offers two virtual address plans:

- Platinum is the standard Virtual Office plan containing the address and mail processing services.

- Platinum Plus includes the standard offering, plus access to meeting rooms for up to 16 hours per month (some locations offer fewer hours – this is clearly stated in the plan details).

Related: This Virtual Office Plan is More Than Just a Business Address

You can add more services at any time, such as mail forwarding, a Live Receptionist service, or a Virtual Phone plan.

Check out with Alliance’s secure payment system – and don’t forget to check the latest promo codes!

Related: Virtual Office Prices | How Much Does A Virtual Office Cost?

What is a Virtual Address?

A virtual address is a recognized street address at a physical office location. The office location has a professional staff who receive your mail, greet guests, set up meeting rooms, and manage the day-to-day running of the center.

The virtual address associated with your virtual office can serve as an official business address for your company. It allows you to have a physical presence in any city without the bloated costs of office space rentals.

Read more: What is a Virtual Office and How Does it Work?

Can You Use a Virtual Address for LLC?

Yes – you can use a virtual address for LLC registration. A virtual address is a real physical address you can use to register your business.

Remember, you cannot use a PO Box for your LLC. It must be a physical location with a street address for your business to be compliant.

Watch this video for a quick and easy explanation:

What Are The Pros & Cons of Using a Virtual Address for a Business?

A virtual office provides many of the same benefits as a traditional office. It provides an address for your business, mail services, onsite workspace, and professional staff.

Virtual address users typically work remotely most of the time, and only work from their virtual office ad hoc (if at all).

So, should you use a virtual office, or opt for a standard office space instead? These pros and cons may help you weigh up your options:

What are the pros of a virtual business address?

- Cost-effective. A virtual office provides the same infrastructure as a physical office, but at a fraction of the cost. That’s because users typically work remotely and only use the onsite space occasionally.

- Flexible. Businesses aren’t tied into long-term leases or large deposits, which frees up capital for investment and growth. For example, after a 6-month initial term, virtual offices from Alliance switch to a simple monthly contract.

- Professional workspace that’s easily accessible. Whether for meetings or to work quietly, a virtual address provides onsite workspace by the hour. It’s fully furnished, connected, and ready for use.

- Transparent billing. Simple monthly billing means entrepreneurs can budget for the cost more easily.

- Customizable. A variety of additional services can be added, customized, or removed, easily. These may include mail forwarding, lobby listing, live receptionist services, a business phone number, and more.

What are the cons of a virtual business address?

- Space is shared. Rather than having your own private space to use whenever you want, virtual office users must pre-book a meeting room ahead of time.

- Less social contact. Working remotely and only using the virtual office occasionally means less in-person connection.

- Shared address. There are some limitations to using a shared business address, even if you have your own suite number. For example, Google My Business doesn’t always accept businesses with a virtual address.

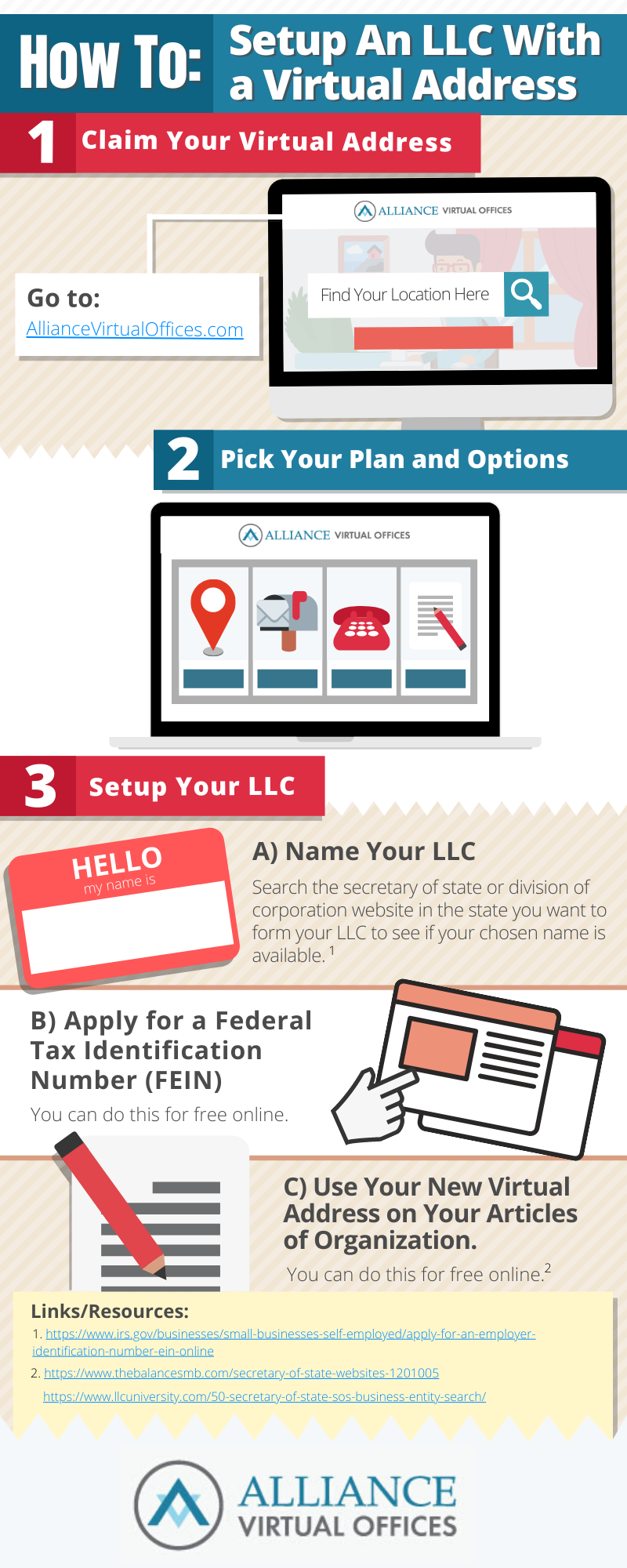

How Do I Register An LLC With A Virtual Address?

Using a virtual address for LLC registration is as easy as:

- Claim Your Virtual Address at www.AllianceVirtualOffices.com

- Pick the Right Plan for your needs

- Use Your New Virtual Address on your Articles of Organization.

Let’s take a look at three common business entity structures and the main characteristics of each:

What is a Business Entity?

There are different levels of entities, starting with sole proprietorship – which is not actually a legal entity – and moving up to corporation level.

The entity you decide on will be determined by the kind of business you run and whether you want to keep your business separate from your personal assets and personal taxes.

What is a Sole Proprietorship?

Unlike an LLC, corporation or other entity, a sole proprietorship does not separate you — the person, the taxpayer — from your business. This is why it increases risk for businesses to be a sole proprietorship.

People do it because it’s easy. There’s no cost to starting it. You simply start selling and file your individual taxes as normal.

A kid selling lemonade on a corner is a sole proprietorship. An independent service provider is a sole proprietorship if no legal entity is created first.

Sounds easy. However, with a sole proprietorship your personal assets aren’t protected. If you are sued or become unable to pay business debts, you are personally liable, and you and your business are considered as one when it comes to paying taxes.

What is a Limited Liability Company (LLC)?

An LLC is one of the most common business entities. It protects everyone in your business, from your members to your managers and everyone else in between.

The most beneficial thing about registering your business as an LLC is that your personal property is well-protected (unlike in a sole proprietorship) as it is separate from your business, given you follow certain guidelines of keeping your business separate from your personal.

With an LLC, yours and any partner’s property is considered completely separate from your business and is treated as such when it comes to tax, legal processes and business debt.

Some states allow single-member LLCs, which means you are considered the one and only owner of your business. However, it’s often a better idea to get a partner on-board for liability purposes. This doesn’t mean giving up a large chunk of the profit pie, though; a partner can simply own 1-2% of your business and it can be someone like a family member or a close friend.

How Do I Register My Business as an LLC?

- Step 1: Choose your LLC name (to do this, you’ll need to search the secretary of state or division of corporation website in the state you want to form your LLC in to see if your chosen name is available first)

- Step 2: Apply for a Federal Tax Identification Number (FEIN) with the IRS (you can do this online for free. The IRS have a detailed guide.)

- Step 3: Complete and file your forms and pay registration fees (the forms are often called the articles of organization)

You can easily do this all online with your Secretary of State or Division of Corporations.

When registering your company, you will be asked to name a registered agent and registered agent address. This is an important decision. You may want to choose an address that is not your home address. This is why many businesses use a virtual address for LLC purposes.

In the case of legal proceeding, a clever opposing lawyer may be able to prove that your LLC is not sufficiently separate from your personal assets, and despite your effort to set up an LLC, they may be able to reach into your personal assets, often referred to as “piercing the corporate veil.”

Read more about registered agent services below.

In most cases, states require that you have two addresses in order to set up an LLC: a physical business address, and a registered agent address.

Here’s what you need to know.

What is a Registered Agent?

A registered agent is a third party with the authority to receive service of process notices, and other official documents on behalf of a business.

Using a virtual office as a registered agent address can be tricky, depending on how you set it up.

Many virtual office providers offer the registered agent option as an additional service because “service of process” mail (SOP) and mail from the secretary of state must be handled differently than commercial mail.

For example, many virtual office clients may have their commercial mail forwarded once per month. If they register using their virtual business address for LLC purposes without setting up a way to handle SOP and other entity documents, they may not receive important notices in a timely manner.

Sidenote: P.O. Box addresses are not accepted as registered agent addresses.

How Much Does a Registered Agent Cost?

If you’re setting up a business as an LLC, partnership, or corporation, then having a registered agent is required by law. So you may be wondering how much will a registered agent cost you.

Organizations can expect to pay between $120 to $500 a year for basic registered agent services.

Though registered agent costs vary by location and basic services offer, they typically don’t represent a significant cost to businesses. This cost can be further negated by switching from a traditional office to a virtual business address for LLC registration.

What Are The Benefits of a Registered Agent?

Having a registered agent ensures you are compliant with the law. It provides peace of mind that your service of process mail and official mail are taken care of and responded in a timely manner.

Remember, if you miss important items of mail, it could cost your business thousands of dollars in fees and fines.

Another important benefit is privacy.

The address of a registered agent is a matter of public record; if you decide to serve as your own registered agent and operate your business from home, then it means that your home address will be available to the public.

Read more: 6 Benefits of a Registered Agent

What Are The Legal Requirements of a Registered Agent?

The legal requirements of registered agents vary by state, however, there are few minimum qualifications that all states agree on.

Here are 5 basic legal requirements for a registered agent:

- The registered agent must be a resident in the place the legal entity is incorporated.

- The registered agent must have an in-state physical address in all states in which a business operates.

- The registered agent should be at least 18 years old (though some states don’t mention an age requirement, it is advised that organizations hire a registered agent that’s familiar with the serious nature of their responsibilities).

- The registered agent needs to be physically available during standard business hours.

- The registered agent must be able to receive official mail and service of process notification.

Bear in mind that in most cases, states require that you have a physical address as well as a registered agent in order to set up an LLC. A virtual address for business can serve this purpose as long as it’s backed by physical space.

To make it easier, we’ve partnered with Anderson Advisors’ Registered Agent Services to couple Registered Agent solutions with your virtual office.

How Do Virtual Addresses Work For Business Licensing?

In order to get a business license, you normally need to have a commercial address. This has to be a licensed business as well. You increase your chances of getting rejected if you use a non-licensed business as your address. A reputable virtual business address for LLC purposes can help you avoid this issue.

What is a Business License?

Simply put, these are permits that are issued by specific government agencies that allow you to run your business in a certain location.

There are two kinds of business license: federal and local.

The type you need will depend entirely on the kind of business you’re running and the activities you plan on carrying out. Each type monitors a different range of activities, so it’s worth checking your government’s website to find out where your business falls.

What is a Federal Business License?

Federal licenses are mandatory if you’re carrying out activities that are regulated by a federal agency. This includes things like agriculture, fishing, mining, and broadcasting.

Permits are issued by different governing bodies depending on the type of activity. For example, if your business is in the broadcasting industry, you need to get in touch with the Federal Communications Commission.

Here is a guide to the different kinds of business activities that require federal licenses and the governing body that controls them.

What is a Local Business License?

Local business licenses are supplied by your state or city and are determined by local laws. Where federal licenses pertain to certain kinds of business activities, a local business license means adhering to your state’s specific business regulations.

If your business requires a local business license, it’s best to work with your virtual office provider to make sure the right virtual business address for LLC formation and its associated business license info are included on your local business license application forms.

Many virtual office providers like Alliance Virtual Offices are service companies and are not required to have a business license. However, we can advise you of the proper address and entity to put on your forms.

How Do Virtual Addresses Impact Bank Credit?

All new small businesses need to establish business credit. This enables you to separate your business’s credit history from your personal credit history.

Building up business credit with the banks will mean you’ll reap the benefits of having a good credit history. This is another area where a virtual address for LLC formation comes in handy.

Related: Opening a Bank Account for an LLC? Here’s What You Need to Know

How can I go about getting business credit?

- Step 1: Incorporate your business. We mentioned this earlier, but in order to get a separate credit history for your business, it needs to be registered as an LLC or a corporation.

- Step 2: Get a federal tax identification number (EIN). You’ll need this number for all federal tax filings and to open a business bank account in the first place.

- Step 3: Build credibility. According to Credit Suite, there are a number of boxes that need to be ticked before you can start building business credit. They include:

- Using your full legal business name on all documentation.

- Having a corporate business address and a landline phone number (you can’t use your personal address or cell number). Use your virtual office address and a business number that’s listed in the 411 directory; having a commercial address and a local phone number that’s not a cell will increase your chances of getting approved for credit.

- Keeping your public records clean.

- Branding your business with an operational website, email address, and a business fax number.

- Step 4: Open a business bank account. Make sure you open it in your business’s legal name and remember to steer any transactions for your business through this account.

- Step 5: Get a business credit card. You’ll need at least one business credit card to start building credit on. Choose a card company that reports to the credit reporting agencies.

- Step 6: Nurture vendor relationships. Nav says that one of the easiest ways to build business credit quickly is to maintain and nurture great relationships with your suppliers and vendors. Work with 3-5 industry-relevant vendors to establish a positive line of credit to begin with.

- Step 7: Keep your information up-to-date. Make sure you regularly update the major credit bureaus (Dun & Bradstreet, Experian, and Equifax) with your latest information.

- Step 8: Pay your bills on time. This goes without saying, but in order to start and maintain good business credit, you need to pay your bills when they’re due – if you don’t, it will have negative impacts on your credit rating.

Are Virtual Offices a Good Fit for New Businesses?

When starting a new business, money is going to be at the front of your mind and it’s likely you’ll be snowed under with a to-do list longer than your arm.

But it’s important that you set your business up legally and in the right way. That means registering as an LLC, getting any business licenses you might need, and taking the necessary steps to start building business credit.

After that, you can focus on nurturing the credibility of your business and delegating tasks to make that never-ending to-do list a little more manageable.

With a virtual office, you can get the professional look of a physical address and phone number without having to pay an arm and a leg for an independent office space. If you’re just starting out, this virtual address for LLC formation might be the perfect way to give your business the foundation it needs to grow and thrive.