- How are LLC bank accounts and personal accounts different?

- What do you need to know to set up a bank account for your LLC?

- Which banks offer the best accounts for LLCs?

- Best Practices to Get Your Bank Account Approved

Q: How can I open a bank account for my LLC?

A: Bank accounts for LLCs are handled slightly differently compared to personal accounts. In order to set this account up, you’ll first need to establish your LLC and receive the necessary forms and certifications proving that the government has approved your new business. You will then provide the bank with these forms, and they will help you set up your LLC account.

According to the latest statistics, entrepreneurs filed a staggering 5.4 million new applications to form businesses in 2021. This is a record-breaking number, and it shows that Americans are more entrepreneurial than ever before.

On the other hand, this record-breaking number also shows that many Americans are figuring out how to run an LLC for the first time.

Diving into a new business can be incredibly exciting, but it’s also a major undertaking and an in-depth learning experience.

And since the purpose of a business is to make money, it should come as no surprise that the financial aspect of an LLC presents one of the steepest learning curves.

As the proud owner of a new LLC, you’re suddenly confronted with an entirely new financial world, filled with different tax obligations, business expenses, profit margins, and much more.

While these numbers can certainly be overwhelming at first, you’ll eventually begin to understand how it all works. Soon enough, these financial complexities will feel second nature.

But to reach this point, you need to approach your business’ finances with a sense of organization, structure, and efficiency.

The obvious starting point is opening a bank account for an LLC.

This new account will help you keep track of your business’s financial performance, including its overall profits, its expenses, and much more.

Your account will also help you create a barrier between your personal expenditures and your LLC’s business activities, thereby simplifying taxes and ensuring you’re playing by the rules.

But why is setting up a separate account for your LLC so important? What makes a business account different compared to a personal account?

Let’s find out…

- What makes a business account different from a personal account?

- What do you need in order to set up a bank account for your LLC?

- Which banks are best for your new LLC account?

What Makes a Business Account Different From a Personal Account?

If you’re completely new to the world of business, you might assume that a bank account for your LLC will operate the same as your personal account.

And in many ways, this is true.

At the end of the day, an LLC bank account is simply a place where you can store the money earned by your business.

You can use your account to facilitate a range of transactions, including paying business expenses, receiving income, and even taking out loans.

The main difference between a personal and business account is that a business account is not in your name. Instead, it is technically owned by the LLC, which forms a separate, legal entity.

A business account is not yours – even if all of the profits go to your personal account and the business itself only serves to make you wealthy.

But why is this such an important distinction?

It all comes down to the two main benefits of LLCs:

- Tax benefits

- Liability protection

Let’s start with tax benefits.

In order to experience the inherent tax benefits of an LLC (namely a lower tax rate), you need to keep your business and personal finances separate.

For example, let’s say you purchased a few different devices over the past year. For your business, you may have purchased a laptop, a printer, a set of speakers, and perhaps a camera to take pictures of your products.

During that same year, you might have purchased several devices for your personal enjoyment, such as a new smartphone, a video game console, a set of VR goggles, and headphones.

If you purchased all of these items from the same online store with the same bank account, you could run into some serious issues at the end of the fiscal year.

How are you going to remember which devices were for your business, and which ones were for your personal use?

Now expand that hypothetical scenario across virtually every transaction you make during any given year.

If all of these transactions are lumped together in a single bank account, you’re going to have a serious accounting headache when tax season rolls around.

If you pay someone else to do your taxes, you’re probably looking at more billable hours and a much higher fee.

If you choose to do it yourself, be prepared to spend days untangling your personal and business transactions.

Opening a bank account for an LLC makes much more sense.

Suddenly, you no longer have to worry about distinguishing between personal and business transactions, because your business’ financial activities are contained within its own bubble.

Make no mistake, the IRS is on the lookout for red flags.

And when they see that an LLC owner is mixing personal and business expenses in the same account, they are much more likely to take a closer look at you.

Generally speaking, this is a clear sign that someone is engaging in tax evasion.

By keeping your business and personal expenses separate, you’re showing the IRS that you’re an organized, efficient entrepreneur who plays by the rules and understands the importance of proper bookkeeping.

Of course, opening a bank account for an LLC doesn’t stop you from being audited.

But if you do get audited, the IRS will find it easier to analyze your activities and (hopefully) come to the conclusion that you’re in the clear.

Now, does this mean that you have to set up a separate bank account for your LLC?

In terms of legality, this is a bit of a grey area.

Most experts agree that while it’s definitely not a good idea, using your personal account for your LLC’s activities probably won’t lead directly to legal issues.

Technically speaking, all income from your LLC is reported directly on Schedule C of your Form 1040. This means that as far as the IRS is concerned, it’s almost as if your separate business entity doesn’t even exist.

Some entrepreneurs assume that since all income is reported on your personal tax return, there’s no point in setting up a separate business account. But as we’ve mentioned, opening a bank account for an LLC is simply a more practical business decision.

It’s even more important when you consider the liability protection side of the equation.

If you commingle your business and personal assets, the courts could decide that you haven’t actually maintained a separate legal entity.

This means that you will lose the limited liability protection offered by your LLC – thereby negating one of the most important benefits of this business structure.

Before you know it, you’ll be held personally liable for lawsuits against your business.

This means you could lose everything if your business is sued.

An LLC bank account is also different compared to a personal account because of the way the bank treats you.

As a personal customer, all you need is valid identification to set up an account.

But as a business owner, you need to prove that your business is actually legitimate. This means handing over a range of forms and documents – more on that later.

Another quick note:

Opening a bank account for an LLC really boosts your professional image.

Clients, customers, and investors will take you more seriously when they’re dealing with an official business account rather than a personal account in your name.

In addition, a separate account helps you build up your credit history in the name of your business. This makes it easier to get loans for your business in the future.

You can even get a mortgage under your business if you have years of solid income history with a separate account.

But we know what you’re thinking:

If you keep your business and personal accounts separate, then how do you actually benefit financially from your LLC? How do you get paid?

The process is simpler than you might think.

The most common method is to transfer funds from your LLC account to your personal account in what’s known as an “owner’s draw.” You won’t be breaking any rules when you do this, because the transfers are clearly identified and reported to the IRS.

Other methods include dividends and salaries, although these are less common for single-owner, small-to-moderate-sized LLCs.

Finally, banks may provide you with additional benefits and resources reserved only for business owners. In some cases, they will assign you a personal small business manager to oversee your financial operations within the bank.

This individual can answer any questions you might have, help you choose the best financial options for your business, guide you through potential investment strategies, and much more.

They can also help you with more complex operations, such as giving yourself a loan through your business in order to purchase property or other assets.

What Do You Need to Open a Bank Account for an LLC?

As previously mentioned, one of the main differences between personal and LLC accounts is the setup process.

More specifically, you will need to provide your bank with a range of forms, certifications, and documents before you open your new account.

The first step is simple:

Set up an LLC.

The exact process for setting up an LLC is the subject for a different article, but there are a few things you might want to keep in mind in the context of your new account.

While you’re setting up your LLC, consider choosing a virtual address.

This is an address that is separate from your home. Thanks to service providers like Alliance Virtual Offices, you can choose a virtual address without actually having to rent out office space.

This means that you’re free to pick pretty much any address you can think of.

Why not boost your reputation and choose an address in the heart of a major city, like Los Angeles or New York?

But wait a second – what does this have to do with opening a bank account for an LLC?

Your bank will probably end up sending you mail throughout each year. If you’re engaged in a number of different transactions with your new account, this mail can start to become seriously overwhelming.

With a virtual address, this mail (and all other mail connected with your business) is sent to a trusted, secure location instead. From there, you can pick it up or have it rerouted to your home address.

This is perfect for digital nomads or anyone who likes to travel often, although virtual addresses are becoming increasingly popular for virtually all entrepreneurs today.

Once you’ve set up your LLC with a virtual address, it’s time to head to the bank and establish your business account. Here’s what you’ll need:

- Articles of organization

- Your EIN

- LLC operating agreement

- Any additional documents requested by your bank

To save time, it helps to go online or call the bank and figure out the exact requirements before you make your appointment. Each bank is different, and some require specific documents.

From there, your bank will help you set up your account with very little effort on your part. You will likely be given a unique online login that is separate from your personal account.

But your work isn’t done once your account is established. There are a few steps you’ll want to take once you’ve opened your new account, including:

- Providing clients and customers with your account information so they can pay you

- Applying for a credit card under your LLC

- Adding payees so you can easily pay bills online with your new LLC account

- Linking your account with brokerages, crypto trading markets, and other investment platforms

- Connecting your LLC account to PayPal or other online payment systems

- Getting a checkbook (including void checks)

With that out of the way, you’re ready to start putting money into your LLC account as your business makes money. If all goes to plan, your profits will outweigh your expenses, and there will be plenty left over to withdraw into your personal account in the form of owners’ draws.

Which Banks Are Best for Your New LLC Account?

As we mentioned before, each bank is slightly different when it comes to LLC accounts.

Each one might offer its own set of benefits to attract new entrepreneurs, so it makes sense to carefully consider the options and choose the best possible bank for your unique needs and priorities.

It may also be worth searching specifically for a bank that allows you to create an account using a virtual address due to the aforementioned benefits of this service.

However, this isn’t always easy, as federal business banking laws (like the Patriot Act) state that in order to open an account for a customer, banks must use a real, physical address.

That being said, banks may be slightly more accommodating in the case of an LLC account – especially if you already have a personal account with them using your home address.

Each state (and each bank) may have slightly different rules and policies when it comes to virtual addresses.

If the bank doesn’t allow you to open the account with a virtual office address, you can always use your home address and then add a second address to your file at a later date.

You can also request that mail be sent to your virtual address without much of an issue.

This will let you avoid having mail sent to your home – even if your bank has your personal address on file.

Keep in mind that each bank has unique policies, and major banks may even use software to scan for virtual addresses.

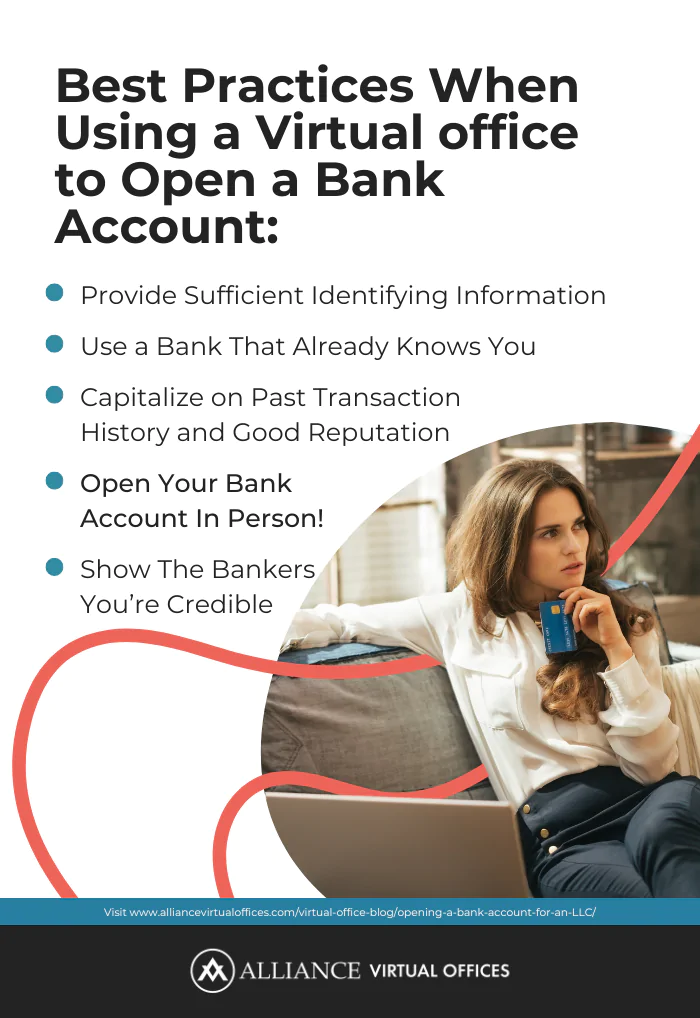

Best Practices When Using a Virtual Office to Open a Bank Account:

- Provide Sufficient Identifying Information

- Trying to open an account using a virtual office address and with no information available can appear suspect. Banks need to have sufficient identifying information on the person attempting to open a business account with a virtual office address.

- Use a Bank That Already Knows You

- If you have already used the bank, your best bet is to stick with them for your business account. This will ensure they have plenty of information already on file, meaning they won’t flag your virtual office address as suspicious.

- Capitalize on Past Transaction History and Good Reputation

- If you have a strong trade history already, this can also help you open your account with a new bank.

- Open Your Bank Account In Person!

- Barring both of these situations, you will likely need to open your account in person. In-person activities are flagged as less risky by the bank’s internal systems.

- Show The Bankers You’re Credible

- Ultimately, using a virtual office address to open your bank can require a bit more credibility. You can establish that credibility using a past relationship with the bank or through in-person interactions while opening the account.

You might also want to consider the following when searching for a solid bank that can handle your LLC’s needs:

- Fees

- Transactions per month

- Special benefits

- Online banking

- Security

- Payroll solutions

- Do they make taxes easier?

- Business credit cards

- Insurance coverage

- Merchant services

- Business loans

- Number of ATMs and physical locations

- Customer service

- International and domestic bank wires

With all that said, here are some of the best bank accounts for your new LLC today:

- Bluevine Business Checking: Bluevine is mentioned frequently by LLC owners as a solid choice, and it’s easy to see why. With a zero-dollar monthly fee and attractive interest rates, this account is an obvious choice for new entrepreneurs. You also get a Debit Mastercard for your business right out of the gates, and there are no insufficient fund fees or minimum balances. Two free checkbooks really sweeten the deal, causing many entrepreneurs to call Bluevine the best bank for small business.

- Chase for Business Complete Banking: Thinking about opening a bank account for an LLC? Chase also has a pretty stellar reputation among entrepreneurs, often providing new entrepreneurs with a signup bonus of $300 right out of the gates. The monthly fee is $15, but if you maintain a balance of more than $2,000, you won’t have to worry about this. Chase’s online banking system is quite efficient, and you can deposit checks online with the QuickDeposit system. Free business debit cards are provided for you and your employees, and you can also apply for highly-coveted Chase business credit cards.

- Axos Bank Basic Business Checking: Axos is another excellent choice with zero monthly fees and unlimited transactions. You also get two free domestic wires per month, making this an incredible choice if you’re planning to conduct a lot of financial activity with your business. Keep in mind, however, that Axos is a fully digital bank – so you won’t have the ability to visit a branch and speak with a representative face-to-face. This might actually be a positive if you’re running a virtual business, and Axos offers top-notch customer service and an incredible online banking platform.

Of course, you can always try foreign banks, as these may offer more favorable lending rates.

Closing Thoughts: Opening a Bank Account for an LLC

At the end of the day, opening a business bank account for an LLC is actually a very simple process.

You don’t have to make this more complicated than it needs to be.

On the other hand, if you approach this relatively simple task with a measure of care and efficiency, you can enjoy a range of financial benefits that really add up as the years go by.

Further Reading

- Get a Virtual Address For LLC Registration

- Availability of Digital Tools Doesn’t Mean Bank Customers Use Them

- Best Business Checking Accounts Of May 2022 – Forbes Advisor

- Types of Costs for Small Businesses: Don’t Miss this Crucial Distinction

- Chinese Banks May Lower Lending Rates, Giving Relief to the Economy

A few dollars in fees might not seem like a big deal right now, but wait until you do the math at the end of the year. Remember, your goal as a business owner is to make as much money as possible while minimizing costs.

And since opening a bank account for an LLC is one of the first steps on the path towards entrepreneurial success, it makes sense to choose the most profitable option for your business right out of the gates.

With this approach, you can put your best foot forward and ensure your business enjoys the best possible start.

Check out Alliance Virtual Offices today for more information on virtual offices, live receptionists, and a range of other services that can make running an LLC even more profitable and convenient than you ever imagined.