- What is an expense?

- What is an investment?

- Why does the difference between these types of costs matter?

Q: What are the different types of costs for a small business?

A: There are two primary types of costs for small businesses. You’ll have to part with capital when handling both expenses and investments, but they are still very different in a number of ways. This is how they differ – and why these differences are so important:

Starting a small business is expensive.

The old saying “it takes money to make money” rings true. Launching a business of any kind requires a considerable amount of capital — both in the initial stage and the growth stage.

But while most new small business owners are well aware of this, few understand the more nuanced elements of business accounting. They may be the difference between spending money and making it — but that’s about it.

Not all money spent produces the same results. There are multiple types of costs in business, and understanding how they differ is what differentiates the financially savvy from struggling entrepreneurs.

If you’re an entrepreneur or small business owner looking to make the most of your money, you need to understand the difference between an expense and an investment.

- Why learning the types of costs in economics is crucial for small business owners

- What is an expense?

- What is an investment?

- How should you handle expenses vs investments?

Accounting as a Small Business Owner

Many small business owners launch their businesses with an eye toward chasing their passions. Maybe they’re trying to turn their hobbies into their jobs. Perhaps they’re trying to turn enjoyable side hustles into full-time work.

Regardless, these entrepreneurs often launch their businesses with dreams of creating and supplying products or services.

But what many quickly realize is that running a small business is much wider in scope than simply creating and selling.

As a small business owner, you have to serve as your own manager, customer service expert, marketing department, and accountant. Types of costs in supply chain management and types of costs in project management are both equally important as you keep track of your financial growth.

This is where many entrepreneurs start to struggle.

Why Learning the Types of Costs for Small Business is Crucial

The economy is becoming increasingly competitive. The ease of access to online platforms means that small businesses are launching at a rapid rate.

While this is fantastic for the overall market, it also creates considerable challenges for business owners.

In fact, billionaire Charlie Munger recently told CNBC that it’s harder for young people to become and stay wealthy than ever before:

“It’s going to be way harder for the group that’s graduated from college now … to get rich and stay rich,” the 98-year-old warned. “Think what it [used to] cost to own a house in a desirable neighborhood in a city like Los Angeles.”

It’s not that there isn’t room for everyone. Many small businesses can succeed almost instantly by serving unexploited niches.

But to make that happen, they need to know where to put their money.

Knowing where to allocate your resources is the only way to grow your business. Those who make smart financial decisions see greater returns, expanding their businesses while avoiding wasted money.

To do this, you need to understand how your money interacts with your growth. You need to understand the different types of costs in the business.

What is an Expense?

In order to understand this topic more easily, it helps to look at all of the different types of costs. Examples are as follows:

The first type of cost is known as an expense. [Text Wrapping Break]

Most people are already familiar with expenses, and these are simply operating costs that require payment.

Almost all consumer purchases fall into this category.

For example, if you purchase groceries, you’re paying for a living expense. You’ll consume the food you buy and eventually need to buy more. While your dinner might be delicious, it doesn’t provide any monetary return.

Without an understanding of business accounting, many small business owners automatically categorize all money spent as an expense. In other words, they see spending money as inherently negative.

But that just isn’t true. There’s a second type of cost that differs significantly from a standard expense.

What is an Investment?

An investment is money that leaves your hands on a more temporary basis.

Rather than disappear after you spend it, invested money has the potential to provide returns. In other words, an investment is money you spend in the hopes of making it back and netting you a profit.

With over half of US households investing in the stock market, chances are you’re familiar with personal investing. But many small business owners don’t bring that familiarity into their businesses.

The fact that so many small business owners mistake investments for expenses is understandable. When you’re in the process of building a small business, you’re normally focused on becoming profitable as fast as possible.

Small business investments take time. The money you invest into your business typically won’t provide returns the next day.

In fact, it can take months or even years to see a return on these investments.

That time delay is the source of considerable confusion about the types of costs for small businesses. In economics, the difference is clear.

But when you’re worried about growing a business at the moment, it often feels like any money you spend is a loss.

While this logic is understandable, operating under that assumption can seriously backfire.

What Are Some Examples of Small Business Expenses and Investments?

Before we go further, it’s helpful to provide some examples of these types of costs to illustrate the difference.

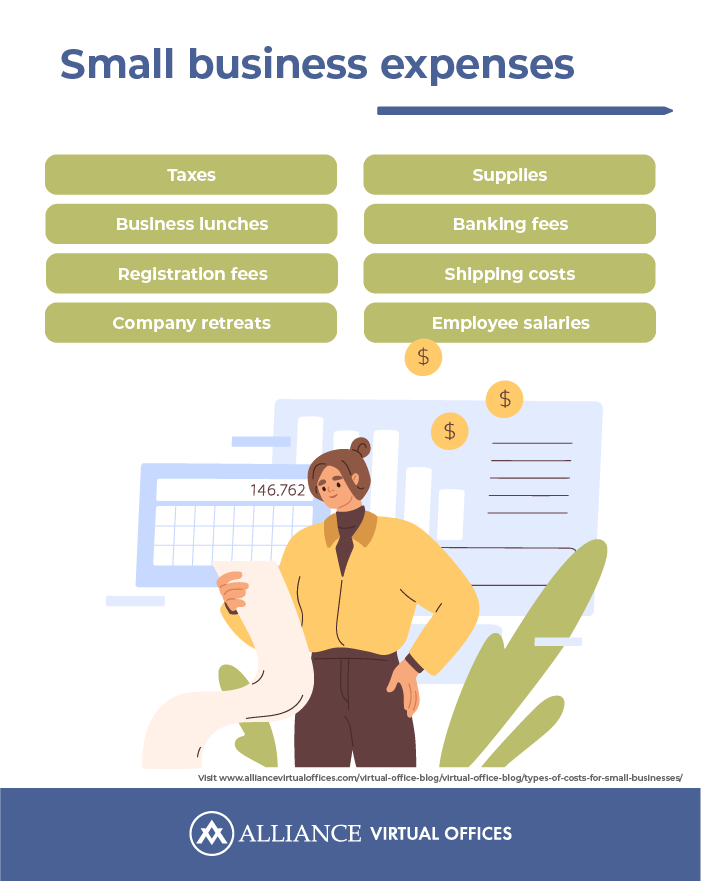

Here are some examples of small business expenses:

- Taxes

- Business lunches

- Registration fees

- Company retreats

- Supplies

- Banking fees

- Shipping costs

- Employee salaries

These are all costs that obviously leave your hands without a chance of providing you with monetary returns.

There are also less obvious expenses though. Loan interest charges or expense ratios on investments also count as expenses, even though they are expenses that come with investments.

On the other hand, many of the things you purchase for your business count as investments. For instance, running marketing campaigns, designing an e-commerce page for your website, or purchasing a virtual receptionist can all directly influence your business’s income.

These investments help you reach more people and convert more of the market into customers, and so they provide returns.

How Should You Handle Expenses Vs Investments?

You need to adjust your spending depending on the types of costs your business is facing.

In most cases, limiting your spending on expenses is a good idea for your small business. This is especially true for startups or newer small businesses.

Spending too much on expenses can stall your growth by keeping you from investing in your business. In fact, too much spending on expenses can completely sink a business.

But small business expenses are very different from small business investments.

Investment spending should be much more liberal. In fact, it’s typically a good idea to spend as much as you can on investments, as long as they are low-risk and high-reward.

You still need to manage your investment spending though. You don’t want to spend so much on investments that you don’t have the money you need for expenses when they pop up.

For example, it’s a great idea to spend money on marketing — but if you spend all of your money on marketing and don’t have enough to pay your taxes, your business might be shut down before you have a chance to see returns on your campaigns.

When designing a budget, you should plan for all your expenses. The key is to reduce your expenses so they aren’t reducing your net profits.

When budgeting for your investments, you want to free up as much money as you can to invest in low-risk, high-reward growth channels.

This will help you grow your business faster helping you beat the odds and stay profitable well into the future.

Conclusion

When it comes to growing a small business, understanding the types of costs is crucial.

Expenses should be minimized, especially during the initial stages of building a small business. This keeps profitability achievable and frees up money for investments.

Further Reading

- Using A Virtual Address for LLC Formation | 3-Steps

- These Are Your Must-Know Small Business Tax Tips

- LLC for the Digital Entrepreneur: What You Need to Know When Traveling

On the other hand, small businesses looking to grow should prioritize investments. By spending liberally on investments like marketing and infrastructure, you’ll increase your sales, ultimately earning that money back — and then some.

If you’re looking for a great investment for your small business, a virtual office from Alliance Virtual Offices is a great place to start. You’ll avoid expensive office rentals while gaining access to an address you can use to register your business.

Get started today with Alliance Virtual Offices.