- What is the difference between a Contractor and an Employee?

- How to fill out a W-9 Form (for independent contractors)

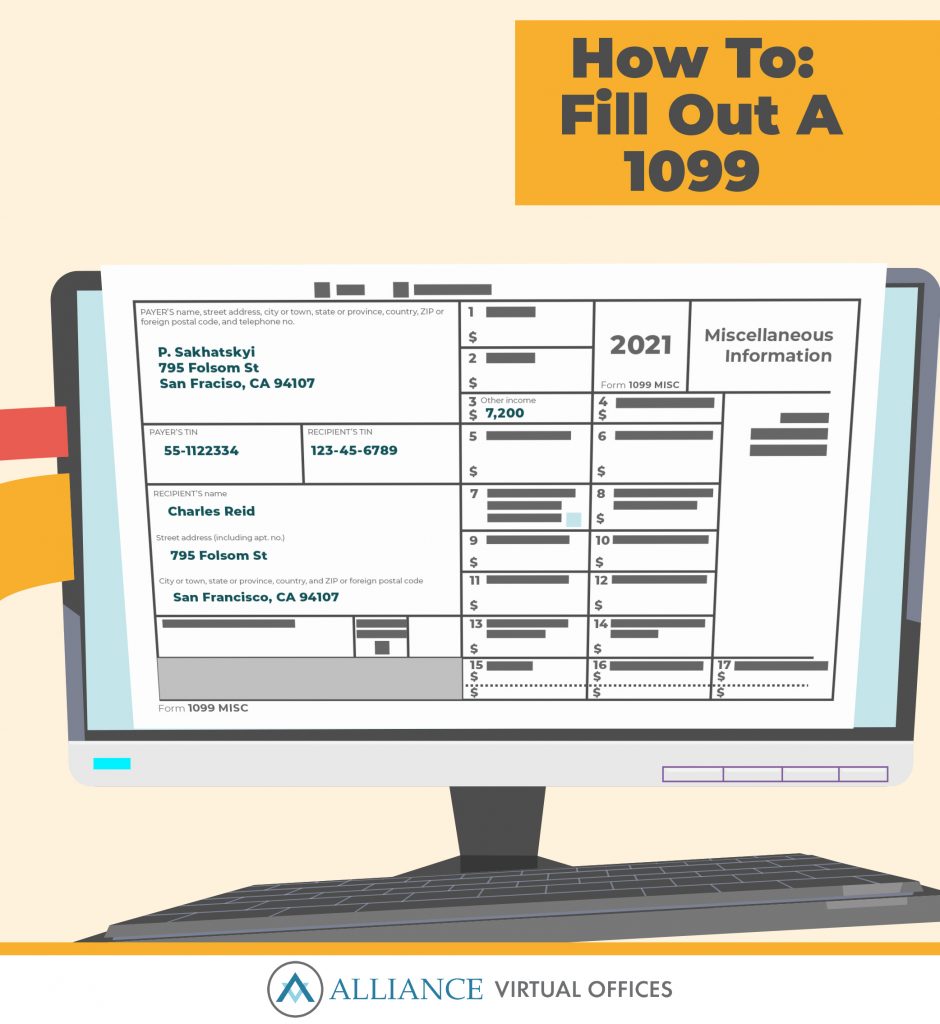

- How to fill out a 1099 Form (for employers)

Q: What is a W-9 vs a 1099?

A: The W-9 is filled out by you (the independent contractor) and submitted to all organizations you work with, so they can file Form 1099. A 1099 reports to the IRS how much you made that year. If a company pays you more than $600 in a year, that company is required to file a Form 1099 with the IRS and provide you with a copy by Jan 31st the following year.

After the rush of the holiday season has subsided, and people are settled into their New Year’s resolutions, the next big event is one that is… not nearly as fun and universally dreaded: tax season.

Disclaimer: Alliance Virtual Offices does not provide tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice.

While some rely on their accountant to crunch the numbers, many prefer to take matters into their own hands. However, year after year, getting to the end point before pulling your hair out seems next to impossible.

Read more: Get your taxes done right this year with QuickBooks Online

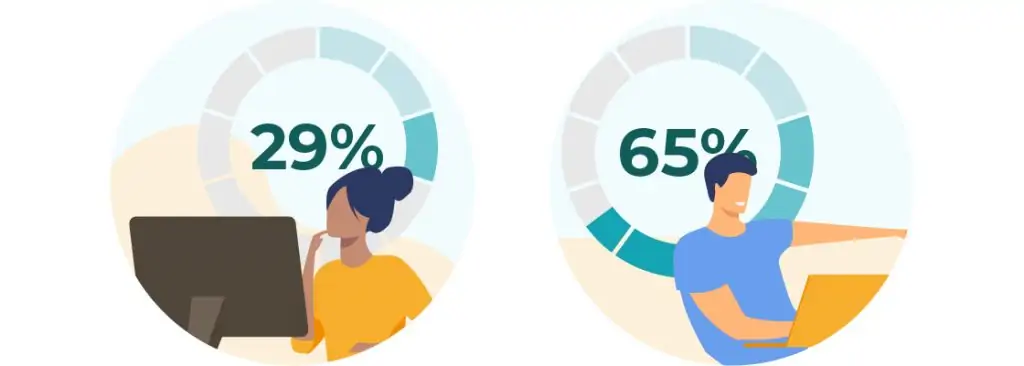

According to research from TaxAudit, 29% of Americans say they are worried they will be audited despite 65% saying they feel there are no errors in their tax returns.

Many of us rush to Google to subside our anxieties and spend hours making sure every last detail is correct.

Be honest, do you have any of these questions sitting in your browser history?

- What is income tax?

- Do I have any dependents?

- What tax form should I use?

- Where is my refund?

- How do I file my taxes?

No judgement. The tax process in America is notoriously complicated and incredibly stressful, especially if you’re a small business owner or freelancer dealing with forms you might be unfamiliar with.

But let’s simply start here:

How do you determine which form is necessary for you to fill out?

Instead of spending hours of relentless research to get your answer, gaining deeper knowledge into the tax process can ensure that you never toss and turn at night wondering “Am I going to be audited?”

With Americans spending around 2 billion hours preparing for and filling out taxes, as well as dishing out billions in tax-preparation costs, it is beneficial for us taxpayers to not only understand the forms we are filling out, but why.

Knowing which tax form to fill out is particularly important for contractors and small business owners, who may not have a full understanding of what is legally required of them.

Generally, businesses that operate with independent contractors or freelancers have to deal with a W-9 or a 1099 form.

Although these two forms do go hand in hand, they serve two different purposes.

So what’s the difference between a W-9 vs a 1099 form? And how can you have a better understanding of which form is necessary for you?

The long story short is that a W-9 form goes to the organization that you work for so they collect information on you, while a 1099 reports to the IRS how much you made that year.

If you’re a company that uses independent contractors and employees, having a grasp of the different tax requirements these types of workers will be helpful in the future.

This is especially crucial as 2020 saw an increase in unemployment, as well as contractual and freelance work.

In fact, research from Upwork found that two million Americans started freelancing over the past year, meaning these workers take up 36% of the U.S. workforce.

Even more, companies are expected to embrace the freelancing and remote working communities in the coming years so knowing what that means for tax season will be helpful.

If you run a business, take a step back and look at your company’s operational infrastructure to understand what steps you need to take.

Ask yourself the following:

- What kind of workers do you have?

- Are they remote/freelancers or employees?

- What does their pay look like? Do they make more than $600 annually?

- How much time have they put in at the company?

Once you’ve identified the answers to these questions, you can begin to work on deciding when it is necessary for you to fill out a W-9 or a 1099 tax form.

But now you may be wondering, what’s the difference between a contractor and an employee?

Knowing the difference between a contractor and an employee, how much workers make and how certain business entities can protect your assets will be crucial.

What Is The Difference Between A Contractor And An Employee?

With today’s increasingly distributed and flexible workforce, knowing the difference between a contractor and an employee may seem confusing as they often perform the same job.

Although it seems like these two types of workers are interchangeable, in the eyes of the IRS, they most certainly are not.

Employees have a different, more strict set of guidelines from the company they work for including how, when, and where they work.

For instance, employees typically:

Employees

Work full time

Receive a salary and other benefits

Have a set schedule

Have specific work-related expectations

Have received company-ran training

But that’s just the beginning.

Think of it this way: when an employee is hired, they are brought on as a long-term member of the company’s operations.

Employees aren’t provided exactly the same freedom as freelancers and usually must abide by a certain set of specifications that their employer gives them, from the hours they work each week to how they perform a certain task.

However, they also have potential to receive other benefits (health insurance, retirement, etc.) from employers that contractors do not.

Additionally, employers have a responsibility to withhold taxes from their employees’ paychecks. The employee can then see how their annual wage and amount of income taxes that were withheld when they receive their W-2 tax form.

A W-2 is often referred to as an “informational return” because that’s exactly what it does: informs the employee and other parties about how much they earned that year, and the amount of state and federal taxes taken out of their pay.

The differing methods of filing taxes is one of the biggest distinctions between employees and contractors.

But how?

While it’s true that contractors and freelancers often perform the same tasks as their employee counterparts, they are offered much more flexibility.

So how do contractors exactly operate?

Independent Contractors

Often submit invoices to receive their payment

Are sole proprietors or have an incorporated business offering their services

Come into a job with training and expertise in the role

Often juggle several jobs with various companies

Have flexible working hours

Personally responsible for tax-related payments

Claim tax deductions for expenses incurred in order to do their job.

While it sounds like legalese, a sole proprietorship doesn’t require any paperwork and essentially begins when you start business by yourself.

You, the contractor, should complete a W-9 right when you start working for a company to provide them with your information.

After that, you’ll receive a Form 1099 at the same time employees would receive their W-2 forms following the end of the year.

Simply put, contractors and freelancers are offered more wiggle room in how they perform their responsibilities, and this includes how they manage their taxes.

Once the distinctions between these two types of workers are made and understood, it’s easier for you to understand which tax forms you are required to fill out.

What is a W-9 Form?

Let’s start with the basics.

A W-9, or Request for Taxpayer Identification Number and Certification, is quite literally a single-page IRS form that you as an independent contractor fill out.

It will provide the company you work for with your taxpayer identification number (TIN), which may be a Social Security Number or an Employee Identification Number (EIN).

This form typically does not get sent to the IRS.

Rather, you can simply send it back to the organization that requested it, who will file your information in case of a discrepancy and for verification purposes.

The information you’ll provide in a W-9 is fairly simple and similar to a W-4. It includes:

- Your name

- Home address

- Business address (if applicable)

- Taxpayer Identification Number

- The type of business you operate (sole proprietorship, partnership, LLC, etc.)

Additionally, you’ll have to state whether you are subject to backup withholding, which is a method the IRS uses to ensure that it collects taxes on income.

Note: You are only subject to backup withholding if you provide an incorrect TIN or fail to report other types of income.

After you send the business you are working for your W-9, they use the information you’ve provided to send you and the IRS Form 1099-MISC, which states just how much income you’ve made in the past year while working for that company.

There is technically no deadline for filling out a W-9, but it’s important to send it to the company you’re working for as soon as possible in order to get paid.

What is Form 1099-NEC?

When tax season approaches, millions of people and businesses simultaneously sigh at the sight of a 1099 form.

Even more puzzling, businesses who used independent contractors were required to fill out a 1099-MISC form prior to 2020.

The reason the 1099-NEC was brought back after decades was largely due to the Protecting Americans from Tax Hikes (PATH) Act that changed the due date of Form 1099-MISC to January from the previous February 28 deadline.

Unsurprisingly, this caused mass confusion, so the IRS separated the reporting of payments for nonemployees to better distinguish the deadlines.

Now, the reintroduced 1099-NEC form solely reports “nonemployee compensation” – that’s you, the independent contractor.

While these forms look jarring at first glance, they are fairly simple to tackle when you break down its components.

- 1099-NEC is completed by the company that received your completed W-9.

- Business owners that hire you (the contractor) must file the 1099-NEC once they pay you over $600.

- A 1099-NEC is used to inform workers how much income they received over the last year.

- The form is sent mainly to freelancers, independent contractors or anyone who is technically self-employed.

Think of it this way:

The biggest difference between a 1099-NEC vs a W-2 is that the first one is for contractors, and the second one is for employees.

Additionally, just like any other tax form, it is absolutely essential that you make sure all the information on your 1099-NEC is correct, as the IRS uses it to certify that your reported income is accurate and truthful.

Each 1099-NEC will typically include the following information:

- Your name

- Your address

- Your TIN

- Name, address and TIN of the business who sent you the form

- Total amount of self-employment income you received in Box 1, which is likely subject self-employment tax

- The amount of federal or state income tax withheld, if any

It’s essential to have an understanding of 1099s in particular as research has found that 1099s grew 15% between 2000 and 2008, that’s even before companies like Uber existed.

Moreover, in 2014 there were a reported 91.1 million 1099s that were filed, which is a 22% increase since 2000 according to market-oriented research think tank Mercatus.

While this number represents the amount of “gigs” rather than freelance workers, it’s safe to say that the future of the workforce is one that focuses heavily on freelancers and contractors.

Although there is yet to be an analysis of what this number will look like following the chaos that was 2020 and the amount of gig jobs that were embraced during this time, it can be assumed to have skyrocketed.

And while some critics have blamed the gig economy for the decrease in traditional work, Mercatus found that the growth of the 1099 workforce is actually a result of traditional labor.

Differences Between A W-9, 1099-NEC, and 1099-MISC

So let’s break down the on-page differences between a W-9 vs a 1099-NEC vs a 1099-MISC..

The W-9 that collects tax information from you, including your name, address, and TIN, while the 1099-NEC reports the compensation you, a nonemployee, received in the last fiscal year to the IRS.

The 1099-MISC form is simply used to report miscellaneous income, and its updated version no longer features non-employee compensation.

Previously, Box 7 was used to report payments made to contractors, but it is now used to report the sales of consumer products $5,000 or more for resale.

You, the contractor, are required to fill out the W-9 and return it to the organization that you are doing work for.

While the W-9 is submitted only one time as you start working for a company, the 1099-NEC is required to be sent to you by January 31 annually at the beginning of tax season.

Businesses fill out the 1099-NEC as soon as you send invoices that equate to more than $600. Then, the 1099-NEC is sent to both you and the IRS.

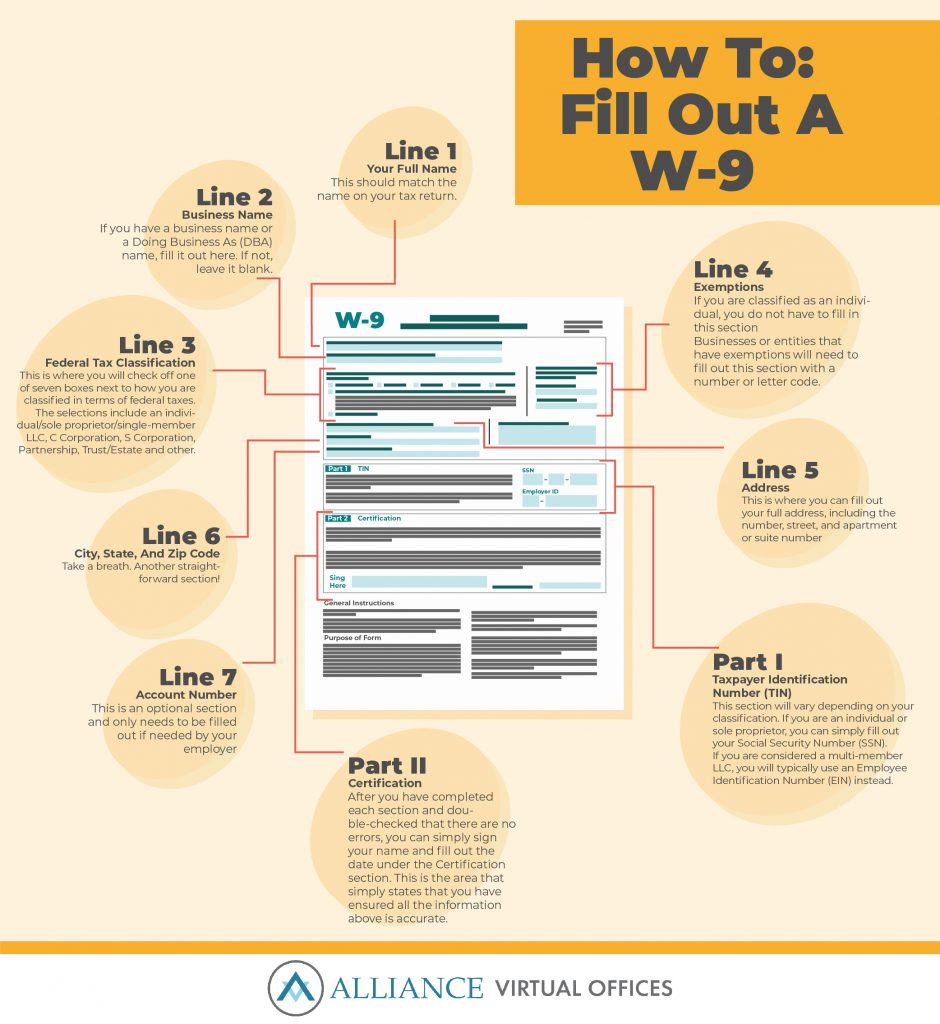

How To Fill Out A W-9

Now that you can distinguish the role of a 1099 versus a W-9, filling out these forms can be a breeze.

You still may be wondering “What do I write for a W-9?” If you’ve ever been a full-time employee, a W-9 is very similar to a W-4.

Better yet, it’s barely one-page long and overall pretty simple.

First, the company should have already filled out the business name and its Employee Identification Number.

After that, you will go line by line and fill out personal information that is pretty self explanatory. It will look something like this:

If you want a visual of what a W-9 looks like, click here for a sample form.

How to fill out a W-9

Line 1: Your Full Name

This should match the name on your tax return

Line 2: Business Name

If you have a business name or a Doing Business As (DBA) name, fill it out here. If not, leave it blank

Line 3: Federal Tax Classification

This is where you will check off one of seven boxes next to how you are classified in terms of federal taxes. The selections include an individual/sole proprietor/single-member LLC, C Corporation, S Corporation, Partnership, Trust/Estate and other

Line 4: Exemptions

- If you are classified as an individual, you do not have to fill in this section

- Businesses or entities that have exemptions will need to fill out this section with a number or letter code.

Line 5: Address

This is where you can fill out your full address, including the number, street, and apartment or suite number

Line 6: City, State, And Zip Code

Take a breath. Another straightforward section!

Line 7: Account Number

This is an optional section and only needs to be filled out if needed by your employer

Part I: Taxpayer Identification Number (TIN)

- This section will vary depending on your classification. If you are an individual or sole proprietor, you can simply fill out your Social Security Number (SSN).

- If you are considered a multi-member LLC, you will typically use an Employee Identification Number (EIN) instead.

Part II: Certification

After you have completed each section and double-checked that there are no errors, you can simply sign your name and fill out the date under the Certification section. This is the area that simply states that you have ensured all the information above is accurate.

And you’re done!

Once you are finished filling out your W-9, you can send it back to the company who sent it to you through the mail or through a secured file attachment so they can keep it for their records.

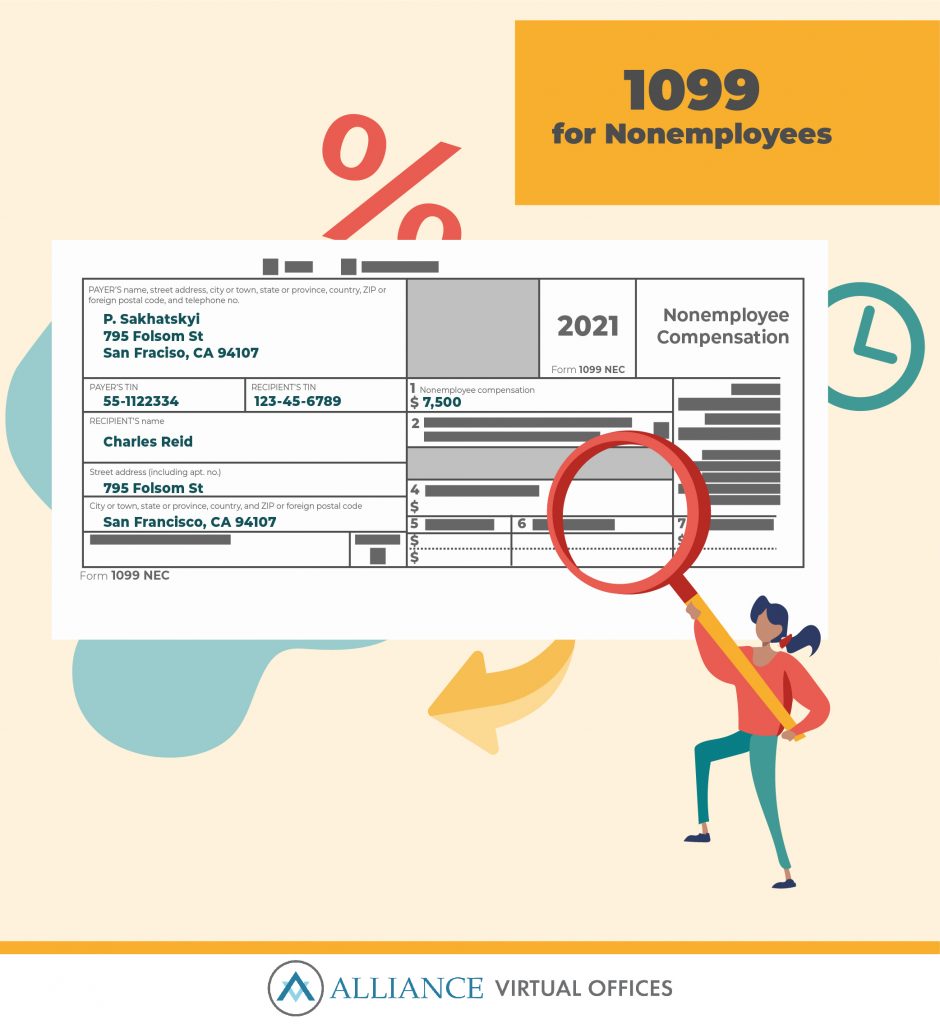

How To Fill Out A 1099-NEC

The 1099-NEC Form is used for non-employees, as well as attorneys under certain circumstances.

So how do you tackle the 1099-NEC and how does it differ from the 1099-MISC that contractors have grown accustomed to in the past several decades?

For starters, businesses will need their EIN, business name, and business address. The company will also fill out your information (name, address, TIN, etc.) on the left side of the form.

Then they can use your W-9 form and fill out the rest:

How To Fill Out A 1099-NEC

Box 1: Non-employee compensation

This is where the company will report how much you made in the last fiscal year.

Box 4: Federal income tax withheld

Typically, businesses do not withhold income tax from non-employees. However, if you are subject to backup withholding, the company may use this section to enter the amount of backup withholding.

Box 5, 6, 7: State tax withheld, state/payer’s number, and state income

- The IRS itself does not need the company to fill out these sections, which would include your state income, any state taxes that have been withheld and which state it’ll be reported to.

- However, the state’s department of taxation may need this information depending on where you are located.

How To Fill Out A 1099-MISC

Similar to the 1099-NEC, Form 1099-MISC is simply used to report income that is considered miscellaneous and no longer includes non-employee compensation.

The 1099-MISC can still be used to report payments that are at least $600 under other circumstances, including:

- Rents

- Prizes and awards

- Medical and healthcare payments

- Non-qualified deferred compensations

- Payments to an attorney

- Fishing boat proceeds

- Consumer goods for resale

- At least $10 in royalties

When filing a 1099-MISC, businesses will still need information similar to what was mentioned above, such as the business and recipient’s basic information (name, address, phone number, etc.), both the business and recipient’s TIN, and the amount that was paid to the recipient.

While the updated 1099-MISC may seem a bit overwhelming, it can be straightforward if you take it box by box:

How to fill out a 1099-MISC

Box 1: Rents

This is where a business will enter any rents they paid that amounted to $600 or more

Box 2: Royalties

Royalty payments of over $10 will go here

Box 3: Other income

The company can fill out any other payments of $600 or over here that may not apply to any of the other sections on this form

Box 4: Federal income tax withheld

Any backup withholding would be entered in this section

Box 5: Fishing boat proceeds

This section should feature an individuals’ share of proceeds it made from the sale of a catch or the fair market value of distribution

Box 6: Medical and healthcare payments

Payments to a physician or healthcare professionals of $600 or over will be filled out here

Box 7: Payer made direct sales of $5,000 or more of consumer products to a buyer (recipient) for resale

- If this applies to the business, they will simply mark it with an X, not a total amount

- This section was previously where non-employee compensation would be filled out

Box 8: Substitute payments in lieu of dividends or interest

This is where payments of at least $10 in substitute payments given to a broker instead of dividends or interest will be entered

Box 9: Crop insurance proceeds

If proceeds are over $600, they will be reported here

Box 10: Gross proceeds paid to an attorney

Same as Box 9

Box 11: N/A

This can be left blank

Box 12: Section 409A deferrals

Section 409A creates guidelines for “nonqualified deferred compensation”. This section will likely be left blank

Box 13: Excess golden parachute payments

- A gold parachute payment is simply an agreement between a company and an employee stating that the employee will receive payments if they are terminated, including severance pay, bonuses, stock options, etc.

- If this payment totals $600 or more, it will be entered here

Box 14: Nonqualified deferred compensation

The amounts deferred that are included under section 409A can be filled out here

Box 15, 16, 17: State information

Similar to the 1099-NEC, these boxes will be filled dependent on the state and whether the payer is part of the Combined Federal/State Filing Program

While it may seem daunting that there are so many sections in the 1099-MISC, each box is relatively self-explanatory and makes it easy for those who paid for certain services to easily identify what applies to them.

How do I save money on taxes on the 1099?

As an independent contractor, it’s important to keep track of how much you spend on your everyday business-related expenses if you want to save money on your income taxes.

On your 1099, you can write off things like home office supplies, business travel, meals with clients and more.

There should be four copies of the 1099 that your employer will fill out.

- One copy will go to the IRS and must be submitted by January 31

- One copy will be sent to the state tax department

- One will be sent to you

- One copy should be kept for records.

Protecting Your Company

If you’re the owner of a small business or even just self-employed, it is essential to protect yourself from any legal repercussions that could arise.

One of the more common methods that individuals or companies take to protect their business is forming an entity through a Limited Liability Corporation (LLC) or a Limited Liability Partnership (LLP).

But what is the difference between the two?

An LLC is a legal entity that serves as a safeguard for businesses. Thanks to their flexible nature, LLCs are extremely common across various industries.

The goal of an LLC is to protect the owner (or owners) with limited liability. This simply means that if the business accrues any debts or faces any lawsuits, you are not personally responsible.

For instance, if your LLC is facing a lawsuit, debtors cannot collect your personal assets (your home, banking, car, etc.) They are quite literally limited to only collecting your LLC’s assets.

LLCs are ideal because practically anyone can start one, from a one-person operation to a business with multiple co-owners. However, this varies by state so it’s important to check what your local laws say.

LLCs are able to file as a corporation, sole proprietorship, or partnership, while LLPs must file solely as an LLP.

An LLP is a common partnership among professional firms such as lawyers, architects, accountants, and the like. Using an LLP provides partners with additional legal protection and allows them to share management responsibilities, but also allows an individual to be not liable for their partners’ potential errors or mistakes.

One of the key distinctions between an LLC and an LLP is that an LLP must have two or more partners. But again, some states require LLCs to have more than one partner as well.

Additionally, both LLPs and LLCs give the owner or owners a pass-through taxation, which simply means any of the profits or losses your company accrues passes through to the owner’s personal tax return.

However, before you make any major business decisions, consult a tax advisor to figure out which would best suit your needs.

Another measure you can take to protect yourself as a freelancer, contractor without a physical office, is to look towards adopting a virtual office address.

At Alliance, our virtual office plans can provide companies and freelancers with the affordable business amenities and services that are otherwise costly.

Virtual Office Features

Prestigious Business Addresses

Business Phone Number (VoiP)

Professional Call Answering

Virtual Receptionist

Local or toll-free phone number

Day Office Rentals

Physical Meeting Spaces

Not only are you equipped with the resources that can seem out of reach being part of a small operation, our Platinum Plus Virtual Office Plan can open the door to unique networking opportunities with like-minded professionals and help you set your services apart from competition.

Even more conveniently, you can set up an LLC using a virtual address.

Doing so can completely fill out your profile as a professionally-run business, even if you’re a single-person operation.

While our virtual office plans obviously give you or your company a prestigious address, it also:

Virtual Office Benefits for Contractors

Protects your home address

Legitimizes and add credibility to your business

Cuts down on costs, which is helpful for companies/freelancers just getting started

Helps you establish business credit

Provides access to other amenities like mail handling, meeting spaces, and virtual receptionists services

If you think that adopting a virtual office address package seems like the right fit for your business, check out how to set one up here.

What can I write off on my taxes?

If you’re a freelancer / independent contractor you may be wondering what exactly you can write off on your taxes.

For starters, if your home is your office and anything you spend to improve that environment should be taken into account. That includes a new ergonomic office chair or an L-shaped desk you purchased to create a fully-equipped home office.

Other potential deductions for contractors include:

Computer supplies (monitors, desktop, etc.)

Software purchases

Fees for banking and money wiring (PayPal, Venmo, etc.)

Virtual office services (think Alliance’s virtual office packages)

Any other home office supplies (filing cabinet, shelves, lighting)

In addition to knowing what deductions you are entitled to as an independent contractor, it is also wise to always keep a blank copy of a W-9 on your computer.

Remember, there is a huge difference between a W-9 vs a 1099 vs a W-2, so keeping track of all of your tax-related forms is crucial for an organized contractor or freelancer.

This allows you to easily connect and network with new clients, while helping you keep track of which organizations you are currently providing services for.

Did You Get All That?

Now that you have a grasp on the difference between a W-9 vs a 1099, filing your taxes is hopefully less headache-inducing.

Regardless if you’re a contractor, freelancer or small business owner, having a full understanding of what you’re entitled to is critical to any well-oiled operation.

Having the appropriate resources in tow can help you stand apart from competition, while also giving you the confidence to expand how many clients you provide your services for.

Being part of this agile workforce can feel confusing and sometimes even lonely, but knowing how to advocate for yourself during tax season can help you establish yourself as a true professional.

Further Reading

- Using a Virtual Business Address to Set Up Your LLC

- How to Get an Online Business License

- W-9 Form PDF

- Form 1099-NEC PDF

- Form 1099-MISC PDF