- Active vs Passive Real Estate Investing: What’s the Difference?

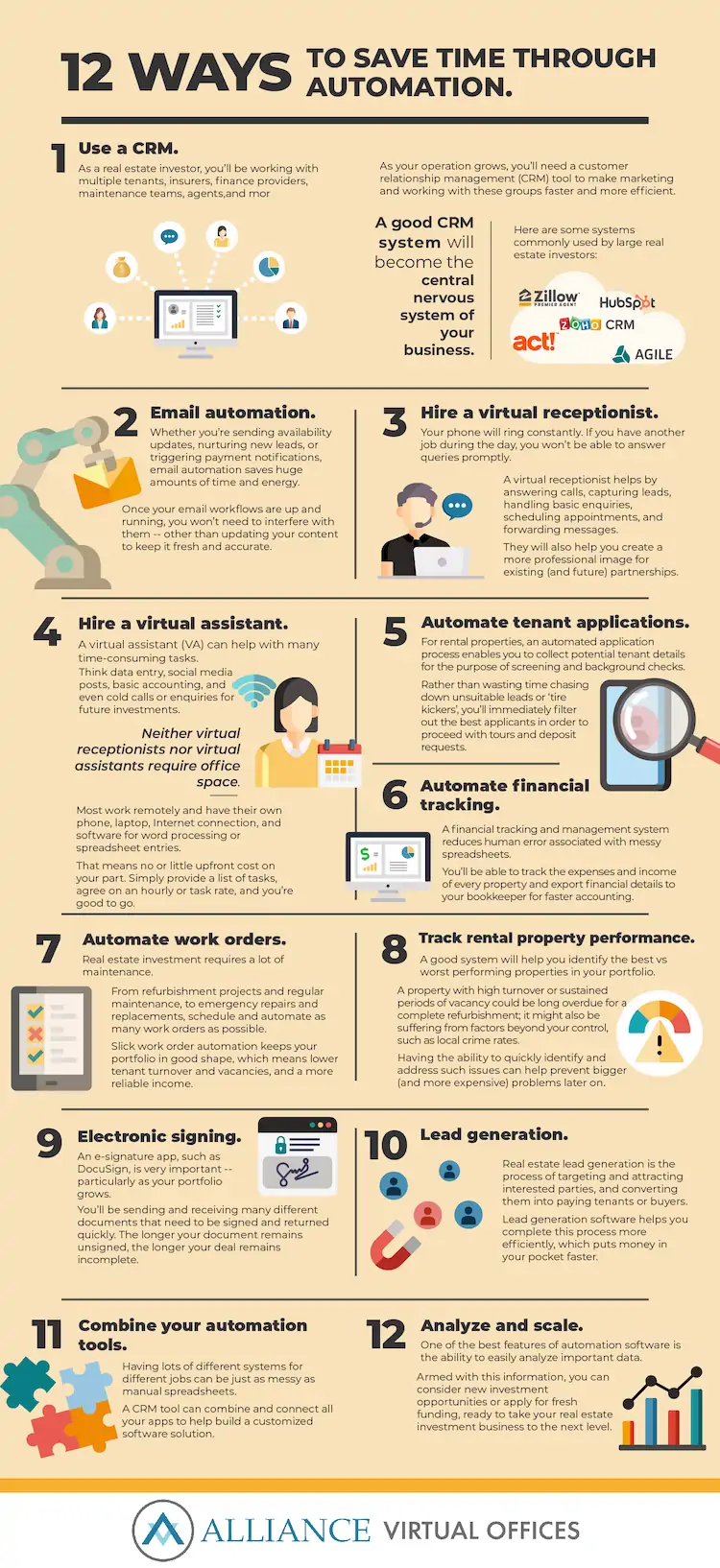

- Infographic: How to Level-Up As a Real Estate Investor

- How Real Estate Investors Utilize Virtual Business Solutions

Q: What is the difference between active and passive real estate investment?

A: Active investment is a hands-on role where you’ll manage the property directly. Passive investment is a backseat approach; you’ll put money into a syndication or REIT and spend much less time on day-to-day operations.

Want to be a real estate investor?

There are many different approaches and strategies for real estate investing.

Here we’ll explain the key differences between passive and active real estate investing, and which approach best suits you.

Let’s get started.

- Active vs Passive Property Investment: Which One is Better?

- Passive vs Active Real Estate Income

- How Do I Become a More Successful Active Real Estate Investor?

- How Real Estate Investors Utilize Virtual Offices

Active vs Passive Real Estate Investing: What’s the Difference?

At a simplified level, passive investment is a hands-off approach with limited control and time commitments.

On the flip side, active investment is much more hands-on and requires significant time and involvement.

Don’t let your address hold you back from success!

Upgrade your business image and ensure compliance with legal and financial requirements by getting a virtual office address from Alliance in the location of your choosing.

A virtual office provides you with a prestigious commercial address that can be used as your business address for LLCs, corporations, and other legal entities. It also helps you maintain your privacy and security, all while adhering to the laws of your state. With a virtual office from Alliance, you can establish your presence in any market.

Don’t let your address limit your business’s growth and potential. Get a virtual office address to take your business to the next level!

It’s the classic case of working ‘on’ a business versus working ‘in’ a business.

Let’s take a closer look at active vs passive real estate investing, and the key differences.

Active Real Estate

What is an active real estate investor?

Active real estate investors are closely involved with all aspects of managing and developing their real estate.

Ever rented a condo or an apartment? Your landlord is a type of real estate investor.

They are usually independent and in control over as much as possible, such as searching for the right properties, negotiations, and financing.

They commonly purchase property for the purpose of a quick return on their investment, or for regular rental income.

Broadly speaking, they do this in two ways:

Fix and Flip

Fix the property up and sell it for a profit. An investor will often buy a property in an established area, redevelop it, and sell it for a profit. The shorter the time frame, the better.

Refurbish and Rent

Rent the property out for cash-flow. In addition to rental income the property may grow in value over time, which represents a longer-term investment should the investor wish to sell it in the future.

Some real estate investors combine these two methods. An investor with a portfolio of real estate properties may keep some for rental and others for a quick sale.

Active real estate investing includes anything from small condos to massive apartment buildings with multiple units.

Investors can grow their real estate portfolio and still remain active by outsourcing tasks and utilizing tools to automate workflows.

Passive Real Estate

Passive real estate investors typically have less day-to-day involvement.

There are two main types of passive investment: direct and indirect.

A direct approach involves purchasing part or all of a property and hiring a management company to take care of regular operations. This could include refurbishment, ongoing maintenance, and collecting rent from tenants.

This way, the investor can still be relatively hands-off in the management of the property.

Another form of passive real estate investing is the indirect approach.

This involves putting capital into a real estate syndication, which is a partnership between multiple investors.

A syndication will combine and share capital, and sometimes skills and other resources too, enabling the group to gain purchase power and acquire properties they couldn’t otherwise afford.

The syndication is typically managed by a sponsor, who pools the syndicate’s funds to buy a specific development or portfolio. The sponsor may directly manage some elements of the property management, or outsource it to an agent.

Passive real estate investors may also invest in funds and REITs.

Other interpretations

The word ‘passive’ in real estate is often associated with the concept of ‘passive income’.

A passive income stream is one that requires very little time or effort, and if it grows, becomes known as progressive passive income.

Virtually all real estate investments are considered ‘passive income’.

That’s because you generate revenue from the money that you invested rather than the work that you do. You don’t actually work for the income in the same way that you would earn a job salary.

However, there may be some crossover.

If you work specifically in the real estate industry, you may be classed as an ‘active’ real estate professional by the IRS. This usually applies if you spend at least 750 hours per year working in real estate.

You may also be classed as a real estate professional by the IRS if you own at least 5 percent of a real estate business.

In that case, your real estate investments will be treated as active income.

Either way, you will still have to pay taxes on your income regardless of whether it’s active or passive.

Active vs Passive Property Investment: Which One is Better?

When deciding whether to choose an active or a passive investment, there is no right or wrong answer.

It depends on your priorities, your financial resources, and your lifestyle.

Here are 5 key considerations to help you understand whether you are best suited to active or passive real estate investment:

How much control do you want?

As an active real estate investor, you are in full control.

You are the main decision-maker and executor of everything from choosing and developing properties, to managing tenants or house sales.

If you want to be in the driving seat of your investment, an active role may be better.

If however you want more of a backseat role, and you are confident putting your investment in the hands of others, you may prefer a passive real estate investment.

Consider your skills and personality.

While you may like the idea of an active investment, do you have the skills and dedication to do it?

Are you an experienced negotiator? Can you manage a property development? Are you prepared to deal directly with tenants or buyers?

When planned and executed well, active real estate investment can be very rewarding.

But take time to consider whether you have the appropriate skill set, personality, and support network to take it on.

How much time do you have?

Active investing can be like a full-time job.

If you have regular financial commitments and rely on another job to meet these needs, you may not have the capacity to take on a real estate investment by yourself.

In that case, passive investment may suit your lifestyle better; the day-to-day responsibilities are carried out by a management team, which requires less time commitment on your part.

How much risk do you want to take?

Generally, a passive investment is considered a lower risk strategy, as passive investors pool their resources with other investors for a safer return.

Plus, you are supposedly plugging into an established system run by an experienced sponsor, who will make informed decisions on your behalf.

Active investing is considered riskier because you are liable for loan guarantees, which increases your exposure to risk.

That said, when you own the property, you own the profits too. But in a downturn, you are responsible for the losses too.

Either way, every investment carries an element of risk. You must carry out your own risk assessment before committing to either passive or active real estate investment.

Do you want to scale or diversify?

An active investment is often limited by certain factors such as cost and geographical location.

You will need a property within easy reach so you can oversee the development and manage tenants or sales.

The more you outsource to others, the less active your role becomes.

However, if you wish to diversify and push further afield, or invest in different types of property, a passive investment gives you the potential to tap a greater variety of deals and new opportunities across the nation.

Passive vs Active Real Estate Income

Remember: The decision over whether to pursue a passive or active real estate investment comes down to your individual and personal circumstances.

Here’s that list again:

- Control: The more active your role, the more control you will have over your investment.

- Skills and experience: If you’re lacking real estate investment experience, you may prefer a passive approach.

- Time: Active investment takes up a lot of time, as you’re responsible for virtually everything.

- Risk: Passive investment is generally considered a lower risk strategy, as you’re not liable for 100% of the costs. But remember that every investment carries risk.

- Growth aspirations: Want to scale faster? A passive investment may offer greater opportunities as you’re not necessarily limited by location or your own personal time commitments.

When it comes to income, an active real estate investor stands to receive 100% of the profits by being the sole proprietor.

An active investor commits their time and exposes themself to risk in return for a greater share of the rewards.

On the flip side, passive investors split the profits among many parties.

But that doesn’t automatically mean active investors make more than passive investors.

A passive investor commits less time and therefore can pursue other deals or developments to generate income, while continuing to receive returns from their real estate syndication.

A passive investor may also be involved in a larger-scale development, which has the potential to generate greater returns.

In the right market, both options have the potential to generate steady cash-flow and return on investment. It’s your job to ensure your preferred strategy matches your personal circumstances.

How Do I Become a More Successful Active Real Estate Investor?

Becoming a successful active real estate investor takes time, research, and effective planning.

It’s essential to know your market in order to identify the right opportunity. It’s tempting to rush into what seems like a great deal.

But you can’t afford to make rash decisions.

Doing so will put your capital at risk.

It’s essential to spend time researching your options fully and, once you’ve settled on an investment, the work doesn’t stop there.

In fact, it’s only just beginning.

As an active investor, you will have many responsibilities. You may already have a full-time job or other commitments, which means spare time is hard to come by.

Good news is, there are various ways to save and recoup precious time while managing your investment.

Here’s the secret:

It’s all about automation.

Automate as much as you can.

The more manual jobs you can shift off your own hands, the more you can free up your time.

And the more time you have, the more you can thoroughly research and plan your next investment opportunity.

Ultimately, this is crucial to make your life easier if you want to succeed.

Here are 12 ways to save time through automation:

They will also help you create a more professional image for existing (and future) partnerships.

Armed with this information, you can consider new investment opportunities or apply for fresh funding, ready to take your real estate investment business to the next level.

CRM for Real Estate Investors

Remember the part about CRM becoming the central nervous system of your business?

The larger your real estate business, the more you will need a reliable CRM system.

It’s all about making your life easier while smoothing the way for new (paying) tenants or motivated buyers.

A CRM system will help you to:

- Organize prospect information, such as contact details and current status, so it’s quick and easy to find.

- Respond to enquiries promptly and keep track of each prospect.

- Manage your sales pipeline and the status of each prospect.

- Keep in touch with former tenants for future deals.

- Automate tasks and workflow such as email follow-ups after tours.

Implementing Virtual Business Solutions

Some of the same strategies that help you save time through automation can offer important additional benefits.

Take the idea of hiring a virtual receptionist, for example.

Working remotely and utilizing a virtual receptionist doesn’t just save you time and money.

Having a friendly, professional voice answering calls on your behalf boosts your professionalism, improves the customer call experience, and builds brand credibility.

For the same reason, many entrepreneurs who utilize live receptionist services often combine it with a virtual office.

- A virtual office provides all the essentials you’d expect from a physical office, such as a business address and mail processing services.

The big difference is, you don’t pay for full-time office space.

A virtual office is a combination of both physical and virtual services. This normally includes a business address, a place to receive mail, and on-demand access to meeting rooms.

You may want to add live receptionist support and a cloud-based business phone number, too.

How Real Estate Investors Utilize Virtual Offices

Protect Your Home Address

Have your rent checks and other documentation sent to your virtual office address rather than your own home. You can publish your virtual address on your website, email footer, and business cards.

Professionalism

A recognized office address looks much more professional and established than a home address, which will give potential partners and investors confidence in your business.

Mail Handling

Rather than risk bombarding your home with junk mail (and unexpected callers), mail can be sent to your virtual address before being forwarded to you. Or you can collect it yourself.

Test New Markets

As you scale your business, a virtual address in a major city can increase visibility and brand awareness.

Build Financial Credibility

The process of building credit and applying for loans is often made easier with a commercial address and a business number.

Here’s how a virtual office can support your real estate investment business:

Virtual office centers also have onsite meeting rooms and office space.

You can reserve a workspace by the hour to meet investors, talk with buyers or sellers, and carry out negotiations in a private, professional setting.

If you need to meet regularly, some virtual office plans have inclusive meeting room usage.

For instance, Alliance Platinum Plus offers 4-16 hours of meeting room usage every month, which represents savings on meeting room rental of approximately 70%.

Conclusion

Remember, there is no right or wrong answer when considering active real estate vs. passive real estate investment.

The choice you make depends on your personal priorities, your financial resources, and your lifestyle.

If you have a lot of time and you’re looking to manage real estate hands-on, an active role could be right for you. However, if your time is already taken up, a passive real estate partnership with a syndicator could be a better solution as it requires less time and effort.

Whichever path you choose, there are many different ways to become a successful real estate investor. With the right approach and planning, it can be a fulfilling and financially rewarding decision.

Further Reading

- Virtual Office Solutions 2021 – The Complete Buyer’s Guide

- Top 5 Answering Services for Small Businesses, by price

- Virtual Office Prices | How Much Does A Virtual Office Cost?