- The shift towards independent contracting

- How to prepare to become an independent contractor

- Navigating the legal landscape of independent contracting

Q: How can I become an independent contractor?

A: To become an independent contractor, start by identifying a marketable skill or service you can offer, then conduct thorough market research to understand your target clients’ needs. You’ll also need to legally establish your business, which may include registering your business name, obtaining necessary licenses or permits, and understanding your tax obligations. This article will teach you everything you need to know.

Becoming an independent contractor can be a great way to take control of your career and increase your earning potential. As an independent contractor, you have the freedom to choose your own clients, set your own rates, and work on your own schedule.

However, making the transition from traditional employment to independent contracting can be daunting.

The first step to becoming an independent contractor is to identify your skills and determine what services you can offer. This could include anything from graphic design to writing to consulting.

Regardless of the field you’re in, this article is your complete guide to becoming a successful independent contractor.

The Shift Towards Independent Contracting

In recent years, there has been a significant shift towards independent contracting.

More and more people are choosing to work for themselves rather than for traditional employers. This trend is driven by a number of factors.

Firstly, the rise of the gig economy has made it easier for people to work as independent contractors. Platforms like Uber, Lyft, and TaskRabbit have made it simple for people to find work as freelancers.

Secondly, many people are attracted to the flexibility that comes with being an independent contractor. You can choose when and where you work, and you have more control over your schedule.

Finally, some people are turning to independent contracting out of necessity.

With the rise of automation and the decline of traditional jobs, many people are finding it difficult to secure full-time employment. Independent contracting provides a way for people to earn a living and support themselves.

If you’re considering becoming an independent contractor, it’s important to understand the pros and cons of this type of work.

While there are many benefits, such as flexibility and control over your schedule, there are also challenges, such as the need to find your own work and manage your finances.

It’s important to weigh these factors carefully before making a decision.

The Significance of Independent Contracting in Today’s Workforce

Independent contracting has become increasingly popular in recent years, and for good reason. As an independent contractor, you have the ability to work on your own terms, choose the projects you want to work on, and set your own rates.

One of the biggest advantages of independent contracting is the flexibility it provides. You can work from anywhere and at any time, which allows you to better balance your work and personal life.

Additionally, you have the freedom to choose the clients and projects that align with your interests and skills.

Another benefit of independent contracting is the potential for increased earnings. As an independent contractor, you have the ability to set your own rates and negotiate contracts directly with clients. This can result in higher earnings compared to traditional employment.

However, it is important to note that independent contracting also comes with its own set of challenges. As an independent contractor, you are responsible for managing your own finances, taxes, and benefits. Additionally, you may not have the same job security or benefits as traditional employees.

Independent contracting can be a viable and rewarding career path for those who are willing to take on the responsibilities that come with it.

Mindset and Preparation for Independent Contracting

When transitioning to independent contracting, it’s important to adopt a mindset that prioritizes self-discipline and self-motivation. You’ll no longer have a boss to hold you accountable, so staying on top of your work and deadlines is up to you.

To prepare for this new way of working, start by creating a schedule and sticking to it. Use tools like calendars and to-do lists to help you manage your time and stay organized.

Additionally, consider setting up a designated workspace in your home or renting a coworking space to help you stay focused and minimize distractions.

It’s also important to have a solid understanding of your finances before becoming an independent contractor.

This includes setting rates that are fair to both you and your clients, as well as understanding how to manage your taxes and expenses. Consider working with a financial advisor or accountant to help you navigate these areas.

Finally, don’t be afraid to market yourself and your skills. As an independent contractor, you’ll be responsible for finding your own clients and projects.

Create a portfolio that showcases your work, and consider networking with other professionals in your industry. With the right mindset and preparation, you can thrive as an independent contractor.

Identifying Your Niche: Market Research and Client Needs

To become a successful independent contractor, you need to identify your niche. This means finding a specific area of expertise that you can offer to clients.

Conducting market research can help you understand what services are in demand. You can use this information to determine what your niche should be.

Start by researching your industry and identifying the services that are in high demand. You can use online resources, industry publications, and professional associations to gather this information.

Once you have a list of services, you can then determine which ones align with your skills and experience.

It’s also important to understand your potential clients’ needs. This means understanding what problems they are trying to solve and what their goals are.

You can use this information to tailor your services to meet their specific needs. This will help you stand out from other contractors and attract more clients.

As you identify your niche, consider creating a list of services you can offer. This will help you communicate your expertise to potential clients. You can also use this list to develop marketing materials highlighting your skills and experience.

In summary, identifying your niche requires conducting market research and understanding your potential clients’ needs.

By doing so, you can determine what services to offer and tailor them to meet your clients’ specific needs. This will help you stand out from other contractors and attract more clients.

Flexibility and Self-Management in Independent Contracting

As an independent contractor, you have the freedom to work on your own terms and manage your own schedule. This flexibility allows you to balance your work and personal life and to take on projects that align with your interests and skills.

To make the most of this flexibility, it is important to develop good self-management skills. This includes setting clear goals, creating a schedule, and prioritizing tasks.

You may find it helpful to use tools such as calendars, to-do lists, and project management software to stay organized.

Another key aspect of self-management is communication. As an independent contractor, you will need to communicate effectively with clients, colleagues, and other stakeholders.

This includes setting expectations, providing regular updates, and addressing any concerns or issues that arise.

The flexibility and self-management skills required for independent contracting can be challenging, but also rewarding. By developing these skills, you can build a successful career as an independent contractor and enjoy the benefits of working on your own terms.

Legal Foundations for Independent Contractors

To become an independent contractor, you must first understand the legal foundations governing this type of work arrangement. As an independent contractor, you are not an employee of the company or individual that hires you, but rather a self-employed individual who provides services to clients.

One of the most important legal considerations for independent contractors is determining your classification.

The IRS has specific criteria for determining whether a worker is an independent contractor or an employee, and misclassification can result in legal and financial consequences.

To avoid this, it’s important to understand the IRS guidelines and ensure that your work arrangement meets the criteria for independent contractor status.

Another legal consideration for independent contractors is contracts. It’s essential to have a written contract outlining the terms of your work arrangement, including the scope of work, payment terms, and any other relevant details.

This can help protect both you and your client in the event of any disputes or misunderstandings.

Additionally, independent contractors are responsible for their own taxes, including self-employment taxes. It’s important to understand your tax obligations and ensure you properly report and pay your taxes.

Understanding the legal foundations for independent contractors is essential for anyone looking to pursue this type of work arrangement.

By taking the time to educate yourself on the relevant laws and regulations, you can ensure that you are operating within the legal framework and setting yourself up for success as an independent contractor.

Navigating Business Registrations and Licensing

When starting a business as an independent contractor, it’s important to ensure that you have all the necessary licenses and permits to operate legally. Here are some steps to follow:

- Research the requirements for your specific industry and location. This can usually be done online or by contacting your local government offices.

- Register your business with the appropriate state and federal agencies. This may include obtaining a tax identification number, registering for sales tax, and registering with the Secretary of State.

- Obtain any necessary professional licenses or certifications. Depending on your industry, you may need to pass an exam or complete specific training to obtain these credentials.

- Keep up with renewals and updates. Many licenses and permits need to be renewed annually or bi-annually, so make sure to keep track of expiration dates and submit renewals on time.

By following these steps and staying on top of your business registrations and licensing requirements, you can ensure that you are operating legally and avoid any potential legal issues down the line.

Contractual Agreements and Legal Resources for Contractors

As an independent contractor, you need to be aware of the legal implications of your work. It is essential to have a contractual agreement in place that outlines the terms and conditions of your services.

This agreement should include details such as project scope, payment terms, and intellectual property rights.

To ensure that your contractual agreement is legally binding, you may want to seek the advice of a lawyer. A lawyer can review the agreement and ensure it meets all legal requirements. They can also help you understand any legal jargon or clauses that may be confusing.

Additionally, there are many legal resources available for contractors.

Websites such as LegalZoom and Rocket Lawyer offer affordable legal services, including contract templates and legal advice. These resources can be particularly useful for small business owners who may not have the resources to hire a full-time legal team.

Having a solid contractual agreement and understanding the legal implications of your work is crucial for independent contractors. Seek legal advice when necessary and take advantage of the many legal resources available to you.

Understanding and Complying with Independent Contractor Laws

As an independent contractor, it is important to understand the laws that govern your work. These laws vary by country and state, so it is important to research the laws that apply to you.

One key aspect of independent contractor laws is the distinction between independent contractors and employees. Independent contractors are not considered employees and are therefore not entitled to the same benefits and protections as employees.

To ensure that you are properly classified as an independent contractor, it is important to have a written contract that outlines the terms of your work.

This contract should include details such as the scope of work, payment terms, and contract duration.

In addition to having a written contract, it is important to keep accurate records of your work and expenses. This will help you demonstrate that you are a legitimate independent contractor, not an employee.

By understanding and complying with independent contractor laws, you can ensure that your work is legal and that you are properly classified as an independent contractor.

Financial Management Strategies for Contractors

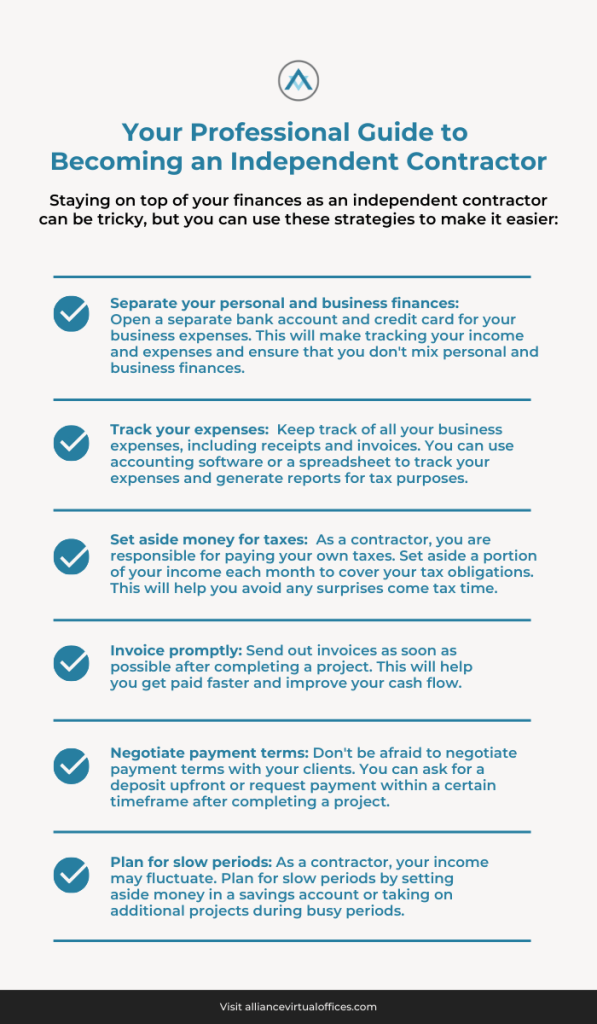

As an independent contractor, managing your finances is crucial to your success. Here are some financial management strategies to help you stay on top of your finances:

By following these financial management strategies, you can ensure that your finances are in order and focus on growing your business.

Tools and Resources for Financial Efficiency

As an independent contractor, it’s important to keep track of your finances and manage them efficiently. Here are some tools and resources that can help you achieve financial success:

- Accounting software: Consider using accounting software like QuickBooks or FreshBooks to manage your finances. These tools can help you track income and expenses, generate invoices, and prepare tax documents.

- Expense tracking apps: Use expense tracking apps like Expensify or Shoeboxed to keep track of your business expenses. These apps allow you to scan receipts and track expenses in real-time, making it easier to stay organized and claim deductions come tax season.

- Retirement accounts: As an independent contractor, you won’t have access to employer-sponsored retirement plans, but you can still save for retirement. Consider setting up an individual retirement account (IRA) or a solo 401(k) to save for your future.

- Business bank account: Open a separate bank account for your business to keep your personal and business finances separate. This can make it easier to manage your finances and track your business expenses.

- Tax resources: Make sure you understand your tax obligations as an independent contractor. The IRS website has resources and information to help you stay compliant and avoid penalties.

By utilizing these tools and resources, you can manage your finances more efficiently and set yourself up for financial success as an independent contractor.

How Alliance Virtual Offices Supports Independent Contractors

As an aspiring independent contractor, Alliance Virtual Offices provides a suite of services essential for establishing and growing your business.

With Alliance Virtual Offices, you can access flexible virtual offices, live receptionist services, and virtual phone plans, all crucial for operating efficiently and professionally from any location. This adaptability is vital in today’s dynamic work landscape.

Alliance Virtual Offices offers over 1400 virtual office locations across 44 countries, enabling you to strategically position your business in key markets worldwide. This expansive network is especially advantageous for attracting a diverse client base.

Moreover, Alliance Virtual Offices ensures that you have access to on-demand professional spaces, meeting room rentals, and coworking spaces, providing a professional backdrop for your work and client meetings.

This aspect of Alliance Virtual Offices is key to solidifying the professionalism of your independent contracting business.

Wrapping Up: How to Become an Independent Contractor

Becoming an independent contractor can be a great way to take control of your career and enjoy the freedom and flexibility of working for yourself. To become an independent contractor, you should start by identifying your skills and expertise and researching your industry to determine the demand for your services.

Once you have a good understanding of your market, you can start building your brand and marketing your services to potential clients. This may involve creating a website, networking with other professionals, and leveraging social media to build your online presence.

As you start to build your client base, it’s important to establish clear contracts and agreements that outline the scope of your work, payment terms, and other important details. This will help ensure that you are protected and that your clients understand what they can expect from you.

Further reading:

- Hiring Freelancers: Tips for Small Businesses

- Integrating Live Receptionists Into Your Small Business Communication

- Creating a Professional Image: Enhancing Brand Perception with Live Receptionists for Startups

- From Chaos to Control: Process for Small Business Productivity

It’s important to stay organized and keep track of your finances as an independent contractor. This may involve setting up a separate bank account, tracking your expenses, and staying on top of your taxes.

Finally, you should consider setting up an LLC to protect your privacy and finances. One of the best ways to do so is with a Virtual Office.

A Virtual Office helps you solidify your professional reputation while also helping you protect your home address. You also gain access to on-demand work and meeting spaces, allowing you to make the most of your flexible workstyle.

By following these steps and staying focused and dedicated, you can become a successful independent contractor and enjoy the many benefits of working for yourself.