Please note that Alliance Virtual Offices does not provide tax services, nor do we provide individual tax advice. We’ve partnered with Anderson Advisors, who can answer any of your tax-related questions.

One of the essential things to know when starting or relocating a business is the federal, state, and local taxes. Corporate/business tax rates vary wildly from state to state, and other types of taxes—like income and sales tax—can change from county to county. Add the business structure you choose into the mix, and you have yourself a complex financial situation.

But Alliance is here to help you find the best state to start a business for tax purposes, where you can grow and operate your company easily and more inexpensively. With a virtual office, you don’t even need to live in the state your business is in to enjoy the corporate tax benefits. We searched for the most business tax-friendly states and the best places to start your company within those states, based on corporate, income, and sales tax rates.

So, let’s talk taxes.

South Dakota

South Dakota is a great landing place for people looking to start a company or move their business. The state does not have a corporate income tax, meaning you won’t pay taxes if your company is registered as a B or C corporation or as an LLC. But that’s not the only reason that South Dakota is one of the best states to start a business for tax purposes.

There is no state individual income tax either. If your business is structured as an LLC (essentially a pass-through entity), you won’t pay taxes on the income you make. If you want to learn more about LLCs for virtual businesses, check out our blog post.

Consider opening your small business in Sioux Falls, South Dakota’s largest and most diverse city. Help your business succeed with the power of an Alliance Sioux Falls virtual office. Enjoy the benefits of our Live Receptionist plan and a virtual phone system to help streamline your day-to-day workflow. And when you’re in town, rent a meeting room for client pitches or networking with local professionals.

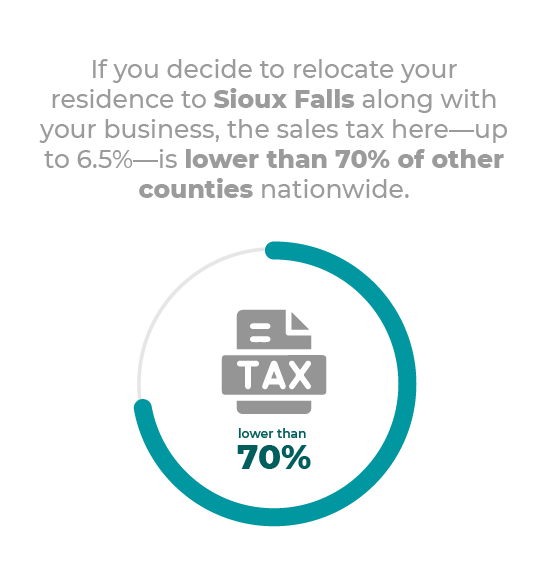

If you decide to relocate your residence to Sioux Falls along with your business, the sales tax here—up to 6.5%—is lower than 70% of other counties nationwide. To protect your business’s profits and to scale your company effectively, this is the place to be. (Plus, you’ll have your pick of activities in your off-hours, from biking along Big Sioux River to skiing in Great Bear Recreation Park.)

Florida

Florida is enticing for many people: It has 1,300 miles of coastline, artistic and diverse cities, and a little place called Disney World.

But it’s also one of the states with the lowest business tax. Companies that are set up as C corporations (companies with shareholders) are subject to a corporate tax rate of 5.5%, much lower than other states. However, if you set up your business as an LLC, S corporation, or sole proprietorship, you’re exempt from this tax.

So, where you should set up your business in Florida? Tucked into Orange County is Pine Hills, a town of about 60,000 people. It is strategically situated near Orlando, one of the business hubs of The Sunshine State. Your business will be located near the fast-growing metro area while still reaping the benefits of a tight-knit community and a small-town feel. Secure a local business address with an Orlando virtual office.

What makes this a place to keep your eye on if you’re relocating your home base along with your business is the low sales tax (lower than 90% of other Florida counties), as well as low property tax, compared to other counties in Florida. In fact, it’s listed as the fifth-best Florida city tax rating by Kiplinger. Grab a meeting room in Orlando and the surrounding area to meet with clients.

New Hampshire

While New Hampshire may not be the most business tax-friendly state (it does impose two types of corporate tax), there are other reasons why you should consider starting up your enterprise in this East Coast state. If you own an LLC, S corporation, or limited liability partnership in New Hampshire, you won’t owe tax on your income after paying the state’s business profits tax and business enterprise tax. That’s because the state doesn’t require a tax on personal income—a huge perk for small business owners. Secure your New Hampshire virtual office to leverage this benefit.

When you’re considering where to put down your business roots, Manchester is a great place to research. The largest city in Hillsborough County and in the state of New Hampshire, Manchester offers its residents not only a vibrant arts scene but also lower property taxes than other counties (since you don’t pay property tax for a virtual office, this is a perk if you’re buying a home here along with starting a business). That, paired with no income tax and no sales tax, means that your business will be in a good position to rake in more profits.

When you need to conduct business in person, book an Alliance meeting room in Bedford, which is just outside of Manchester.

Alaska

When you thought Alaska’s untamed lands couldn’t be more intriguing, wait until you hear about the state’s taxes.

Okay, talking taxes may not be as exciting as finding out where to spot moose or puffins, but when you’re considering whether to start a business in The Last Frontier, you should be aware that the state has no individual income tax. This means that unless your company is structured as a C corporation, the income from your business won’t be taxed.

There’s a huge incentive for settling your business in Anchorage, Alaska’s most populated city. Though you’ll need to pay property tax if you also live here, the municipality has no sales tax—a huge benefit (other Alaska cities and counties can charge up to 7%). If you become a resident of Anchorage and start a business, you may be better off financially here than in other cities in the U.S.

Starting a business in Anchorage, or really anywhere in Alaska, is made easier with a virtual office and Alliance’s virtual phone service, which gives you a local business number, a powerful phone system for connecting team members, and auto-attendant to streamline your calls.

Nevada

It’s no secret that Nevada is one of the best states for business taxes, mostly because it doesn’t have a corporate tax. No matter how big or small your registered business, you won’t pay a dime in corporate taxes. Start accessing this huge benefit today with an Nevada virtual office. Nevada also does not impose individual income tax for its residents. So, if you live here, you’ll have more money to put back into your business, like creating marketing materials and hiring employees.

Note: If you hire employees, you may be considering offering them remote work stipends for a work-from-home situation. Instead, leverage Alliance’s business support services by adding a coworking membership where your employees can work and collaborate.

Consider setting up your company in Henderson, a city southeast of Las Vegas that attracts large-scale business events through its citywide incentive program. Your organization will be situated not only in a town that enjoys the benefits of a state with the best tax incentives for business but also in a place that prioritizes making business resources accessible. Just keep in mind that Henderson has a pretty steep sales tax of just over 8.3%, so the area may be better suited financially to businesses that don’t sell goods.

Need a professional space to meet clients in Henderson? Book a Henderson meeting room.

Wyoming

Wyoming claims some of the most beautiful landscapes in the West—from the Grand Tetons to Devils Tower to Yellowstone National Park. It’s no wonder that this is one of the best states to visit, but what about living and working here? Well, you’re in luck.

Wyoming is the best state to start a business for tax purposes because it doesn’t impose individual income tax or corporate tax. This can go a long way in easing your business’s overall financial burden. Though a few other states are just as tax-friendly, Wyoming sets itself apart as a tax haven because it doesn’t tax business receipts or businesses in certain sectors (like Nevada does with its gaming sector). It’s on our list as one of the best states for small business.

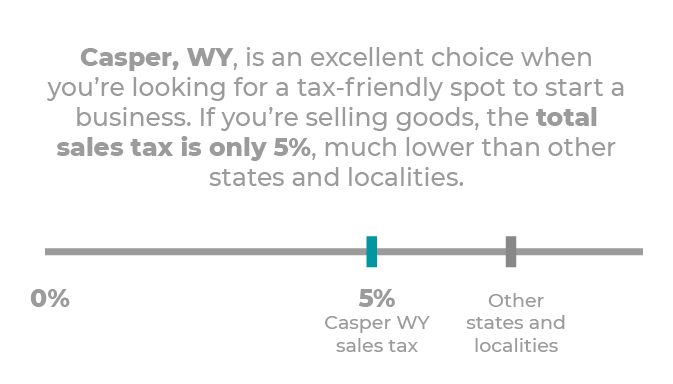

Casper, WY, is an excellent choice when you’re looking for a tax-friendly spot to start a business. If you’re selling goods, the total sales tax is only 5%, much lower than other states and localities. And because it’s the second-largest city in Wyoming, you’ll find ample resources and business incentives to help get your organization off the ground.

You’ll also find a great Casper virtual office to protect your home address and provide a professional space to meet with clients and get business done when you’re in town.

Now that we’ve covered some of the best states for business taxes, we hope you have a good handle of where the most beneficial place might be to set up your business. Wherever you decide to start your venture, understanding local and state taxes is essential. Keep in mind that if your business is set up in one state but you’re living elsewhere, there may be tax implications of working remotely from another state and employing people in other states (e.g., employee tax rates). Consult a financial advisor if this is your situation.

Alliance Virtual Offices has the resources to help you with the process of doing business, such as understanding the difference between W9 vs. 1099 forms and learning how to cut costs as a small business. We’re the leading flexible workspace solution, with support services to help scale your company quickly and keep you focused on what you do best: winning more business. Check out our meeting rooms, coworking spaces, and Live Receptionist services.