- Understanding the importance of business insurance for consultants

- Types of insurance essential for consultants

- Enhancing credibility and protection with a Virtual Office

Q: Do I need business insurance for my consulting business? If so, what kind of insurance is best for my needs?

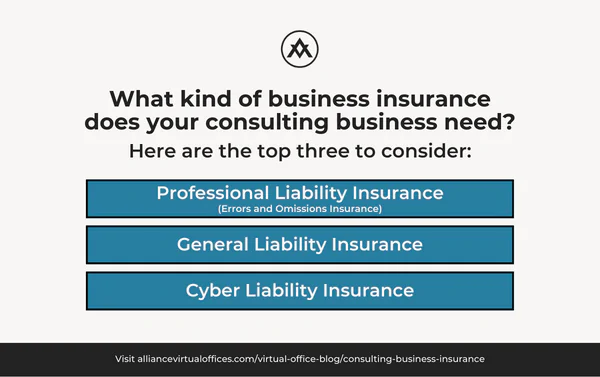

A: Business insurance is crucial for consultants because it protects them against potential risks, financial and otherwise. Consultants should consider professional liability, general liability, and cyber liability insurance.

Insurance is vital to emerging businesses because, despite our best efforts, no one can plan for everything. Even the most detailed business plans fail when unexpected situations arise.

HBR calls these unexpected situations novel risks, risks so unlikely that they can’t be planned for. Novel risks may have heavy consequences for consultants.

These unexpected risks are why consultant business insurance is so important. Because these situations are unpredictable, securing high-quality business insurance protects your business from unforeseen hazards.

The cost of this protection depends mainly on your business, the coverage you’re looking for, and the dangers of your industry. Some small business insurance can be found for less than $20 per month, whereas other plans may cost upwards of hundreds of dollars each month.

Unsurprisingly, entrepreneurs interested in consultancy and new consultants must do careful due diligence when determining which insurance to use. Before you leap into the various kinds of insurance and the fees and premiums you may be expected to pay, familiarize yourself with as much information as possible.

The more you know about consultant business insurance, the better suited you are to find high-quality coverage.

Today, we’ll show you the importance of business insurance for consultants and the various types essential for consultants. Finally, we’ll show you how to enhance credibility and protection with a Virtual Office from Alliance.

If you’re having questions about personal liability, risk management, and how to use consultant business insurance to mitigate the risks of your work, you’re in the right place.

Read more about consultant insurance coverage and how Virtual Office solutions can bolster your business credibility.

- Understanding the importance of business insurance for consultants

- Types of insurance essential for consultants

- Enhancing credibility and protection with a Virtual Office

The importance of business insurance for consultants

Insurance is vital for any business. Using an LLC protects you from personal financial damages, but high-quality insurance can provide similar protection for your business. This means that if you incur damages covered by your insurance, your provider may help you in your time of need.

Granted, this depends on the structure of your insurance, but good insurance providers will ensure that their clients are protected and taken care of when needed.

For consultants, this provides peace of mind and helps individuals feel comfortable giving financial and business advice.

Some entrepreneurs feel they can forego high-quality insurance to save money, but this is a shortsighted, foolish decision. You may save money in the short term, but a standard hiccup may cause severe financial damage if your business operates without or with poor insurance.

Thankfully, there are plenty of insurance options, and many small business owners, solopreneurs, and consultants can find high-quality business insurance that meets their needs and isn’t prohibitively expensive.

Read more: Small Business Insurance Cost Doesn’t Have to Break the Bank

As with any other business, finding the right consultant business insurance requires research, time, and effort. Similarly, creating a detailed action plan can help negate some frustrations of finding the right insurance provider.

Read more: Unlocking Investor Doors: A Proven Blueprint for Ambitious Entrepreneurs and Emerging Ventures

Why business insurance is vital for consultants

Consultant business insurance is a cornerstone of risk management; it protects against unforeseen circumstances and liabilities.

These risks are multifaceted and ever-present for consultants operating in various industries, from management and technology to finance and law.

Without adequate insurance coverage, consultants expose themselves to many potential risks that could jeopardize their financial stability, professional reputation, and even their ability to continue operations.

One of the primary reasons why business insurance is indispensable for consultants is its role in safeguarding against professional risks and liabilities in their line of work. Consultants offer clients expertise, advice, and services, often in complex and high-stakes projects.

In the dynamic consultancy landscape, clients rely heavily on consultants’ recommendations and solutions, and any error or omission may lead to significant consequences.

Professional liability insurance, or errors and omissions insurance, is a critical safeguard in these scenarios. It covers claims arising from errors, negligence, or failure to deliver promised services.

Without this protection, consultants are vulnerable to lawsuits, legal expenses, and potential damages that may result in financial ruin.

Further, business insurance offers consultants financial security against various risks, including property damage, bodily injury, and data breaches.

General liability insurance, for example, protects consultants from third-party claims of bodily injury or property damage occurring on their premises or as a result of their business operations.

Modern consultants also need to contend with cyber attacks and the potential for user error to result in data breaches. Cyber liability insurance is increasingly essential in today’s digital age, where consultants handle sensitive client data and are always at risk.

A single security breach or data loss incident could lead to significant financial losses, legal liabilities, and reputational damage. With cyber liability insurance, consultants can mitigate these risks and ensure they have the resources to address any cybersecurity threads immediately.

Exploring the consequences of operating without adequate insurance coverage

Operating without adequate insurance coverage, or without insurance at all, exposes consultants to countless potential risks and consequences that could severely affect their business and professional reputation.

Without professional liability insurance, consultants are vulnerable to negligence claims, errors, or omissions in their professional services.

A dissatisfied client who perceives a consultant’s advice as faulty or detrimental to their business interests may file a lawsuit, alleging financial losses or damages. The legal expenses of defending against such claims can be exorbitant, draining the consultant’s financial resources and undermining their credibility in the industry.

To make matters worse, the veracity of these claims doesn’t initially matter. If you’re going to court, you’re spending money, so operating without insurance opens your business up to individuals gaming the system or searching for an easy payout.

Moreover, consultants face inherent risks in their day-to-day operations, including property damage, bodily injury, and legal liabilities.

Without general liability insurance, consultants may find themselves personally liable for accidents or injuries that occur on their premises or because of their business activities.

A slip-and-fall accident during a client meeting or a property damage incident caused by a consultant’s negligence could lead to costly lawsuits and settlements. Similarly, consultants without cyber liability insurance are ill-equipped to handle the financial fallout from data breaches or other cyber-attacks.

In today’s digital era, data is an asset and a prime target for cybercriminals. The consequences of a security breach can be catastrophic for consultants, resulting in financial losses, legal liabilities, and irreparable damage to their reputations.

Essentially, the importance of consultant business insurance cannot be overstated. It serves as a critical safety net and protects against various risks and liabilities in the consultancy profession.

Investing in comprehensive insurance coverage allows consultants to safeguard personal financial stability, protect their professional reputation, and ensure they have the resources to navigate unforeseen challenges efficiently.

Real-world scenarios

Professional Negligence

Consider a management consultant who provides strategic advice to a client, but due to professional oversight, the implemented strategy leads to financial losses for the client’s business.

The client files a professional negligence lawsuit against the consultant, claiming damages for the losses incurred. Without professional liability insurance, the consultant would be personally liable for legal defense costs and potential settlement or judgment amounts, which could have serious financial repercussions.

Data Breach

Imagine an IT consultant tasked with upgrading a client’s cybersecurity infrastructure. Despite their best efforts, a data breach occurs, exposing sensitive client information.

The affected clients decide to take legal action against the consultant for failing to adequately protect their data, alleging negligence and breach of contract. Cyber liability insurance would be instrumental in covering the associated costs of investigating the breach, notifying affected parties, and mitigating potential legal liabilities and regulatory fines.

Contractual Dispute

Imagine a legal consultant hired to draft a contract for a client’s business transaction. However, a dispute arises between the client and their business partner regarding the terms of the contract, leading to litigation.

The client holds the consultant responsible for errors in the contract drafting process and initiates legal proceedings against them. Professional liability insurance would cover the consultant’s legal defense costs and any damages awarded in the event of a lawsuit.

Each scenario underscores the critical importance of consultant business insurance in mitigating risks and protecting assets, reputation, and financial well-being.

Investing in comprehensive insurance coverage tailored to their specific needs and risks allows consultants to operate confidently and resiliently in today’s competitive business environment.

Essential types of insurance for consultants

Now that you understand why consultant business insurance is so important let’s explore the various kinds of insurance you can purchase.

Read more: Types of Insurance for Business: A Comprehensive Guide

Consultants operate in diverse fields, each with unique risks and exposures. Only some consultants will need every kind of insurance. Nevertheless, here are three essential types of insurance that consultants should consider.

Professional Liability Insurance

This type of insurance protects consultants against claims of professional negligence, errors, or omissions arising from their professional services. It covers legal defense costs, settlements, and judgments associated with allegations of inadequate work, missed deadlines, or faulty advice.

Professional liability insurance is particularly crucial for consultants who provide advisory, design, or expertise-based services. Even minor mistakes may lead to significant financial losses and reputational damage.

General Liability Insurance

General liability insurance covers third-party bodily injury, property damage, and personal injury claims arising from the consultant’s business operations.

General liability insurance protects against common risks, such as slip-and-fall accidents at the consultant’s office, property damage caused during client meetings, or advertising-related claims like defamation or copyright infringement. As it offers broad protection against potential liabilities, it is essential for consultants who interact with clients or the public.

Cyber Liability Insurance

In today’s digital age, consultants face increasing cyber risks associated with data breaches, hacking incidents, and cyberattacks.

Cyber liability insurance helps consultants mitigate financial losses and liabilities resulting from data breaches or cyber incidents involving sensitive client information. It covers expenses such as forensic investigations, data recovery, notification costs, legal fees, and regulatory fines or penalties.

Cyber liability insurance is critical for consultants who handle sensitive client data or conduct business operations using digital systems and networks.

Unfortunately, knowing the ins and outs of various kinds of insurance won’t help if you don’t know what type of insurance your consultancy needs.

Assessing individual insurance needs requires consultants to evaluate their specific business activities, potential risks, and exposure to liabilities.

Here are some steps consultants can take to assess their insurance needs effectively.

Conduct a risk assessment

- Consultants should identify and evaluate the primary risks associated with their consultancy services, considering the nature of their work, client interactions, industry regulations, and business environment.

- A comprehensive risk assessment helps consultants understand their unique exposures and determine the types of insurance coverage required to effectively mitigate those risks.

Consider industry standards and client requirements

- Consultants should familiarize themselves with industry standards and best practices regarding insurance coverage in their field.

- They should also assess whether their clients or contractual partners have specific insurance requirements or expectations, as compliance with these requirements may influence the consultant’s insurance decisions and contractual obligations.

Evaluate business assets and financial exposure

- Consultants should assess the value of their business assets, including intellectual property, equipment, and financial resources, to determine the potential economic impact of unforeseen events or liabilities.

- By quantifying their financial exposure, consultants can identify the appropriate insurance coverage needed to protect their assets and maintain financial stability in the event of a claim or lawsuit.

Consult with insurance professionals

- Consulting with insurance professionals, such as independent agents or brokers specializing in business insurance, can provide valuable insights and guidance on selecting the right insurance policies tailored to the consultant’s specific needs and risk profile.

- Insurance professionals can offer expert advice on coverage options, policy limits, endorsements, and risk management strategies to ensure consultants adequately protect against potential liabilities.

Following these steps will help you ensure that you know what kind of insurance your business needs and how you can get it.

Once you’ve made it this far, all that’s left is to compare and choose insurance policies.

Here’s how you can make this choice a bit more straightforward.

Understand coverage options

- Familiarize yourself with different coverage options for each type of insurance, including the scope of coverage, policy limits, and exclusions.

- Assess whether the insurance policies address your specific risks and exposures and provide sufficient protection against potential liabilities.

Evaluate policy limits and deductibles

- Review policy limits and deductibles associated with each insurance policy to determine the maximum coverage amount and out-of-pocket expenses in the world of a claim.

- You must balance adequate coverage and affordable premiums by selecting policy limits and deductibles that align with your risk tolerance and budgetary constraints.

Compare premiums and costs

- You should obtain quotes from multiple insurance providers and compare premiums, deductibles, and coverage terms to identify the most cost-effective options.

Review policy exclusions and endorsements

- Before purchasing coverage, you should research insurance companies’ reputations and financial stability to ensure they work with reputable and reliable insurers.

Following these guidelines and conducting thorough due diligence allows consultants to make informed decisions about comparing and choosing providers.

Virtual Offices – boosting consultant business credibility

Now that you’ve gained a basic understanding of consultant business information, how to choose the right insurance, and how to find the right provider, let’s explore how a Virtual Office from Alliance can boost your consulting business’s credibility.

Read more: Getting Started with Alliance Virtual Offices

A Virtual Office from Alliance Virtual Offices offers consultants a prestigious business address without the overhead costs associated with a traditional office space.

By having a professional business address in a prime location, consultants can establish a credible and established presence in the eyes of clients, partners, and stakeholders. This can be particularly beneficial for consultants who operate remotely or from home but want to project a professional image to their clients.

Additionally, having a virtual office allows consultants to separate their personal and professional lives, enhancing their perceived professionalism and credibility in the eyes of potential clients.

Here are a few of the ways a Virtual Office provides consultants with a range of benefits that support their professional endeavors.

- Reputable business address

A virtual office provides consultants with a prestigious business address in a desirable location, such as a central business district or commercial hub. This address can lend credibility to the consultant’s business and create a positive first impression on clients and prospects.

- Mail handling services

Alliance’s Virtual Offices offer different mail-handling services, allowing consultants to receive and manage business mail and packages efficiently. This ensures that important correspondence and documents are handled professionally and securely, enhancing the consultant’s reliability and responsiveness.

- Meeting room and coworking space access

Alliance offers access to professional and easily reservable meeting rooms and coworking spaces. This enables consultants to conduct client meetings, presentations, and workshops professionally, reinforcing their professionalism and facilitating productive interactions with clients and stakeholders.

- Professional call handling

Professional call handling and forwarding services help your consultancy present professionally. Alliance Virtual Office offers a Virtual Phone that you can use to create a positive impression of accessibility and responsiveness, which enhances your reputation for excellent customer service and client support.

Although a Virtual Office can easily enhance a consultant’s business image and credibility, it’s important to recognize that it will not directly influence insurance decisions or rates.

When determining insurance eligibility and pricing, insurance providers evaluate risk factors like business activities, claims history, industry regulations, and coverage requirements.

While a Virtual Office can contribute to a consultant’s overall professional image and stability, insurance decisions are primarily based on risk assessment and underwriting criteria established by the insurer.

Consultants should avoid making legal claims or assumptions about the impact of Virtual Offices on insurance qualifications and rates and instead focus on leveraging Virtual Office solutions to support their business operations and enhance their professional standing.

Enhancing your consultancy through Alliance’s Virtual Offices

Business insurance is crucial in safeguarding consultants against potential risks and liabilities associated with their professional activities.

Insurance provides consultants with peace of mind and security in their business operations, from protecting against legal claims to ensuring financial stability in the face of unforeseen events.

Alliance Virtual Offices’ Virtual Office solutions can enhance a consultant’s business strategy by providing a prestigious business address, efficient mail-handling services, professional meeting facilities, and reliable call-handling support.

While Virtual Offices can positively impact a consultant’s professional image and credibility, they must recognize that they do not directly influence insurance decisions or rates.

By leveraging business insurance and Virtual Office solutions, consultants can strengthen their overall business protection and position themselves for successful consulting careers.

Further reading

- Unlocking Investor Doors: A Proven Blueprint for Ambitious Entrepreneurs and Emerging Ventures

- Types of Insurance for Business: A Comprehensive Guide

- Small Business Insurance Cost Doesn’t Have to Break the Bank

- Getting Started with Alliance Virtual Offices

Alliance Virtual Offices offers Virtual Offices and several other digital tools useful for established entrepreneurs, new business owners, and new or old consultants.

Securing consultant business insurance is the perfect way to protect yourself and your business from the potential financial fallout you risk when offering professional advice.

Contact us today to see how Alliance can help you find a Virtual Office to help you grow your business. Be sure to check out our Virtual Office Blog for more information.