- Understanding Business Insurance Essentials

- Deep Dive into Professional Liability Insurance

- Maintaining and Updating Insurance Policies

Q: What type of insurance is best for small business?

A: There is no one-size-fits-all best insurance for small businesses, but there are a few helpful strategies you can use to determine the best insurance for your situation. This article walks you through the different types of insurance and how to find the balance between cost and coverage.

Navigating the complexities of business insurance can be daunting, especially for consulting professionals who face unique risks.

Understanding which types of insurance are essential can safeguard your consultancy from unforeseen challenges.

This article delves into the various insurance policies crucial for your business and how a polished, professional reputation can positively influence your dealings with insurance providers.

Understanding Business Insurance Essentials

As a business owner, you need to protect your assets and investments with insurance coverage. Here are some essential types of business insurance you should consider:

General Liability Insurance

General liability insurance covers your business against bodily injury, property damage, and advertising injury claims. This type of insurance is essential for businesses that have physical locations or interact with customers.

Property Insurance

Property insurance protects your business property, including buildings, equipment, and inventory, against damage or loss due to theft, fire, or other covered events. It’s important to note that flood and earthquake damage are not typically covered under standard property insurance policies.

Workers’ Compensation Insurance

Workers’ compensation insurance provides medical and wage benefits to employees who are injured or become ill while on the job. This type of insurance is required by law in most states.

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects your business against claims of negligence, errors, or omissions in your services. This type of insurance is essential for businesses that provide professional services, such as lawyers, doctors, and consultants.

Business Interruption Insurance

Business interruption insurance provides coverage for lost income and expenses if your business is forced to close due to a covered event, such as a fire or natural disaster.

By understanding these essential types of business insurance, you can protect your business from potential risks and liabilities. Be sure to consult with an insurance professional to determine the best coverage options for your specific business needs.

Identifying Key Insurance Types for Consultants

As a consultant, you face unique risks that require specific types of insurance coverage. Here are some key insurance types that you should consider:

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects you from claims of negligence or mistakes made in your professional services. This type of insurance is essential for consultants who provide advice or services to clients.

General Liability Insurance

General liability insurance protects your business from claims of bodily injury, property damage, and personal injury. This type of insurance is important for consultants who have clients visiting their office or who work on-site at their client’s location.

Cyber Liability Insurance

Cyber liability insurance protects your business from losses due to data breaches, cyber-attacks, and other cyber threats. This type of insurance is essential for consultants who handle sensitive client information or use technology in their business.

Business Owner’s Policy

A business owner’s policy combines general liability insurance and property insurance into one policy. This type of insurance is a good option for small business owners, including consultants, who need basic coverage.

By identifying the key insurance types for your consulting business, you can protect yourself and your clients from potential risks and liabilities.

Deep Dive into Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is a type of coverage that protects businesses from claims of negligence or inadequate work. This type of insurance is particularly important for businesses that provide services, advice, or expertise to clients.

Professional liability insurance can help cover legal fees, settlements, and judgments if a client sues your business for damages resulting from your work. It can also provide coverage for claims of libel, slander, and copyright infringement.

When choosing a professional liability insurance policy, it’s important to consider the specific risks associated with your business and industry. Some policies may exclude certain types of claims or have limits on coverage amounts.

Professional liability insurance can provide peace of mind for businesses that rely on their expertise and reputation to succeed. By protecting against costly lawsuits and damage to your reputation, this type of insurance can help your business thrive in the long run.

The Role of General Liability in Business Protection

General liability insurance is an essential component of business protection. It covers damages and injuries that may occur to third parties due to your business operations. This type of insurance can help protect your business from the financial burden that may arise from lawsuits or claims against your business.

General liability insurance typically covers bodily injury, property damage, and personal injury. It can also provide coverage for advertising injury, which includes claims of slander, libel, or copyright infringement.

It is important to note that general liability insurance does not cover all types of risks that your business may face. For example, it does not cover professional liability or employee injuries. To fully protect your business, it is recommended that you consider additional types of insurance, such as professional liability insurance and workers’ compensation insurance.

General liability insurance is a crucial component of business protection. It covers damages and injuries that may occur to third parties due to your business operations. However, it is important to understand that it does not cover all types of risks and that additional types of insurance may be necessary to fully protect your business.

Evaluating Cyber Liability Coverage Needs

When it comes to protecting your business from cyber threats, cyber liability insurance is a must-have. However, not all cyber liability coverage is created equal. To evaluate your cyber liability coverage needs, consider the following:

- Risk Assessment: Conduct a thorough risk assessment to identify potential cyber threats and vulnerabilities in your business. This will help you determine the level of coverage you need.

- Policy Coverage: Review your policy coverage to ensure it covers all potential cyber risks your business may face. This may include data breaches, cyber extortion, and loss of income due to a cyber attack.

- Policy Limits: Determine the appropriate policy limits based on the potential financial impact of a cyber attack on your business. Consider the cost of data recovery, legal fees, and lost income when setting policy limits.

- Deductibles: Evaluate the deductible amount to ensure it is affordable for your business. A higher deductible may lower your premiums but may also increase your out-of-pocket expenses in the event of a cyber attack.

Evaluating your cyber liability coverage needs will allow you to ensure your business is adequately protected from cyber threats.

Workers’ Compensation: A Closer Look

Workers’ compensation insurance is a must when it comes to protecting your employees. This type of insurance covers any work-related injuries or illnesses your employees may sustain while on the job.

Workers’ compensation insurance can help cover the cost of medical expenses, lost wages, and even rehabilitation services. In addition, it can protect your business from any legal action that may result from a workplace injury.

It’s important to note that workers’ compensation insurance requirements vary by state, so it’s important to check your state’s requirements before purchasing a policy. Additionally, the cost of workers’ compensation insurance can vary depending on the type of business you have, and the level of risk associated with your industry.

Commercial Property Insurance: Is It Necessary?

When you own or lease a commercial property, it’s important to consider the risks associated with owning that property. Commercial property insurance can protect your business from financial loss due to damage to your property, theft, or other covered events.

Commercial property insurance covers a range of property types, including buildings, equipment, inventory, and furniture. It can also provide coverage for loss of income if your business is unable to operate due to property damage.

While commercial property insurance is not legally required, it is highly recommended. Without it, you could be responsible for costly repairs or replacement of damaged property out of your own pocket.

When considering commercial property insurance, it’s important to carefully review the policy to ensure that it covers all of your business’s property and that the coverage limits are sufficient. It’s also important to note that certain events, such as floods or earthquakes, may require additional coverage.

Commercial property insurance is an important investment for any business that owns or leases property. It can provide peace of mind and financial protection in the event of property damage or loss.

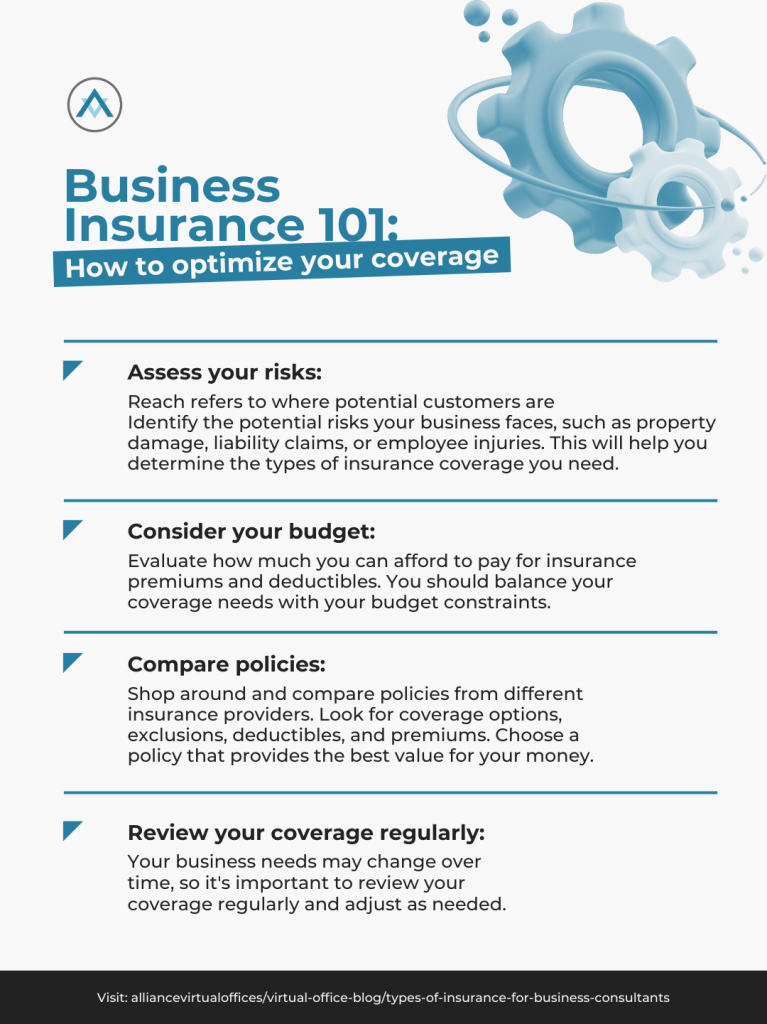

Selecting the Right Insurance Coverage

Choosing the right insurance coverage for your business is essential to protect your assets and avoid financial losses. Here are some tips to help you select the right insurance coverage:

Using these tips, you can select the right insurance coverage for your business and protect your assets from potential risks.

Balancing Coverage Needs with Budget Constraints

When it comes to purchasing insurance for your business, it’s important to strike a balance between coverage needs and budget constraints. While you want to make sure you have adequate protection, you also don’t want to overspend and hurt your bottom line.

One way to approach this is to carefully assess your risks and prioritize coverage accordingly. For example, if you operate a business that involves a lot of driving, you may want to prioritize commercial auto insurance. On the other hand, if you primarily operate out of a physical location, property insurance may be a higher priority.

Another option is to consider higher deductibles or lower coverage limits to help keep premiums more affordable. While this may mean taking on more risk, it can be a way to balance your coverage needs with your budget constraints.

Ultimately, the key is to work with a reputable insurance agent or broker who can help you navigate the options and find the right coverage for your specific business needs.

The Impact of a Professional Setup on Insurance Perceptions

When it comes to running a business, having a professional setup can have a significant impact on insurance perceptions. A professional setup includes having proper documentation, adhering to safety protocols, and maintaining a clean and organized workspace.

By having a professional setup, insurance companies are more likely to view your business as low-risk, which can result in lower insurance premiums. Additionally, a professional setup can also improve employee morale and productivity, as it creates a safer and more efficient work environment.

To ensure that your business is viewed as low-risk by insurance companies, it’s important to invest in proper documentation such as contracts, licenses, and permits. You should also have safety protocols in place, such as regular equipment maintenance and employee training, to prevent accidents and injuries.

Maintaining a clean and organized workspace is also crucial in creating a professional setup. This not only improves safety but also creates a positive impression on clients and customers who visit your workspace.

Investing in a professional setup can positively impact insurance perceptions and result in lower insurance premiums.

Strategies for Negotiating with Insurance Providers

When negotiating with insurance providers, it is essential to keep in mind that you are seeking the best possible coverage for your business at a fair price. Here are some strategies to help you negotiate effectively:

- Research and compare: Before negotiating with an insurance provider, research and compare coverage options and prices from multiple providers. This will give you a better understanding of the market and help you negotiate from a position of knowledge.

- Be clear about your needs: Clearly communicate your business’s needs and risks to the insurance provider. This will help them understand what coverage you require and may result in a more tailored policy.

- Consider bundling: Bundling multiple types of insurance, such as property and liability insurance, may result in lower overall costs and simplify the negotiation process.

- Be prepared to negotiate: Don’t be afraid to negotiate on price, deductibles, or coverage limits. Insurance providers may be willing to make concessions to secure your business.

- Review the policy: Before signing any agreement, thoroughly review the policy to ensure that it meets your business’s needs and that you understand all terms and conditions.

By following these strategies, you can negotiate with insurance providers effectively and secure the coverage your business needs at a fair price.

Maintaining and Updating Insurance Policies: Best Practices

As a business owner, it is important to regularly review and update your insurance policies to ensure that you are adequately covered. Here are some best practices to follow:

- Schedule an annual insurance review with your agent to assess your coverage needs and make any necessary adjustments.

- Keep accurate records of your insurance policies, premiums, and claims. This will help you track changes over time and ensure you have the right coverage in place.

- Consider bundling your policies with one carrier to simplify your coverage and potentially save on premiums.

- Be proactive in identifying potential risks to your business and discuss them with your agent to determine if additional coverage is needed.

- Stay informed about changes in laws and regulations that may impact your insurance needs.

By following these best practices, you can help ensure that your business is protected against potential risks and liabilities.

Wrapping Up: Types of Insurance for Business

In this article, we explored the essential types of insurance for consulting businesses, from professional liability to cyber liability, and how choosing the right coverage is critical for risk management.

Professional and friendly services like Gilde and Hiscox can help you get the coverage you need without overspending.

A professional setup, such as a Virtual Office, can also solidify your business’s reputation and may positively impact your insurance strategies.

Further reading:

- 10 Signs You Need a Live Receptionist

- Integrating Live Receptionists Into Your Small Business Communication

- Creating a Professional Image: Enhancing Brand Perception with Live Receptionists for Startups

- From Chaos to Control: Process for Small Business Productivity

As you consider fortifying your consulting business against potential risks, remember the value of presenting a professional image. Explore Alliance Virtual Offices’ Virtual Office services to enhance your consultancy’s credibility and potentially aid in your insurance dealings. Take the next step in securing your business by considering the benefits a Virtual Office can offer.