- What are the benefits of freelancing?

- Why might a freelancer want to start an LLC?

- How can a freelancer start an LLC?

Q: When is it the right time to turn your freelance business into an LLC?

A: A freelance business can be beneficial for a number of reasons – but it can be even more advantageous when it takes the form of an LLC. The right moment to switch to an LLC depends on your unique circumstances, including the type of your business and the amount of income you are generating. That being said, there are some basic rules that you can follow if you’re approaching this major decision for the first time.

In 2019, an IMF report found that global tax evasion and avoidance had reached $427 billion per year, with corporations shifting $1.38 trillion in profits each year into offshore havens that charge virtually zero tax.

In 2021, Harvard Business Review reported that corporations in the United States were paying an average of $20 billion each year to lawyers – reflecting the fact that many of these companies are sued on a regular basis.

For a solo entrepreneur running a freelance business, this might all seem way above your pay grade. But these statistics illustrate two of the most important aspects of running a business:

Legal protections and tax obligations.

Corporations today do everything in their power to avoid paying taxes – even if they have to venture into certain “grey areas” of the law by establishing offshore bank accounts. Why? Because the goal of a corporation is to make as much money as possible, plain and simple.

This is exactly what you should be doing as a freelance business owner. While you don’t need to compromise your moral standards in order to run a business, you should be aiming to minimize taxes and maximize profits to the greatest extent possible.

In addition, you should be aware that lawsuits have the potential to utterly destroy your business and by extension, your own financial well-being. Even if your business is still quite small, you never know who might sue you in the future.

The good news is that a freelance LLC can help you address both of these key issues as you run your freelance business, providing both tax benefits and legal protections. But when is the right time to actually start an LLC?

The Benefits of Freelancing

If you’re wondering whether to start an LLC, you might be concerned about sacrificing some of the benefits of freelancing that you’ve come to enjoy. And yes, freelancing definitely comes with its fair share of advantages:

- Independence: For starters, freelancers don’t need to answer to anyone but themselves. This sense of freedom can be incredibly rewarding, and it’s one of the main reasons many freelancers never go back to working as an employee.

- Freedom: Aside from being your own boss, you also get to set your own schedule as a freelancer. If you wake up one day and decide that you simply don’t feel like working, you can take the day off without calling your boss and pretending to cough into the phone.

- Flexibility: Freelancers also get to choose precisely who they want to work with. If a client is more of a hassle than they’re worth, you can simply drop them and work with someone else. In a normal company, you might be forced to work with people you can’t stand.

- Travel: If you’re running a freelance business, you also have the opportunity to travel to your heart’s content and embark on a “working vacation” that could span several months or even years. “Digital nomads” are all the rage right now, and this type of work-life balance is more achievable than ever before with the rise of online businesses.

- Work From Home: Finally, freelancers may have the opportunity to work from home, spending more time with their loved ones and enjoying a more relaxed environment.

Freelancer vs. LLC

So do you need to sacrifice these benefits when you start an LLC?

Absolutely not!

An LLC simply changes the way your business is structured, and you can continue to operate as a solo freelancer without any notable changes to your lifestyle.

However, an LLC does create several changes from a legal and tax perspective – and most of these changes will be positive if you choose the right moment to make the switch.

Why a Freelancer Might Need to Start an LLC

What Is an LLC?

If you’re wondering whether it’s the right time to start an LLC, you might still be a little unsure about what an LLC actually is.

“LLC” stands for “Limited Liability Company,” and this phrase should give you a clue as to one of the key benefits of this type of business.

An LLC is considered a separate legal entity.

This means that to a certain extent, the US legal system will view your LLC in the same way as any other person within the United States. No – LLCs cannot vote. And they can’t apply for their own driver’s license.

But they can help you keep your business life and your personal life separate.

Benefits of an LLC

Okay, so why would you actually need to create a separate legal entity for your business?

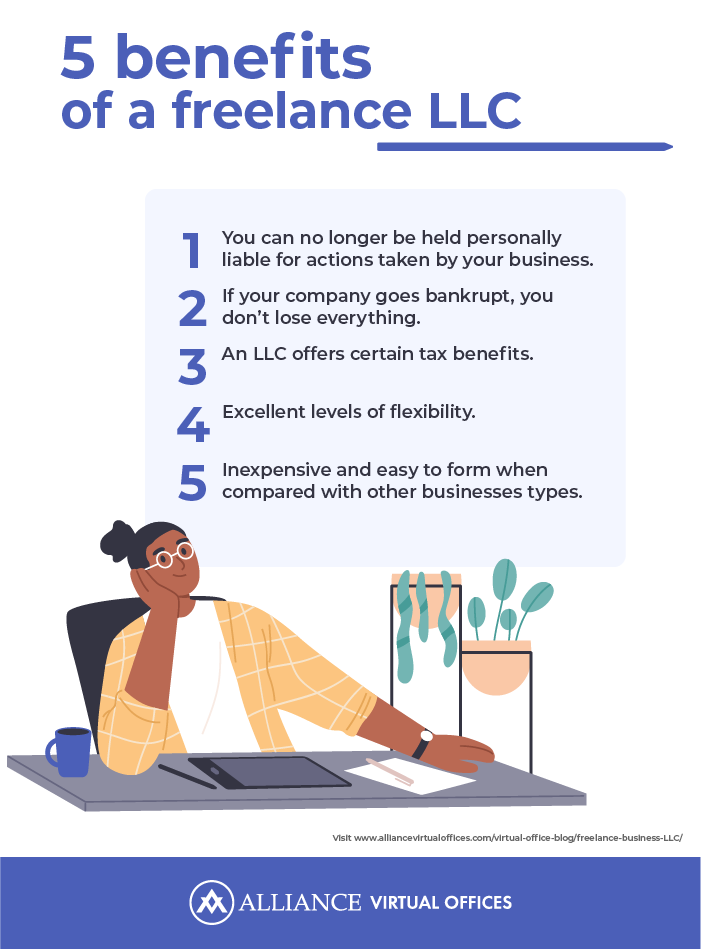

Here are some benefits associated with starting a freelance LLC:

- You can no longer be held personally liable for actions taken by your business

- If your company goes bankrupt, you don’t lose everything

- An LLC offers certain tax benefits

- Excellent levels of flexibility

- Inexpensive and easy to form when compared with other businesses types

Now let’s break down some of those benefits in greater detail, starting from the top:

Why would it be important to escape liability for actions taken against your company? Well, a lawsuit can easily destroy your business – both in terms of your finances and your own personal reputation.

Let’s say you have a business selling toy cars, and one of your toy cars injures a small child.

The family of the child sues you, and a court determines that you will have to pay the family millions of dollars in settlement money.

If you were running a sole proprietorship, this would likely clean out your entire life savings, forcing you to declare bankruptcy and liquidate most of your assets.

If you were running an LLC, however, the family would be forced to sue your company – and not you personally.

This is an important distinction, and it can save you from serious financial consequences.

If the LLC only has $50,000 available as capital, that is the maximum amount of money that the family could take.

Even if you have $12 million in your own personal bank account, the family would not have the ability to take a single cent – because you have established a separate legal entity in the form of an LLC.

With that being said, insurance can help mitigate potential losses posed by lawsuits, meaning your business won’t always go bankrupt just because it is being sued. Instead, you can settle out of court and use your insurance policy to pay victims.

The same logic applies to commercial litigation cases. For example, you might have signed a contract with a distributor to supply them with toy cars at a fixed price. If that distributor claims that you have violated the agreement and sues you for breach of contract, only your LLC will be held liable. Once again, your own personal funds will never be at risk.

But what about the tax benefits of an LLC?

This is where things get slightly complicated.

An LLC can take many different forms. You can choose to remain as a sole proprietorship, enjoying only the benefits of legal protection and not much else.

You can also choose to have your LLC treated in the same way as a corporation, which gives you access to tax benefits.

If you choose to have your LLC treated as a corporation by the IRS, you can select from two different corporate structures:

- C-Corp: This is the “classic” corporate structure. Owners usually pay themselves in the form of dividends, and they only pay personal income taxes on those dividends. However, the income of the corporation itself is also subject to taxation.

- S-Corp: This type of corporate structure allows you to avoid the “double taxation” experienced by C-Corp owners with its “pass-through” tax system. You only pay taxes once, and the company itself is not subject to corporate tax.

For most freelance business owners, choosing an S-Corp will be the most attractive option. Some have described this as the “best of both worlds,” allowing you to enjoy the flexibility and informality of a sole proprietorship while experiencing the tax benefits of a corporation.

The actual tax benefits of an S-Corp are a little more complicated when you really start to get into the details. First of all, there are certain limitations you need to be aware of. If the corporation has many shareholders, the US government won’t allow you to form an S-Corp.

In addition, you can’t simply declare that you’ve earned $0 during a year and keep all of your profits in the company.

First of all, you need money to pay for living expenses. Secondly, the IRS requires that you pay yourself a “reasonable wage” as the owner of the S-Corp.

So what constitutes a “reasonable wage?” The IRS is extremely vague on this subject, and you really have to use your best judgment.

That said, your wage should reflect the overall success of the business and your level of experience as an entrepreneur.

After you have paid yourself a “reasonable wage,” you can take additional funds out of the LLC in the form of a distribution.

This is perhaps the best way to take money out of your LLC because you can report it as passive income. This means that it will not be subject to employment tax. You can also withdraw funds out of your LLC by giving yourself a loan.

Speaking of employment tax, this is one of the main disadvantages of starting an LLC. As the owner of an LLC, you are expected to pay both employer and employee portions of employment tax, which can represent a significant amount of money.

LLCs vs. Corporations

You may also wish to start a corporation. A corporation offers a number of unique benefits, although it’s not quite as flexible as an LLC.

While LLCs are generally more favorable for freelancers, corporations do offer some significant advantages.

Although corporation owners are subject to “double taxation,” they only actually pay taxes on the distributions they receive (normally in the form of dividends).

This means that if a corporation owner keeps their living expenses very low, they can pay a relatively low tax rate on their corporate income.

In contrast, an LLC owner must pay tax on the profit/income earned by a company – even if they received no distributions whatsoever during the tax year.

When to Start an LLC as a Freelancer

So here’s the million-dollar question:

When should you start an LLC as a freelancer?

If you’re selling products or services that could result in lawsuits, the answer is simple:

As soon as possible.

Legal protection cannot be underestimated, and you might be surprised to learn how easy it is to be sued while trying to run a business.

Unfortunately, many people file frivolous lawsuits in an effort to win settlements they don’t really deserve.

Some people even fake injuries or create false narratives. Generally speaking, the legal system will root these people out and prevent them from winning lawsuits.

But legal fees can be very expensive – even if you have a strong chance of success.

This is why it’s important to create a legal barrier between you and your company. If a lawsuit totally destroys your business, you can still start from scratch and establish a new business in the future.

If you simply continue as a sole proprietorship, you risk losing your own personal assets as a result of legal action. Think about the possibility of losing your car, all of the money in your bank account, and any other assets you might have purchased.

Even if your LLC is forced to declare bankruptcy, you’ll still have enough money to live comfortably and potentially start again.

Certain businesses are inherently more vulnerable to lawsuits than others. For example, if you have a company that sells chainsaws, the possibility of being sued for injuries is quite high.

On the other hand, many freelancers have a relatively low chance of being sued. For example, a freelance web designer is unlikely to be sued for causing injuries.

But even these “digital nomads” could face legal action for other issues. For example, a freelance journalist might face a libel or defamation lawsuit. A freelance graphic designer may also face copyright infringement or intellectual property lawsuit.

At the end of the day, it’s a good idea to start an LLC after you start making a considerable amount of money each year.

This is for two reasons:

Firstly, you now have a lot to lose in a potential lawsuit.

Secondly, you are now paying much more in taxes each year.

Many people start thinking about forming an LLC (and by extension, an S-Corp) when their net income begins to exceed $30,000 per year. At this point, S-Corp status will likely save you about $2,000 per year in self-employment taxes alone.

Of course, the more you earn, the more taxes you save with an S-Corp structure.

On an entirely different note, the best time specifically to start an LLC is January 1st. This will make tax season much easier because you won’t have to separate out the months spent as a sole proprietorship and the months spent operating as an LLC.

How to Start an LLC as a Freelancer

Starting an LLC is actually quite straightforward, and most states allow you to form an LLC simply by registering your business entity on the secretary of state’s website within the IRS.

This means that hiring a small business attorney isn’t always necessary – but it can be immensely beneficial if you want to approach this process with confidence and efficiency.

An accountant may also be helpful during this initial stage, and you may also benefit from meeting with a freelance business consultant or a freelance business analyst.

With that said, here are the basic steps involved in starting an LLC:

1. Create a Business Name

You’ll need to choose a business name that hasn’t been taken by anyone else. It should clearly communicate the purpose of your business and the type of services it provides. In addition, you should be careful not to take a name that is already copyrighted.

2. File Your Articles of Organization

The articles of organization include all of the important details of your new LLC, including its name, its address, its purpose, and your own personal information as the “registered agent” of the company. You’ll need to file this document to start your LLC.

3. Create an Operating Agreement

The operating agreement is a different document that outlines the various responsibilities and rights of the members. If you’re a freelancer, you will likely be the sole member of the LLC, and so this document will be quite straightforward.

With all that said, you may need to obtain an additional freelance business license depending on the type of your business. For example, solo attorneys need a license to legally practice law.

In terms of filing fees and other costs, creating an LLC is relatively cheap. This ensures that your freelance business expenses stay quite low.

One of the key factors involved in this process is choosing a business address, as you’ll need to clearly provide this address as part of your articles of organization.

But wait a second – why is choosing an address complicated? Can’t you just use your home address and leave it at that?

Well, there are a number of reasons why including your home address on your articles of organization might be a bad idea. First of all, you never know who might show up at your doorstep if you make your home address public.

Secondly, your home address might not sound very prestigious on paper. For example, people might not take your business seriously if you live in a small, rural town.

Finally, you’ll receive all your business mail to your home address. This can quickly become overwhelming – especially with certain types of companies.

The solution is simple: get yourself a virtual business address via Alliance Virtual Offices. This service is ideal for a freelance business, as it lets you separate your home life from your LLC.

Alliance Virtual Offices offers mail forwarding, and they let you choose a prestigious business address in a major city like New York, San Francisco, or Los Angeles. This gives your new LLC the legitimacy of a major corporation.

Before you create an LLC, establish a freelance business plan, and file your articles of organization, check out Alliance Virtual Offices and get a virtual address.

This could save you tons of stress and hassle down the road, and many freelancers are making the switch to a virtual address today.

In addition, Alliance Virtual Offices provides you with physical office space if you ever need to meet with potential business partners or clients. Who knows? You might even need to book meetings with potential shareholders as your company grows.

These physical meeting spaces are extremely professional, allowing you to send the right message, boost legitimacy, and set an excellent first impression. AVO even offers a live receptionist service, providing you with a trained customer service rep to answer your calls.

Conclusion

Freelancing provides excellent freedom and flexibility. However, as your business grows, you may need to explore potential tax benefits and legal protections. Starting an LLC doesn’t necessarily mean sacrificing the benefits of freelancing, as it gives you the advantages of both a corporation and a sole proprietorship.

Further Reading

- 6 Mistakes Freelancers Make When Setting Up an LLC

- Business Entities for Freelancers: Which One Is the Best?

- Should I Start an LLC as a Freelancer?

With a virtual office address from Alliance Virtual Offices, starting an LLC and keeping your personal life separate has never been easier.