- What makes adding a new venture to your business difficult?

- Why should you avoid starting a second LLC?

- How does adding a DBA to your LLC solve these problems?

Q: Do I need a DBA for my LLC?

A: If you only have one line of business, a DBA for an LLC is unnecessary. However, a DBA can be beneficial if you’re starting a new business line, as it saves you from the headaches of starting a completely new LLC.

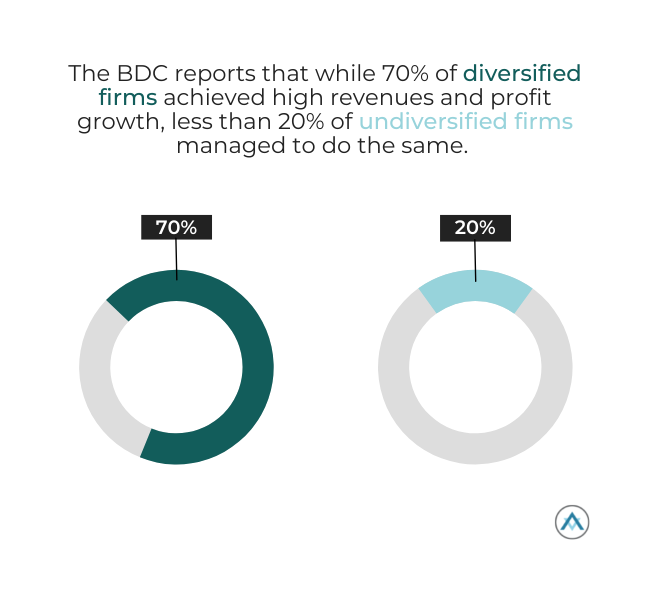

Diversification is often the key to success.

According to one survey, diversification “correlates strongly and positively with financial success,” and diversified companies tend to outperform those that are undiversified.

The BDC reports that while 70% of diversified firms achieved high revenues and profit growth, less than 20% of undiversified firms managed to do the same.

Just think of some of the biggest businesses in the world:

- 3M

- Disney

- General Electric

- Johnson & Johnson

What do all of these names have in common?

They don’t just focus on one line of business. Instead, they’re involved in all kinds of different products and services, maximizing their profits and revenues to an incredible extent.

But diversification alone isn’t enough to push your business towards greater levels of success.

It’s also about how you diversify.

If you have an LLC, you might assume that starting a new line of business requires you to start a completely different LLC, complete with new registration papers, new tax returns, and all kinds of additional headaches.

But that’s simply not the case.

Why?

Because you can start a new line of business and explore all kinds of new opportunities simply by adding DBAs to your LLC.

But we know what you’re thinking:

“How do I start a DBA?”

Don’t worry – we’re about to tackle this topic in depth.

- The Difficulties of Adding a New Venture to Your Business

- Why Should You Avoid Starting a Second LLC?

- Why Adding a DBA to Your LLC is the Best Move

The Difficulties of Adding a New Venture to Your Business

Diversification can go seriously wrong if you’re not careful.

There are many horror stories of companies that have attempted to start new lines of business in an unstructured, vague manner – essentially trying to do everything at once and appeal to every customer imaginable.

If you want to diversify, you need to do so efficiently.

Your first step should be to identify your strengths as a business. What do you do better than any of your competitors?

By playing to your existing strengths, you can start new lines of business which can build onto your earlier success.

At the same time, there’s no point in creating a carbon copy of your existing business – diversification is all about trying new things and accessing new markets.

At first, these two concepts might seem at odds with one another.

How do you play to your existing strengths while simultaneously trying something new?

In the end, it’s all about striking a fine balance.

To get a sense of how to achieve this balance, consider a few examples laid out by Harvard Business Review:

Blue Circle Industries started out as one of Britain’s leading cement producers. Eventually, they attempted to diversify by selling additional products related to home building. But their approach was vague and unstructured, and there was no real direction behind it.

They tried to sell everything and anything to home builders – including bricks, bathtubs, and even lawnmowers. In the end, their diversification strategy proved to be a failure.

HBR contrasts this with another British company called Boddington Group. This company started out as a brewery but struggled to earn significant profits because of its small-scale production.

It then shifted gears, using its vertically-integrated network of breweries and pubs to become a major player in the hospitality industry. Eventually, the company abandoned brewing altogether, buying up hotels, restaurants, and even nursing homes.

Boddington Group was successful because it was able to identify its key strengths and then capitalize on them. Their approach to diversification was also very structured and goal-driven.

Companies that establish new lines of business also struggle with marketing and branding.

If you’re running a company that already has a very specific marketing strategy geared to one particular product or service, it’s difficult to add a new line of business that fits underneath this general umbrella.

For example, you might own a chain of car washes. The branding strategy for this type of business may be very clean and friendly, and you may be targeting average motorists and families.

But what if you decide to start a chain of auto shops that specialize in aftermarket street racing customization? The marketing strategy for this type of business needs to be completely different, as you need to use new tactics to appeal to a very different audience.

Although these two businesses exist in the same general space and build on your existing success in the auto industry, they can’t operate as one entity.

You can’t simply add a new page to your car wash website and tell people:

“By the way, we can also upgrade your vehicle with tons of awesome aftermarket upgrades.”

That would be confusing, vague, and unstructured – it’s much better to start from a clean slate and establish a completely different business entity. Doing so means your new customers see you as a reliable auto shop and not just a car wash that is trying to upsell them on random additional services.

You can also use more risqué marketing methods to appeal to a younger audience.

The same logic applies to online businesses.

Let’s say your eCommerce store has been raking in plenty of profits by selling children’s toys. Maybe you’d like to diversify by selling new products to an adult audience.

Perhaps you decide to sell cheap consumer gadgets to customers in their teens and early 20s.

Right off the bat, it should be obvious that you can’t use the same marketing strategies you were relying on previously. Your entire eCommerce store is set up with colorful branding and simple messaging that appeals to young kids, and that’s clearly not going to appeal to an adult audience.

But just for the sake of discussion, let’s assume that you decided to sell these adult products through your child-focused eCommerce site anyway.

Many entrepreneurs might assume that this is a simpler, easier approach that could save them money.

In fact, the opposite is true. You’ll end up wasting your marketing budget on branding techniques and advertisements that don’t even work.

Why? Because you’re not addressing your target audience in an accurate way.

In the end, it’s clear that if you wish to diversify effectively and create a new line of business capable of real profits, you’ll need to branch out.

This means establishing a separate business entity… But what’s the best way to do that?

Why Should You Avoid Starting a Second LLC?

At first, you might assume that creating a new line of business means setting up another LLC.

Makes sense, right?

After all, an LLC has plenty of benefits, such as:

- Tax advantages

- Legal protections

- Flexibility

- Inexpensive

- Easy to form

- Great for solo entrepreneurs

- Flexible management options

So if you’re going to start a new business, why not take advantage of these benefits and establish a second LLC?

Because you don’t need to.

We’ll get into exactly why this isn’t necessary in just a second, but first, consider the disadvantages of owning and operating two LLCs at the same time:

- More Work: First and foremost, keeping tabs on two LLCs at the same time will be extremely time-consuming. One LLC is easy enough, but when you have to start worrying about the unique needs and requirements of two different business entities, it can really start whittling into your free time.

- More Paperwork: You can also expect much more paperwork if you establish two separate LLCs. It begins when you register your second LLC, as this requires a whole new set of paperwork with plenty of forms that need filling out. But the headaches won’t stop there. Expect plenty of additional mail throughout the entire year as the IRS contacts you in regard to two different LLCs.

- More Expensive: You also need to consider the costs of owning and operating two separate LLCs simultaneously. The registration fees are just the beginning, and there may be a number of additional costs you’ll need to pay as you continue to run these two companies.

- More Accountants: Finally, you need to consider the additional accounting requirements. At the end of each fiscal year, you’ll need to file two different tax returns. This means paying the same accountant to do the same job twice – or hiring two different accountants. Not only does this result in higher overall operating costs, but it also causes a ton of needless complexity and confusion.

That being said, there are a few benefits to owning multiple LLCs that you might want to consider.

First of all, owning different LLCs allows you to sell pieces of your company easily.

Let’s say you started off as a restaurant owner but you’ve shifted your attention entirely towards food manufacturing. If you have a separate LLC that represents your restaurants, you could sell that part of your business for a profit.

It might also be easier to attract investors who are interested in a particular side of your business. For example, someone might want to invest in your green energy company, but they might be less confident about your side venture that involves oil and gas.

Having different LLCs allows people to invest in specific aspects of your business operations. Otherwise, they’d be forced to invest in a single LLC that might contain a mixture of different business ventures.

Finally, a holding company can make it easier to manage multiple LLCs under a single banner.

But with all that said, many entrepreneurs will benefit most not by setting up a separate company, but by adding a DBA for LLC.

Why Adding a DBA to Your LLC is the Best Move

A DBA for LLC allows you to start a new line of business without establishing a separate LLC.

It gives you the opportunity to explore a completely different branding strategy, using accurate, targeted marketing techniques that appeal to a new audience.

At the same time, a DBA for LLC exists under the same banner as your original company, so there is no need to file additional tax returns, fill out additional paperwork, or file additional registration documents.

But what exactly is a DBA for LLC? Why might you need one? And what are the specific benefits of a DBA for LLC?

Let’s explore this concept in a little more depth:

What is the Purpose of a DBA?

DBA stands for “doing business as,” which should give you some indication as to what this concept is all about.

A DBA also goes by many other names, including:

- Trade name

- Fictitious business name

- Assumed business name

For the most part, these phrases all mean the same thing, and the registration process is exactly the same regardless of what phrase you see in your local laws.

Do I Need a DBA for My LLC?

So wait a second… What is a DBA for LLC, exactly?

Essentially, you can use a DBA to operate under a completely different name, while still remaining under the umbrella of your LLC.

This gives you the same basic advantages of an LLC, while also allowing you to branch out and explore a new line of business.

If you fail to add a DBA for LLC, you would lose the legal protections and tax advantages of your LLC.

As previously noted, a DBA for LLC is a great strategy if you’re ready to diversify and explore new opportunities. However, a DBA can also be an excellent choice if you’re just starting an LLC for the first time.

For example, you might be starting a new LLC with the plan to run several businesses underneath one banner from the very beginning.

Let’s say you want to start a company that makes custom gaming PCs, VR headsets, and gaming chairs. If this is your plan right from the start, you might choose three different DBAs for your LLC during the registration process:

- X-Caliber Gaming PCs

- Reverie VR Headsets

- Nitrous Gaming Chairs

These three DBAs would then operate under the same LLC – perhaps with a name like Northwest Gaming Supplies, Ltd. This would give you the opportunity to explore different marketing strategies for slightly different markets without having to establish multiple LLCs.

A DBA for LLC might also help you lock down specific domain names, and this can be especially beneficial if you’re running an online business.

When you purchase a new domain name, you can set up a new DBA to make sure you have a business entity ready to go – when or if you decide to flesh out this website.

You can do this as a preemptive move even if you’re not planning on creating a new business centered around the domain for many years.

Registering a DBA isn’t the only way you can branch out as an LLC.

You might also consider establishing a virtual address to go along with your new business venture.

For example, if you start out as a computer repair shop in a small town, a new venture might be to sell an app or a piece of software that could be used across the entire globe.

You might then choose to establish a DBA under your computer shop’s LLC to give yourself a more prestigious and respectable reputation.

But if you’re thinking, “My business address is still located in your small town; will investors and customers notice?”

It’s true that eyebrows may be raised.

To avoid this, you can register your DBA under a virtual address.

You can choose any virtual address you like – perhaps in Silicon Valley or New York.

Not only will this improve the reputation of your new business venture, but it will also make life easier in several ways:

- Avoid mail sent to your home or your original business

- Maintain privacy

- Have your mail forwarded

- Store your mail at a safe location

- Travel the world without being tied to a specific location

Some virtual address providers are better than others, and Alliance Virtual Offices is a solid choice due to its wide range of services. Unlike many other virtual office providers, Alliance Virtual Offices allows you to book meeting rooms and office space.

These flexible spaces are ideal for important meetings with investors, strategic planning sessions, and much more.

At the end of the day, a DBA for LLC is only one example of an improvement you can make to your company.

Research the various possibilities, and you’ll quickly learn that there are many ways in which you can transform your LLC, guiding it towards success in the most efficient way possible.

Conclusion

A DBA for LLC is a solid choice for anyone who wants to explore new opportunities and lines of business with their existing companies.

Diversification is key – but you have to do it right.

If you don’t plan out your business expansion correctly, your profits could suffer. And before you know it, you’ll be running two failing companies instead of one strong, structured organization.

A DBA for LLC gives you the best of both worlds – providing all the tax and legal benefits of an LLC, while cutting down on additional paperwork and costs.

Whether you’d like to start a new product line, offer a new service, or lock down a domain name, a DBA for LLC provides plenty of benefits with little to no downside.

The Future is Bright

There’s only one question remaining:

How will your business expand and diversify?

Growing a business is a thrilling adventure, and although diversification can seem a little daunting at times, it’s a great way to challenge yourself and explore new opportunities.

If nothing else, it keeps entrepreneurship interesting.

And remember – you’re not alone in this journey. With help from Alliance Virtual Offices, you can make the most out of your new DBA with a virtual office.

Further Reading