- Why compete with a small business when you can simply buy it?

- What’s the best way to buy a small business?

- How do you manage several small businesses at the same time?

Q: How can you purchase a business?

A: Although this process might seem daunting, purchasing a business is almost exactly the same as purchasing a car, a house, or any other item. First, find a seller. Then, make your offer and come to an agreement. Finally, ownership of the company will be transferred to you, and you will re-register the business under your name.

Even though running a business can be incredibly rewarding and profitable, most owners eventually plan to sell the operation, rake in a few million, and retire on a sunny beach somewhere.

That’s the dream.

And if you’re trying to figure out how to buy a small business, this is good news.

It means that if you’re shopping for a business, you’ll be spoiled for choice. According to the most recent statistics, 50% of business owners attempt to sell their businesses themselves.

But here’s the thing:

90% of all people who try to buy a business never complete a transaction.

Even if your transaction reaches the negotiation table, there’s a 50% chance the sale will fall apart before closing.

Make no mistake – buying an existing business can be advantageous for a number of reasons.

But it’s also a real challenge.

So how can you succeed where others have failed?

How do you take advantage of an economy filled with mass sell-offs, with fears increasing over inflation and rising operating costs? Why would you even want to buy a small business in the first place?

In this article, you’ll learn the benefits of buying a small business, the ins and outs of the acquisition process, and how to manage several businesses under one banner.

Ready to get started?

- Why buy an existing small business in the first place?

- How to successfully buy a small business

- Buyers’ checklist

- How to manage your newly-acquired business

Why Buy an Existing Small Business in the First Place?

But hold on a second… Why should you purchase a small business in the first place?

What’s the point?

Isn’t it better to simply build a company from the ground up? By overseeing growth from the early stages, you get to control branding, marketing, and many other aspects of a business.

If you simply purchase another company, you’re basically stuck with someone else’s dream.

While this is true, most entrepreneurs recognize that profits are more important than crafting the “perfect business.” After all, business is not an art form. It’s about making money, plain and simple.

And when someone else has already done all the important heavy lifting for you, it’s easy to pick up where they left off. You won’t need to worry about finding customers, developing products, or any of the other important challenges associated with starting a new business.

This is highly attractive to anyone who doesn’t have a lot of time to spare. Perhaps you’re a working professional, and your full-time career doesn’t leave much time for entrepreneurship.

But if you’re earning a high salary, it makes sense to invest those funds into not only stocks and real estate, but also businesses. If you purchase a pre-existing business, you don’t have to devote as much time to its daily operations – especially if you simply keep the old employees and tell them to run the business in exactly the same way.

In addition, you have to realize that getting a business up and running is the hardest part of the entire process. Forbes reports that 20% of new businesses fail within just two years. 45% don’t last more than five years, and 65% don’t last more than a decade.

By purchasing a pre-existing business with a solid track record over many years, you’re taking substantially less risk.

Take a look at the latest financial news, and you’ll see that major companies often purchase other businesses to eliminate the competition. Known in some circles as “hostile takeovers,” this strategy allows business leaders to kill two birds with one stone.

First of all, they inherit a proven enterprise with a number of loyal customers. Secondly, they can merge two similar businesses under one banner, inheriting not only the company’s well-oiled business plan but also stealing all of their customers and ensuring all profits go to one source.

This strategy of purchasing a “synergistic” small business can be especially effective if you’re already a small business owner who wants to expand – especially if a major competitor is preventing you from achieving success.

By combining two small businesses into one, you can generate profits in a way that would be impossible when operating both businesses separately.

How to Successfully Buy a Small Business

So how do you buy a small business?

First, you need to think about what type of business you’re looking for. If you’ve already identified a competitor that you’d like to eliminate, this process is easy.

If you’re not sure what type of business you’d like to purchase, consider an enterprise that is similar to your current operation. This helps boost synergy and reduces the learning curve.

For example, if you’re already running a car auto shop, it makes sense to purchase another car auto shop. Or if you want a more well-known example, just think of Facebook’s purchase of Instagram.

With this synergistic approach, you won’t have to learn the ins and outs of an entirely new industry. That being said, it makes sense to buy a slightly smaller business than your own, as this keeps costs low while giving you a chance to improve and grow.

If you don’t have your own business, your options are much more open. That being said, it still makes sense to choose a niche that you’re at least somewhat familiar with.

Start with businesses related to your passions, interests, and hobbies. Choose a business in one of these niches, and the learning curve will be much less steep.

Whatever the case may be, research is of the utmost importance.

If you’re already an established entrepreneur with at least one business under your belt, you already know that the research stage is one of the most important parts of starting a new business.

The same logic applies to buying a business.

But even if you have no experience as an entrepreneur and you simply want to buy an existing business that essentially “runs itself,” you’re probably already familiar with the importance of research.

After all, adequate research is important for just about any major purchase.

When you buy a new house, you have to examine the property very carefully and identify any red flags. When you’re purchasing a car, you read online reviews to make sure you’re not getting a “lemon.”

Even if you’re buying a new vacuum cleaner, research is necessary.

And when you’re buying a business, the same basic rules apply.

So how do you research businesses that you wish to purchase?

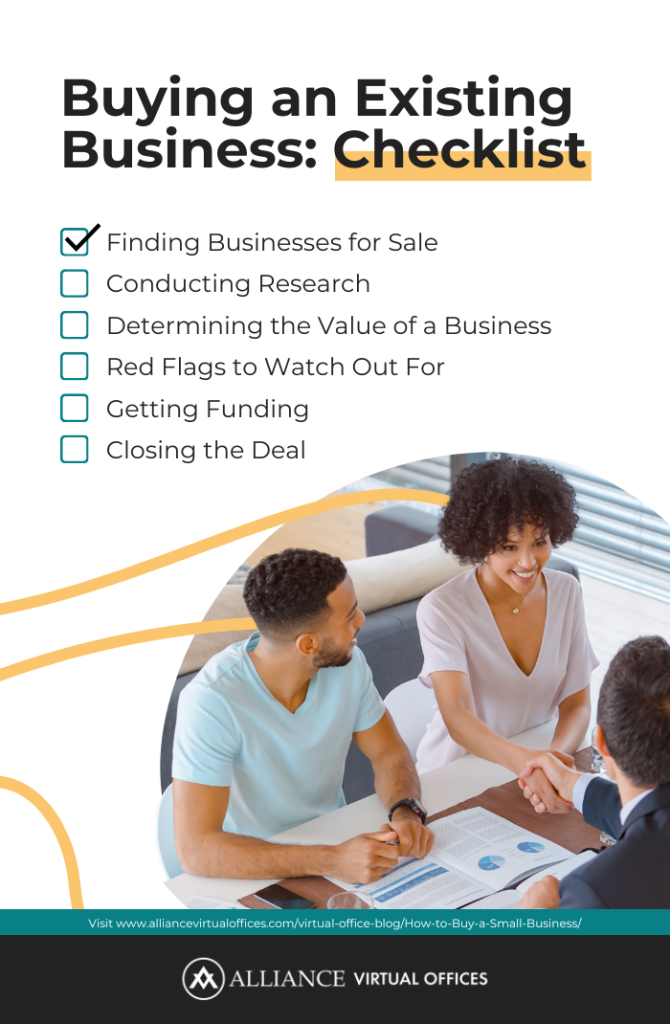

Buying an Existing Business: Checklist

1. Finding Businesses for Sale

The first step is to find out whether certain businesses are actually for sale.

You can do this in a number of different ways:

- Contact businesses yourself and ask whether they’re interested in selling

- Connect with a business broker who can find you potential businesses to buy

- Check specialized websites for buying and selling businesses (like buybizsell.com)

- Post your own advertisements stating that you’re looking for a business to buy

- Use your networking skills (work colleagues, friends, family, etc.)

2. Conducting Research

Once you’ve discovered a small business that seems like it has potential, it’s time to learn as much as possible about the company before you make an offer.

A good first step is to run a quick Google search. Check out the company’s official website and learn as much as possible about its inner workings.

Of course, the company’s website is not always a reliable source of information. This is why you should also check out a number of other resources online, such as:

- The Better Business Bureau (BBB)

- Online reviews

- Social media comments

- Any articles or blog posts about the business

A company’s reputation is very important. The last thing you want to inherit is a PR nightmare.

3. Determining the Value of a Business

If you’re trying to figure out how to buy a small business, there’s one thing you should definitely keep in mind:

The value of the business.

That makes sense, right? After all, if you’re going to buy a business, you should know exactly how much that business is worth. If you fail to determine the real value of the business accurately, you could end up paying far too much.

This is where it gets a little bit complicated.

Make no mistake – you’ll need to crunch the numbers and do the math here. If you’re not a financial whiz, you might consider getting help from an accountant at this point.

The value of a business can be determined in a number of different ways:

- Determine the ODI: The Owner’s Discretionary Income is a solid starting point if you want to know how much a business is really worth. ODI is the “take-home pay” of the owner after all of the operating costs are taken into account – including wages, debts, business expenses, and so on. Ask yourself whether you could live comfortably on the current Owner’s Discretionary Income.

- Market Capitalization: You can determine a company’s market capitalization by multiplying its share price by its total number of shares outstanding. For example, a company with a share price of $1 and 100 shares outstanding would be worth $100. This is one of the most straightforward ways to determine a company’s value.

- Book Value: Another method is to simply look at the balance sheet and determine the book value by subtracting liabilities from total assets.

- Liquidation Value: Liquidation value is the amount of money that you’d receive if you sold all the business’ assets and paid off all its debts at the same time.

- Price-to-Earnings Ratio: Also known simply as “P/E”, the price-to-earnings ratio also helps you determine the value of a business. This method takes the yearly earnings of a business and multiplies it by a factor that represents high potential for growth and consistency. For example, if a company had a P/E of four and yearly earnings of $100,000, its value would be $400,000.

- Market Comparison: If you look at similarly sized businesses within the same niche, you can establish a pretty accurate idea of a fair price. You might also consider looking at the prices of very similar businesses that have sold recently. This type of approach is known as “market comparison.”

Crunching the numbers may sound difficult, but all of the necessary information can be found in the company’s financial documents. These documents include:

- Tax returns

- Balance sheets

- Accounts receivable

- Debt disclosures

- Accounts payable

- Cash flow statements

- Property documents

- Asset listings

- Business insurance documents

- Employee contracts

- Incorporation information (if applicable)

4. Red Flags to Watch Out For

There are a number of red flags that you might want to watch out for if you’re assessing a potential small business:

- No demand for the product or service

- Too much competition

- Too much debt

- Poor choice of location

- Substandard branding strategy

- Supply chain issues

- Cost of production is too high

- Too many upgrades required

5. Getting Funding

If you’re wondering how to buy a small business with no money, you should know that this endeavor is technically possible.

If you don’t have enough money to purchase the entire business, there are a number of options that can help you come up with the necessary cash.

So how do I get a loan to buy an existing business?

Options include:

- An SBA loan to buy a small business (SBA 7(a) Loan)

- Online lenders

- Private bank loans

- Government assistance

Another option is seller financing. This is when a seller agrees to accept staggered payments rather than a lump sum. This can benefit both parties, as the seller is guaranteed stable income for months or even years, while the buyer experiences less financial stress.

Of course, you should always try to use your own money first in order to avoid debt. Alternatively, you could turn to friends or family for funding, as this would likely result in lower interest rates.

That being said, it makes sense to run the numbers based on your unique situation. Sometimes, a loan is preferable to using your own money for a range of reasons.

6. Closing the Deal

When you know the value of the business, and you have the necessary funds to complete the purchase, it’s time to close the deal.

This process may take months or even years, so be prepared. Negotiate effectively, be willing to compromise, and back up your offers with evidence. During the negotiation process, you might want to have a lawyer, an accountant, or a financial expert at your side.

There are a number of legal documents you may need when closing the deal:

- Bill of sale

- Letter of intent

- Transfer of any patents, trademarks, and copyrights

- Transfer of customer lists

- Franchise paperwork

- Non-compete agreement

- Asset acquisition form (IRS form 8594)

Finally, you’ll need to re-register your new business under your name.

How to Manage Your Newly Acquired Business

Once you have completed the transaction, you’ll need to manage your new business and guide it towards success. This is really a subject for another article, but there is one major point worth covering:

Your employees.

Generally speaking, a small business acquisition is associated with mass layoffs. But if you want to keep the business running in exactly the same way, it makes sense to keep virtually all employees in their former positions.

After all, “if it ain’t broke, don’t fix it!”

Just make sure to check in with your management staff and read KPI reports to ensure everything is still firing on all cylinders.

If you’re more of a hands-on kind of person, you might want to fire the company’s top leaders and manage operations personally. But remember, this is a lot of work.

Regardless of which direction you choose, re-registering your business is critical.

And when you take this step, consider using a virtual address.

In the modern world, this step is incredibly easy with virtual office providers like Alliance Virtual Offices.

With a virtual office, you can easily manage one or more companies under a single banner – even if they’re not within the same geographical area.

So if you’re wondering, ‘how do I buy a small business near me?’ – you can potentially broaden your search and consider companies much further afield.

Simply choose any address in a major city, re-register the business with your new virtual address, and enjoy a range of benefits, including:

- Improved reputation

- Mail forwarding

- Better privacy

- Better security

- Easier to travel and work

- Access new talent in other areas

- Reach new markets

- Save money on office rental costs

It’s Time to Close the Deal

Expanding your entrepreneurial empire might be easier than you think – especially since so many business owners are trying to sell.

But for every 15 buyers, there’s just one business for sale. This means that you’ll be competing with many other buyers.

While figuring out how to buy a small business can be challenging, it comes with immense rewards. Generally speaking, this is a better choice compared to adding disparate products or services to a pre-existing business.

After you complete this transaction, Alliance Virtual Offices can make it easier to manage your new empire with a range of helpful services, including virtual offices, virtual phone systems, live receptionist services, and much more.

Check out Alliance Virtual Offices today.

Further Reading