- An overview of crucial customer retention metrics

- Techniques for accurate calculation and analysis

- Strategies for applying these metrics to enhance business strategies

Q: What are customer retention metrics and how do they help my business?

A: Customer retention metrics help businesses diagnose the health of their customer relationships and make informed decisions to enhance loyalty, satisfaction, and overall business performance for future success.

“Make a customer, not a sale.”

This famous quote from entrepreneur Katherine Barchetti is as relevant today as it has always been – perhaps more so.

In the post-Covid era, high costs of living and operational expenses pose ongoing challenges for businesses.

That’s why developing customer loyalty is essential.

Loyal customers make repeat purchases and spend more over time. They become advocates, recommending your business to others and introducing new customers at their own expense.

Customer retention metrics can help you do this.

Customer retention metrics play a vital role in gauging customer loyalty and the overall health of your business.

By tracking metrics such as Customer Retention Rate, Churn Rate, Customer Lifetime Value, and Repeat Purchase Rate, you can assess how well – or how poorly – your business is retaining customers over time.

These metrics will help you gain insights into customer behavior, preferences, and satisfaction levels, enabling you to take action to strengthen customer loyalty for future success.

You can use this data to identify areas for improvement, tailor your products or services to better meet customer expectations, and implement targeted retention strategies.

In this article, we’ll explore the key customer retention metrics available to your business, and how to apply them.

- Four essential customer retention metrics and how to calculate them

- Digging deeper with advanced metrics and analysis

- How to use metrics to improve customer satisfaction and retention

Core Customer Retention Metrics Explained

It costs 5-25X more to acquire a new customer than to keep one. That’s why it’s so essential not just to make customers, but to keep them.

Customer retention metrics offer valuable insights into how loyal your customers are, how valuable they are to your business, and how to segment them to customize your retention strategies.

Let’s start with four customer retention metrics:

In this section, we’ll introduce the purpose of each of these metrics and how to calculate them.

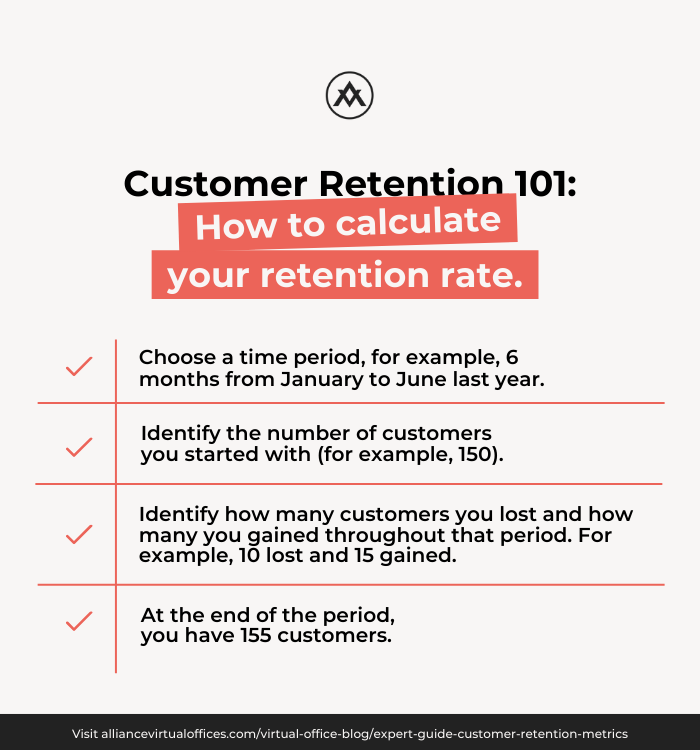

- Customer Retention Rate (CRR)

Customer Retention Rate reflects the strength of your customer loyalty.

Subtract your new customers from your total customers, divide by your starting number, and multiply by 100 to identify the percentage.

For example:

- Total Customers 155 ‐ New Customers 15 = 140

- 140 ÷ 150 = 0.93

- 0.93 x 100 = 93.3%

Your retention rate for the period was 93.3%.

Note that the customer retention rate is the inverse of the attrition (or churn) rate. A 93.3% retention rate would mean a 6.7% attrition rate.

Once you have a customer retention rate for a specific period, you can compare it against other timeframes in your business.

This will help you to understand how your business is performing over time. It will also show you when your company performs best or worst during the year.

Why is Customer Retention Rate an important metric?

Loyal customers spend more over time and provide a stable source of revenue. Businesses with a strong focus on customer retention often gain a competitive advantage.

In terms of cost, acquiring new customers is often more expensive than retaining existing ones.

What’s more, loyal customers are more likely to become brand advocates, recommending your products to others and effectively marketing your business on your behalf.

Finally, monitoring CRR provides important insights into customer satisfaction and loyalty.

If your CRR declines, it may signal underlying issues with product quality, customer service, or overall customer experience.

- Churn Rate

Churn rate is the percentage of customers who stop doing business with your company over a specific period.

You can obtain the churn rate by following the customer retention rate above and inverting it.

Or, work out your churn rate as a percentage using the steps below:

- Number of customers you had at the beginning of your chosen time period (for example, 150).

- Number of customers you lost during that time period (for example, 10).

- Divide the number of lost customers by the total number of customers you had at the start of the time period (0.06).

- Then, multiply this number by 100 to get your churn rate as a percentage (6.6%).

Why is Churn Rate an important metric?

Churn Rate provides a clear indication of how well your business is retaining customers.

A high churn rate suggests that too many customers are leaving. Constantly replacing lost customers is costly and resource-intensive, which negatively impacts revenue and growth.

A high Churn Rate may indicate underlying issues with product quality, customer service, or overall customer experience. By analyzing the reasons for churn, you can identify and address problem areas to improve customer satisfaction and loyalty.

Whether through improved customer service, loyalty programs, or product enhancements, efforts to reduce churn can contribute to a healthier and more sustainable business.

- Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) indicates the total revenue your business can reasonably expect from a single customer throughout their business relationship with you.

It is a holistic metric that goes beyond immediate transactional value, giving you insights into the long-term profitability of your customer relationships.

Here’s a useful example illustrating how to calculate CLV:

- Choose a time frame. For example, 12 months January – December last year.

- Work out your Average Purchase Value (APV). Divide your company’s total revenue in that period by the number of sales during that same period.

- For instance, if your business generated $20,000 revenue in a month from 200 sales, the APV for that period is $20,000 ÷ 200 = $100.

- Work out your Average Purchase Frequency (APF). Divide the number of sales by the number of unique customers. If a customer made multiple purchases over a specific period, they are counted only once in the calculation.

- If your business generated $20,000 in a year from 40 customers who collectively made 200 purchases, then the APF is 200 purchases ÷ 40 customers = 5 times.

- Average Customer Lifespan (ACL). Add all of your customer lifespans and divide this figure by your total number of customers. If your business is new and lacks the sample size of customers required for the calculation, ACL can also be derived from the churn rate.

- Customer Lifetime Value (CLV). Now that we have all the components needed for CLV, we can calculate it by simply multiplying them all together.

- With an Average Purchase Value of $100, an Average Purchase Frequency of 5, and an Average Customer Lifespan of 36 months, the Customer Lifetime Value is:

- Average CLV = $100 x 5 x 36 = $18,000

Why is Customer Lifetime Value an important metric?

CLV emphasizes the importance of customer retention and helps segment customers based on their potential value.

By understanding the potential value of customers over their lifetime, you can tailor your marketing strategies and customer experiences to different segments, optimizing efforts for the most valuable customer groups.

Feedback from high CLV customers is particularly valuable.

Use insights from these customers to improve products and services, ensuring they meet the needs and expectations of the most valuable segments.

What’s more, you can develop targeted retention strategies to extend the customer lifespan, encouraging repeat purchases and building long-term relationships.

CLV also provides a basis for forecasting future revenue and planning for business growth. It offers a more accurate prediction of the revenue potential that can be expected over time.

- Repeat Purchase Rate

As the name suggests, the Repeat Purchase Rate measures the percentage of customers who make more than one purchase from your business over a specific period.

To calculate the Repeat Customer Rate:

- Choose a time period, such as a month or even a whole year. Let’s use 12 months as an example.

- Identify the number of customers who made more than one purchase during this period. For example, 63.

- Divide this number by your total number of customers. For example, 120.

- Multiply by 100 to convert to a percentage. In this example, the Repeat Customer Rate is 52.5%.

This figure becomes more relevant over time. Repeat this exercise for previous years and compare the percentage to find out how much repeat business your customers are generating.

Why is Repeat Purchase Rate an important metric?

RPR is a direct indicator of customer loyalty. A high repeat purchase rate suggests that a significant portion of your customers are loyal.

This is a good sign. Repeat customers contribute significantly to your company’s revenue by generating additional sales and spending more over time.

A high Repeat Purchase Rate indicates that your marketing efforts, customer engagement strategies, and overall customer experience are effective in encouraging customers to come back.

It also shows that your customers are satisfied with the quality of products or services.

However, a low or declining RPR can alert you to potential issues with product satisfaction or customer service.

Monitoring RPR also helps your business forecast and plan for revenue growth.

Advanced Metrics and Analysis Techniques

Now, let’s dig a little deeper into customer satisfaction metrics.

The following three metrics contribute to a holistic understanding of the customer experience. They are:

These metrics offer deeper insights into customer behavior and loyalty.

These measures play a key part in customer engagement analysis, business performance measurement, strategic customer management, and more.

Net Promoter Score (NPS)

Net Promoter Score measures customer loyalty and satisfaction based on how likely they are to recommend your products to others.

This qualitative perspective on customer satisfaction reflects whether your customers are becoming brand advocates.

A high NPS often correlates with positive retention rates, indicating that satisfied customers are likely to continue their relationship with the business.

How to calculate your Net Promoter Score

To calculate the Net Promoter Score (NPS), collect customer feedback through a simple survey question and then analyze the responses. The NPS question typically asks:

“On a scale of 0 to 10, how likely are you to recommend our product/service/company to a friend or colleague?”

Based on the responses, categorize your customers into three groups:

- Promoters (score 9-10): These are enthusiastic and loyal customers who are likely to recommend your business.

- Passives (score 7-8): These customers are satisfied but not enthusiastic promoters. They are considered somewhat neutral.

- Detractors (score 0-6): Detractors are customers who are dissatisfied and may potentially harm your brand through negative word-of-mouth.

The Net Promoter Score is then calculated by subtracting the percentage of Detractors from the percentage of Promoters:

NPS = Percentage of Promoters − Percentage of Detractors

The resulting score can range from -100 to +100. A positive score indicates that you have more promoters than detractors, suggesting a healthy level of customer loyalty and advocacy.

Customer Effort Score (CES)

CES is a survey-based measure that reflects how easily customers can interact with your company, such as making a purchase, resolving an issue, or navigating your website.

Customers provide a score based on their perceived effort, typically on a scale from “very easy” to “very difficult.”

CES helps you understand the customer experience in terms of simplicity and ease. A lower effort score is generally associated with higher customer satisfaction and loyalty.

It’s a great way to pinpoint problem areas and improve the customer experience, leading to increased customer satisfaction and, consequently, retention.

How to calculate your Customer Effort Score

Ask customers a straightforward question such as:

“How easy was it for you to [complete a specific task or interaction]?”

Responses are collected on a scale, often ranging from “Very Easy” to “Very Difficult” or using a numerical scale.

Once you’ve collected responses, calculate the average score by summing up all the scores and dividing by the total number of responses.

CES = Sum of Individual Scores ÷ Total Number of Responses

The resulting average score represents the Customer Effort Score. A lower score indicates lower perceived effort, while a higher score suggests a more challenging or inconvenient experience.

Segmentation and Cohort Analysis

Segmentation involves dividing customers into distinct groups based on shared characteristics or behaviors.

Cohort analysis involves studying groups of customers who share a common experience or characteristic over a specific time period.

Segmentation and cohort analysis provide deeper insights into customer behavior, preferences, and trends. They allow you to create custom strategies for specific groups and track how these groups evolve over time.

Both segmentation and cohort analysis complement metrics like NPS and CES by providing context.

For example, if your Net Promoter Score varies significantly among different customer segments, segmentation analysis will help you understand the distinct needs of each segment.

Cohort analysis, when combined with metrics like Customer Retention Rate, allows you to track how the satisfaction and behavior of customers from specific time periods evolve over their lifecycle.

Both segmentation and cohort analysis provide valuable insights into customer behavior, preferences, and trends. Leveraging these insights can enhance the effectiveness of retention strategies and personalize marketing efforts.

Segmentation

- Identify High-Value Segments: Segment customers based on characteristics such as demographics, behavior, or purchase history.

- Tailor Messaging and Offers: Customize marketing messages and promotions for each segment. For example, if one segment values discounts while another values exclusive access, tailor your promotions and campaigns accordingly.

- Address Unique Pain Points: Analyze each segment’s pain points and develop retention strategies to address these issues.

- Personalized Communication Channels: Understand the preferred communication channels of different segments. Some may respond better to email, while others may prefer social media or SMS.

- Customize Product or Service Enhancements: Based on segment characteristics, customize product features or service offerings.

Cohort Analysis

- Identify Behavior Patterns Over Time: Analyze cohorts to identify behavior patterns and trends throughout their lifecycle with your business.

- Optimize Onboarding Processes: Identify common challenges faced by new customers and optimize onboarding processes to increase early engagement and satisfaction.

- Lifecycle-Based Engagement: Develop retention strategies based on the different stages of the customer lifecycle.

- Predictive Modeling: Use cohort data to create predictive models that anticipate future behavior, enabling you to proactively address potential issues and implement targeted retention strategies.

- Continuous Iteration: Regularly analyze new cohorts to adapt and refine retention strategies based on evolving customer behaviors and market dynamics.

As customer behavior evolves, ensure that retention strategies and marketing efforts remain aligned with changing preferences.

Implement a test-and-learn approach by experimenting with different retention strategies and marketing messages for various segments and cohorts. Analyze the results to optimize and fine-tune strategies over time.

Implementing Metrics for Business Success

Now that you have these metrics, what do you do with them?

These metrics can be woven throughout your business to provide detailed insights into the health of your business, your customer loyalty, and your future trajectory.

There are numerous ways to utilize these metrics, such as those below.

Integrating Metrics into Strategic Decision Making

Ever noticed how some brands offer a last-second discount when you attempt to cancel a subscription?

This is the result of a combination of customer retention metrics. If you are deemed a high-value customer, you fall into a price-sensitive segment, and if the company is focused on reducing churn, you will likely be offered a discount to stay.

Similarly, you can incorporate customer retention metrics into your business decision-making processes to promote long-term success and sustained growth.

Here’s how these metrics are important in shaping marketing strategies, product development, and customer service improvements:

Marketing Strategies

Understanding Customer Lifetime Value (CLV) helps you to identify high-value customers and tailor marketing efforts to acquire and retain them.

By focusing on customer segments with higher CLV, you can optimize marketing budgets and improve the overall return on investment.

On the flip side, monitoring churn rate helps identify customers who are at risk of leaving.

By implementing targeted retention campaigns, such as exclusive offers, personalized communication, or loyalty programs, you can reduce churn and foster customer loyalty.

Product Development

Analyzing the reasons behind customer churn can provide valuable feedback for product development.

If your customers are leaving due to specific issues or lacking features, this information can guide product enhancements and updates to better meet customer needs and expectations.

CLV is also a valuable tool for product development, as it can inform product pricing strategies.

By understanding the long-term value of a customer, you can set pricing that aligns with customer lifetime profitability, ensuring sustainable revenue growth.

Customer Service Improvements

Churn rate analysis can help identify patterns related to customer dissatisfaction.

If a significant number of customers are leaving due to poor customer service, focus on enhancing the quality of your customer support to improve overall satisfaction and retention.

Knowing the CLV of a customer also enables you to prioritize high-value customers in terms of service quality.

This personalization can contribute to a positive customer experience, leading to increased loyalty and repeat business.

Examples of Businesses Successfully Using These Metrics

Amazon is one example of how CLV can optimize marketing and customer acquisition strategies.

The company provides personalized recommendations, loyalty programs like Amazon Prime, and a seamless shopping experience to increase the CLV of its customers.

Another example of CLV in action is Adobe. The company transitioned its software products to a subscription-based model, Adobe Creative Cloud, which allows the company to build long-term relationships with customers, provide regular updates, and maintain a steady stream of revenue.

Turning Data into Action

The results of your metrics enable you to make informed and strategic choices. This ensures that decisions are based on data-driven evidence rather than intuition alone.

Ultimately, the ability to turn metrics into actionable strategies allows you to continuously improve your business operations.

Steps include:

- Collect relevant data from your transactions, customer interactions, and surveys.

- Segment the customer data based on relevant criteria (e.g., demographics, behavior, location).

- Identify patterns, correlations, and anomalies.

- Look for trends over time and across different customer segments.

- Investigate the underlying reasons behind these trends, whether positive or negative.

- Formulate hypotheses based on the identified trends and conduct tests to validate or refute them. This could involve A/B testing, experimentation, or further data analysis.

- Utilize these findings to inform decision-making and plan improvements.

Take Airbnb’s Host Guarantee Program as an example.

Airbnb identified trust and safety concerns as barriers to hosts listing their properties.

It introduced a guarantee program offering protection for hosts against property damage to encourage more hosts to join.

As a result, the program increased the number of listings and enhanced trust between hosts and guests, contributing to the platform’s growth.

Technology’s Role in Metric Tracking and Analysis

When it comes to tracking and analyzing customer retention metrics accurately, technology is your friend.

Utilize Customer Relationship Management (CRM) systems and analytics tools to gather, organize, and derive meaningful insights from large volumes of customer data.

Tools such as Salesforce, Hubspot, and Google Analytics can help you to gain insights into customer behavior.

You can also automate the collection and analysis of customer data, reducing manual efforts and scaling your customer retention efforts efficiently.

Customer data platforms like Segment and Tealium aggregate customer data from various sources, creating a unified customer profile.

At an advanced level, you can automate workflows within CRM systems to trigger retention strategies based on specific customer behaviors or milestones, ensuring timely and relevant interactions.

Ultimately, CRM and analytics tools enable you to track and analyze customer retention metrics quickly and accurately.

This, in turn, enables more informed and effective decision-making, leading to improved customer experiences and enhanced business outcomes.

Wrapping Up: Customer Retention Metrics

“Make a customer, not a sale.”

Now that we’ve explored the value of customer retention metrics, this famous quote holds more significance than ever.

Customer loyalty is the cornerstone for building a sustainable and profitable business, especially in the challenging post-Covid era.

Loyal customers are not merely transactional; they are the lifeblood of a thriving enterprise. They make repeat purchases, spend more over time, and become advocates who promote your business at little to no cost.

In short, they are invaluable.

These metrics will enable you to identify the factors that turn away customers and, therefore, help you keep more customers for longer.

The results will also drive fresh insights and inform key changes for your marketing campaigns, product development, and customer service improvements.

By leveraging these metrics, your business can cultivate loyalty, adapt to evolving customer dynamics, and drive sustainable growth and profitability in an ever-changing business landscape.

Building Customer Loyalty through Alliance Virtual Offices

One way to enhance customer retention efforts is to utilize Alliance’s Live Receptionist service.

Callers are personally greeted with helpful and attentive service, ensuring a positive experience every time.

It also complements your business operations, ensuring seamless day-to-day operations and projecting a polished image to clients, partners, and potential investors.

Alliance’s team of friendly, professional receptionists provide exceptional customer service to strengthen business relationships and build loyalty.

Utilizing the customer retention metrics outlined within this article, alongside Alliance’s friendly and professional Live Receptionist service, is an efficient way to win and keep more business.

Discover more about Alliance Virtual Offices’ flexible and cost-efficient Live Receptionist solutions here.

Further reading: