- Assessing your need for business insurance

- Selecting the right business insurance

- Supplementary business protection strategies

Q: Do I need business insurance for my operations? How do I pick the best insurance for my business?

A: While most businesses need some level of insurance to comply with federal regulations, this depends largely on the number of employees at your company and the industry you work in. Outside of these regulatory needs, insurance helps guarantee that your business can handle unexpected financial pitfalls and other disasters. Picking the best insurance for your business takes careful research about your business’s insurance needs and the offerings you have access to.

Recent technological advances have created new headway for artificial intelligence, cybersecurity, the SaaS industry, and more. These developments are quickly permeating the public consciousness, and although they come with a whole slew of benefits for workers and employers everywhere, many of the risks are still unknown.

Regarding AI in particular, the sheer amount of speculation associated with any meaningful advancements leaves many individuals feeling actively nervous about the future and what artificial intelligence may cause. Outside of AI fears, the pandemic was a stark reminder to employees and employers everywhere that the things we don’t plan for are often the most impactful.

Unsurprisingly, this has many new business owners asking, “Do I need business insurance?” and although there is some variation, the answer is very often yes.

Insurance coverage helps ensure that you are personally protected from potential lawsuits, liability claims, and other financial actions taken against your business.

Considering that small business insurance can cost under $20 per month for general liability coverage, there is no reason not to secure business insurance as a safety precaution.

In addition, getting high-quality coverage for your company allows you and other employees to take greater risks. When you don’t have to worry about personal liability, you can focus more on innovation.

Nevertheless, all businesses are different, so today, we’ll discuss how to assess your company’s need for business insurance, how to select the right business insurance provider, and finally, some supplementary business protection strategies that you can utilize outside of or in addition to traditional coverage.

If you’re looking to improve your business risk management, you’re in the right place. Keep reading for information on business protection strategies, insurance coverage, business continuity planning, and more.

- Assessing your need for business insurance

- Selecting the right business insurance

- Supplementary business protection strategies

Assessing your need for business insurance

Before you can answer the question, “Do I need business insurance?” You should take the time to create a brief business setup checklist to ensure that you have a clear and concise plan of action for the first few quarters after your business’s launch.

Read more: Business Setup Check List

The time immediately following your business’s creation is paramount and should be taken seriously, so using a checklist helps you visibly see what needs to be done as well as gives you an idea of what kind of coverage you’ll need when you start exploring insurance.

Using a checklist for business setup and quickly securing high-quality business insurance is a great way to show potential investors that you’re serious about your operations. Granted, having insurance isn’t guaranteed to influence a potential investor’s decision-making, but it does help your company look professional and established.

Read more: Unlocking Investor Doors: A Proven Blueprint for Ambitious Entrepreneurs and Emerging Ventures

Once you’ve covered your business setup checklist and are ready to get the ball rolling, it’s time to answer the question, “Do I need business insurance?”

Business insurance serves as a critical shield for entrepreneurs, safeguarding their operations against unforeseen risks and liabilities.

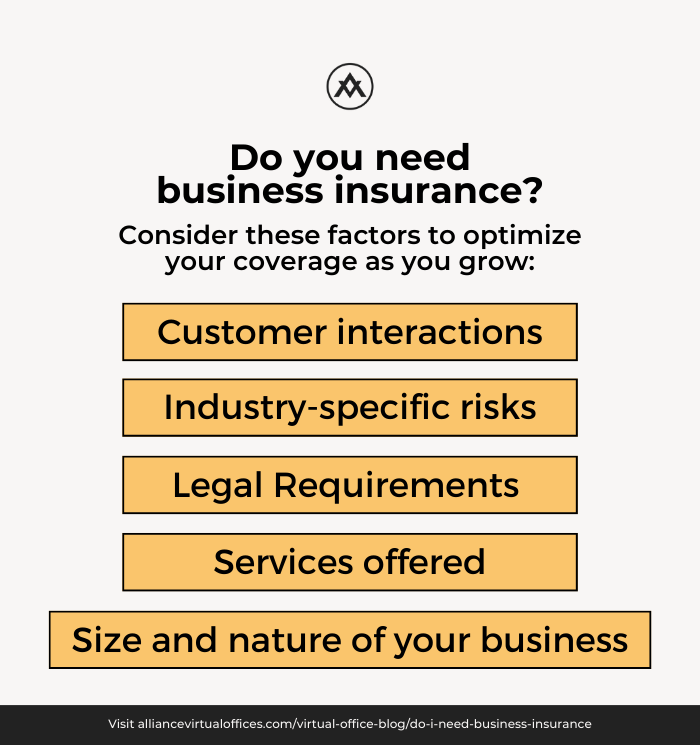

Understanding the necessity of business insurance begins with a comprehensive assessment of various factors that shape the need for coverage.

Below, we’ve covered many of these factors to help give you a clear framework that can help you know if you need to secure insurance for your business.

Size and nature of your business

Firstly, the size and nature of your business play pivotal roles.

Large enterprises, for example, often face greater risk exposure due to their scale of operations and extensive assets. Conversely, small businesses may encounter different but equally significant risks, including those related to limited resources and vulnerability to market fluctuations.

Essentially, if you run a small business with no employees and take few risks, foregoing insurance may work in your favor. Alternatively, if you have employees, your operations aren’t risk-free, and you’re focused on rapid scaling, securing business insurance is a smart way to help ensure your company’s financial security.

Industry-specific risks

Industry-specific risks also warrant careful consideration.

Certain sectors, like manufacturing or construction, carry higher risk levels due to their operations. Businesses operating in these kinds of industries typically require specialized insurance coverage tailored to mitigate industry-specific risks like equipment damage, employee injuries, or product liability claims.

Unsurprisingly, if any of the above risks apply to your business, securing business insurance isn’t just a good idea, it’s most likely required by law.

Legal Requirements

Legal requirements may vary across jurisdictions and industries, mandating specific types of insurance coverage depending on where and what you do for work.

For example, many states require businesses to carry workers’ compensation insurance to provide benefits to employees injured on the job. In addition, professional services like accounting or legal consulting may necessitate professional liability insurance to protect against claims of negligence or errors in professional services.

Services offered

The services your business offers are the quickest way to determine if you need insurance outside of having several employees or large-scale operations. If your business provides services that could result in any kind of harm to another party, whether that harm is a result of poor advice, bodily harm, or another kind of damage, you should get business insurance.

Ultimately, if you’re asking the question, “Do I need business insurance?” and your business is larger than a solo operation, you should simply get insured.

Customer interactions

Customer interactions further underscore the need for business insurance.

Businesses directly engaging with clients or providing services on client premises face heightened liability risks. Accidents or property damage during service delivery can result in costly legal battles and compensation claims.

Consequently, businesses with frequent client interactions, like consulting firms or contractors, often prioritize liability insurance to shield themselves from potential lawsuits.

Now that you’re familiar with assessing your business’s insurance needs, let’s look at how to build a checklist of criteria for business owners to evaluate their specific insurance needs. When tackling this checklist, it’s important to consider the unique aspects of each business.

While there isn’t a one-size-fits-all approach to determining insurance requirements, certain fundamental considerations can guide entrepreneurs in assessing their needs. These may include evaluating the value of business assets, estimating potential liability risks, and forecasting future growth and expansion.

A comprehensive checklist may include elements like property and casualty insurance to protect physical assets, general liability insurance to cover legal claims and lawsuits, and professional liability insurance for businesses offering specialized services.

Additionally, factors like the business’s location, industry regulations, and revenue projections should inform insurance decisions.

Exploring common scenarios and examples where business insurance is essential sheds light on the practical significance of securing adequate coverage.

Consider a retail store facing the risk of property damage due to an unavoidable natural disaster, like a flood or hurricane. Without property insurance to cover repair costs and inventory replacement, this store stands a good chance of going bankrupt.

Similarly, a technology startup handling sensitive client data may prioritize cyber liability insurance to mitigate the financial fallout of data breaches or cyber-attacks.

Essentially, assessing the need for business insurance involves a multifaceted evaluation of business size, industry risks, legal obligations, and customer interactions.

By understanding these key factors and utilizing evaluation criteria tailored to their specific circumstances, entrepreneurs can make informed decisions regarding insurance coverage to protect their ventures from potential threats and liabilities.

Selecting the right business insurance

Hopefully, the question, “Do I need business insurance?” isn’t as pressing as it was. Now that you know how to assess if your business needs insurance, it’s time to learn how to find the right insurance for your specific business.

Some entrepreneurs are worried about expensive premiums, which is fair, but with the right procedures and assessments, you can find high-quality small business insurance that doesn’t cause undue financial stress on your company.

Read more: Small Business Insurance Cost Doesn’t Have to Break the Bank

Selecting the right business insurance is a crucial step toward protecting your enterprise from various risks and liabilities. To begin, it’s essential to identify the types of insurance relevant to your business activities.

Different industries face distinct risks and, as such, require specialized insurance coverage tailored to specific needs.

For instance, businesses operating in the construction industry may prioritize property insurance to safeguard expensive equipment and construction sites against damage or theft.

Similarly, healthcare providers may opt for malpractice insurance to mitigate the risks associated with medical errors or negligence claims.

General liability insurance is foundational coverage that spans across industries, offering protection against common liabilities like bodily injury, property damage, and advertising injury claims.

This broad coverage is particularly valuable for businesses that interact with customers or operate in public spaces, as it shields them from potential lawsuits arising from accidents or injuries on their premises.

Professional liability insurance, also known as errors and omissions (E&O) insurance, is essential for service-based industries where advice or professional services are rendered to clients.

This includes professions like consulting, legal services, and accounting, where errors or omissions in professional advice can lead to costly legal disputes and financial losses.

Professional liability insurance provides coverage for claims of negligence, errors, or omissions in performing professional duties, ensuring that businesses are protected against legal claims and potential financial liabilities.

Property insurance is another critical coverage for businesses that own or lease physical property, including office buildings, equipment, and inventory. This coverage protects against damage or loss of property due to perils like fire, theft, vandalism, or natural disasters.

Industries like manufacturing, retail, and hospitality heavily rely on property insurance to safeguard their physical assets and ensure business continuity in the event of unforeseen disasters.

When comparing insurance policies and understanding coverage limits, it’s essential to conduct a thorough evaluation of the terms, conditions, and exclusions of each policy.

Pay close attention to coverage limits, deductibles, and the scope of coverage provided. Consider factors like the business’s growth trajectory, changes in operations, and emerging risks that may impact insurance needs over time.

Consulting with insurance professionals is invaluable when navigating the complexities of selecting the right insurance coverage. Insurance brokers or agents possess specialized knowledge of insurance products and can provide tailored advice based on your business’s unique needs and risk profile.

They can help assess your insurance requirements, recommend suitable coverage options, and negotiate policy terms and premiums on your behalf.

Ultimately, selecting the right business insurance requires a thoughtful analysis of the types of coverage relevant to your industry, careful comparison of policies, and consultation with insurance professionals.

By understanding your business’s specific needs and risks and seeking expert guidance, you can ensure your enterprise is adequately protected against potential threats and liabilities.

Supplementary business protection strategies

Learning about business insurance raises countless questions and concerns, many of which need to be discussed with an insurance professional to ensure you’re getting the appropriate coverage and protection.

Nevertheless, there are other ways businesses can protect their operations that can bolster their insurance’s efficacy and may even positively impact their premiums, depending on the business itself.

Read more: How a Virtual Office Gave this Insurance Business Owner the Tools Needed to Grow

Below, we’ve put together a brief list of methods that business owners can use to protect their operations without relying on insurance alone. Granted, none of these methods should be used in isolation, but when it comes to your livelihood, anything you can do to protect it should be considered.

- Cybersecurity

- Continuity plans

- Regular risk assessments

- Virtual Offices

- Comprehensive strategies

Cybersecurity

Implementing robust cybersecurity measures is paramount in safeguarding your business against cyber threats and data breaches. With the increasing frequency and sophistication of cyberattacks, businesses of all sizes are vulnerable to potential security breaches that can compromise sensitive information, disrupt operations, and damage reputation.

Investing in reliable cybersecurity solutions like firewalls, antivirus software, encryption tools, and employee training programs can help mitigate cyber risks and fortify your business’s digital defenses against evolving threats.

Continuity plans

Creating a solid business continuity plan is essential for ensuring resilience and operational continuity in the face of unexpected disruptions or disasters. Additionally, it’s worth keeping in mind that pretty much all disasters are unexpected.

A business continuity plan outlines procedures and protocols for responding to emergencies, restoring critical functions, and minimizing downtime to maintain business operations.

By identifying potential risks, developing contingency plans, and establishing clear communication channels, businesses can mitigate the impact of disruptions while swiftly recovering from adverse events, safeguarding their reputation and financial stability.

Regular risk assessment

Conducting regular risk assessments is a proactive approach to identifying and mitigating potential threats and vulnerabilities within your business operations.

Risk assessments involve evaluating internal and external factors that could pose risks to your business, like regulatory compliance, market volatility, supply chain disruptions, and technological vulnerabilities.

By systematically assessing risks, prioritizing mitigation efforts, and implementing risk management strategies, businesses can enhance resilience, minimize losses, and capitalize on opportunities for growth and innovation.

Virtual Offices

Introducing the concept of using a Virtual Office from Alliance Virtual Offices can be a strategic addition to your business protection arsenal. A Virtual Office offers various benefits, including a professional business address, mail handling services, and access to meeting rooms and administrative support, without the need for physical office space.

While a Virtual Office may not directly influence insurance decisions, it can enhance business credibility and stability by projecting a professional image and facilitating efficient business operations.

By leveraging a Virtual Office solution, businesses can establish a presence in prestigious locations, expand their market reach, and foster client trust and confidence without the need to secure expensive physical office space.

Comprehensive strategies

Comprehensive strategies that include insurance and Virtual Office solutions are key to achieving holistic business protection and risk management.

While insurance provides financial protection against potential losses and liabilities, Virtual Office solutions offer operational support and flexibility, enabling businesses to adapt to changing market dynamics and mitigate operational risks.

By integrating insurance coverage with Virtual Office solutions, businesses can optimize their risk management efforts, enhance business resilience, and position themselves for long-term success in a competitive business landscape.

Combining Virtual Offices with business insurance for a stronger business

Assessing insurance needs, selecting appropriate coverage, and adopting a holistic approach to business protection are fundamental steps in ensuring the resilience and sustainability of your company.

Understanding the risks inherent in your industry, evaluating coverage options, and implementing supplementary protection strategies can safeguard your business against potential threats and vulnerabilities.

Remember, proactive risk management and comprehensive insurance coverage are essential components of a robust business protection plan. By prioritizing these aspects, you can mitigate potential losses, enhance business continuity, and position your company for long-term success in today’s fast-paced business environment.

Further reading

- Unlocking Investor Doors: A Proven Blueprint for Ambitious Entrepreneurs and Emerging Ventures

- Business Setup Check List

- Small Business Insurance Cost Doesn’t Have to Break the Bank

- How a Virtual Office Gave this Insurance Business Owner the Tools Needed to Grow

Alliance Virtual Offices offers Virtual Offices and other digital tools and services for entrepreneurs looking to get their businesses started.

If you’re asking yourself, “Do I need business insurance?” chances are high the answer is yes, and you are in the right place.

Contact us to see how Alliance can help you secure a Virtual Office that meshes well with your insurance coverage and be sure to check out our Virtual Office Blog for more information!